In this guide, we explain how to fill out and present form 111. Although at first making this declaration of withholdings and payments on account of Personal Income Tax (IRPF) may be difficult for you, with this guide you’ll have it ready easily. In this tutorial video you will learn how to fill out Form 111:

What is Form 111?

Form 111 is a declaration that must be submitted by the self-employed and companies that have made withholdings on account in the exercise of their economic activity.

Withholding means deducting a part of what must be paid to enter it later in the AEAT on account of the personal income tax (IRPF) of the person you pay to.

Normally, you will present this form to pay the withholdings made in the payroll of your workers and in the invoices that you receive from professionals (such as your advisor, your IT worker, etc.).

Who is required to file Form 111?

All self-employed workers and companies are required to submit form 111 if:

- Have workers on the payroll, even if their income is not withheld.

- Have received invoices from professionals.

- Have invoices for agricultural, livestock or forestry activities.

- Have received invoices from certain self-employed in modules, obliged to withhold 1% on account of personal income tax.

- Pay prizes in contests, games, etc.

- Profit capital gains from forestry use in public forests.

- Pay for transfers on image rights.

When do you have to file Form 111?

For the self-employed and most companies, the term to present this form is quarterly. It will be carried out within 20 days after the end of each calendar quarter and will include the data for that quarter.

- First trimester: from April 1 to 20, both inclusive.

- Second term: from July 1 to 20, both inclusive.

- Third quarter: from October 1 to 20, both inclusive.

- Fourth quarter: from January 1 to 20, both inclusive.

If the deadline day falls on a Saturday, Sunday or holiday, it will be extended until the next business day.

If you are a large company, you will have the obligation to file form 111 monthly.

How to file Form 111: on paper or online

Companies may only submit this form online, with a digital certificate.

The self-employed, in addition to online, will be able to present it on paper. If they print the PDF and it comes out:

- To pay: must make the presentation and deposit in the bank.

- Negative (with zero fees): must present it to Hacienda (Treasury), in person or by mail.

Where to get the Form?

Whether you are going to present form 111 online or on paper, you must fill it out first and calculate its amount. But where to do it?

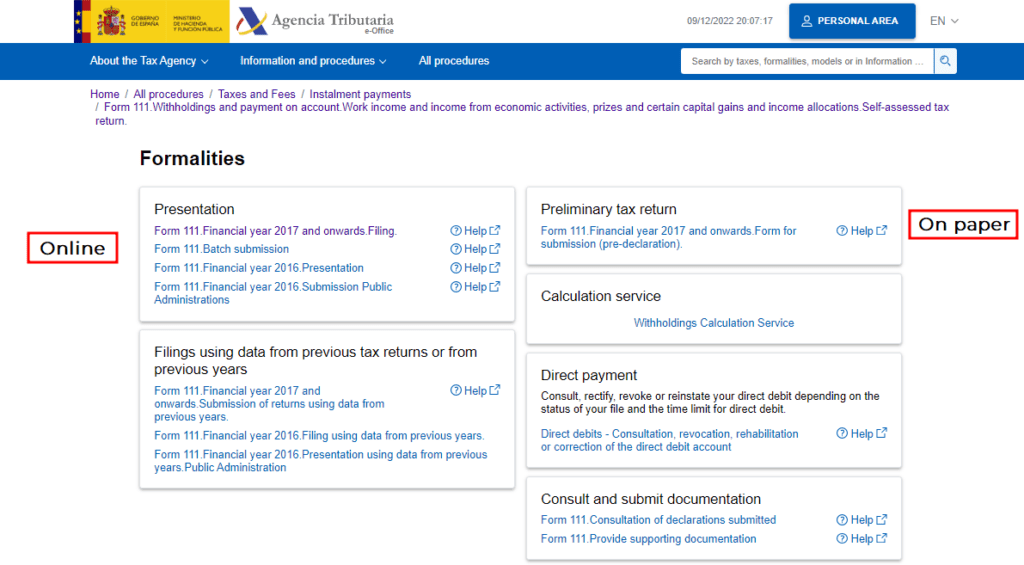

The Tax Agency website allows you to obtain and fill out the form for submission online or on paper. Enter the Tax Agency page and follow these steps:

All Procedures => Taxes and Fees => Instalment payments => Form 111. Withholdings and payment on account.

Paper presentation

Click on the Form of the model for its presentation (pre-declaration). A new screen will open with the form for you to fill it out. Once validated you can download it in PDF format and print it for its presentation.

You will not need identification labels because the printed form incorporates a barcode from the label with your identification data.

How to fill in form 111?

In this section, we will see what data is necessary to prepare Form 111, how to fill in the different sections of the declaration, and what result can be produced when obtaining the settlement. We will also discuss the concept of a supplemental declaration.

What data do you need to fill in Form 111?

This step is about declaring the withholdings that you have made in the payroll of your employees, in the invoices received from professionals, and from businessmen. Although the form may seem complicated, follow the steps that we detail below and you will see how easy it is to fill it out.

Necessary payroll data:

- Number of workers

- Amount of the base subject to the personal income tax withholding

- Income tax withholding amount

In this form, you will only have to declare the total sum of these amounts. It is in form 190 (annual summary of withholdings) where the base and the personal income tax withholding corresponding to each worker appear in detail.

You must reflect the same data for compensation in kind (those that are not paid in money) such as when you provide them with a vehicle, housing, insurance, etc.

Make the same sum for the different types of income you have paid: Invoices to professionals, prizes…

Steps to fill out Form 111

The process to fill out Form 111 is the same whether you decide to submit the form online or by printing the PDF. But remember that companies can only do it online. When doing this process, the English version of the site is not available.

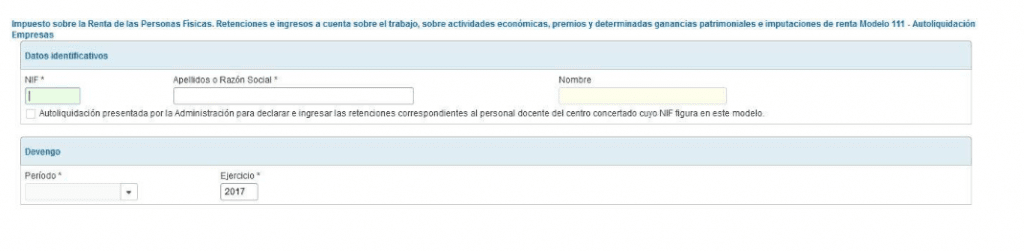

0. ID Data

It’s mandatory to fill in the NIF and the surnames or the company name of the declarant.

Accrual

Period: Select the quarter to which the data corresponds.

Accrual year: the current year appears by default.

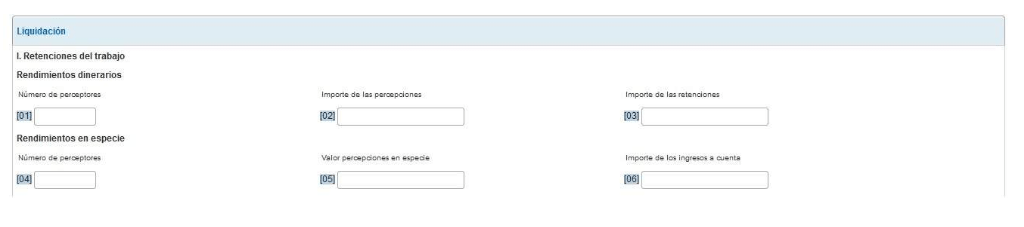

I. Job withholdings

Withholdings: Write here the data that you prepared before the payroll of your workers.

Monetary income:

Box 01, Number of recipients: number of workers you have had in that period.

Box 02, Amount of perceptions: the total sum of the bases that are subject to withholding.

Box 03, Amount of withholdings: sum of personal income tax withholdings for all payrolls.

Returns in kind

Boxes 04, 05 and 06: The same as the previous boxes but referring to payments in kind.

If any payroll does not have withholding, you must also include it. Write down the income tax base in the amount of the perceptions and do not add anything to the withholdings.

II. Income from economic activities

In these boxes, write down the sum of the invoices received from professionals, businessmen from whom 1% must be withheld or from agricultural, livestock and/or forestry activities.

Box 07, Number of recipients: total number of people you pay.

Box 08, Amount of perceptions: Total sum of the tax bases of the invoices.

Box 09, Amount of withholdings: Total sum of IRPF withholdings from invoices.

Boxes 10, 11 and 12: The same as the previous boxes but now considering income in kind.

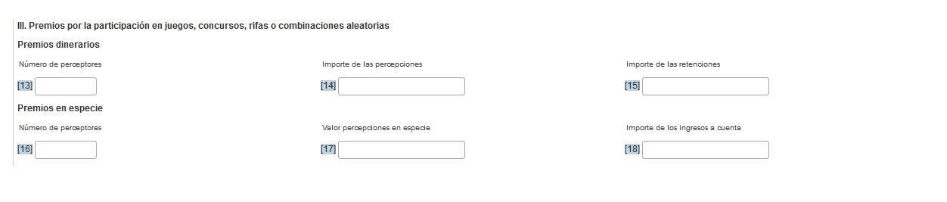

III. Prizes for participation in games, contests, raffles or random combinations

This section is only filled in when you have delivered prizes subject to withholding during the declared period.

You have to distinguish between cash prizes (money, checks) and prizes in kind (cars, pans, televisions…)

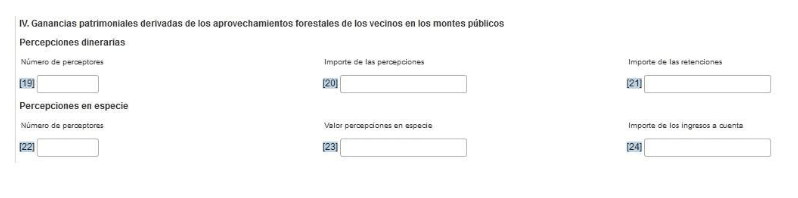

IV. Capital gains derived from the forest exploitation of neighbors in public forests

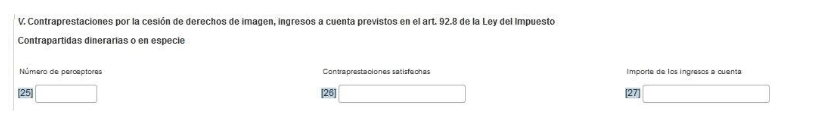

V. Remunerations for the transfer of image rights

These sections are hardly produced. They are filled in the same way as the previous ones.

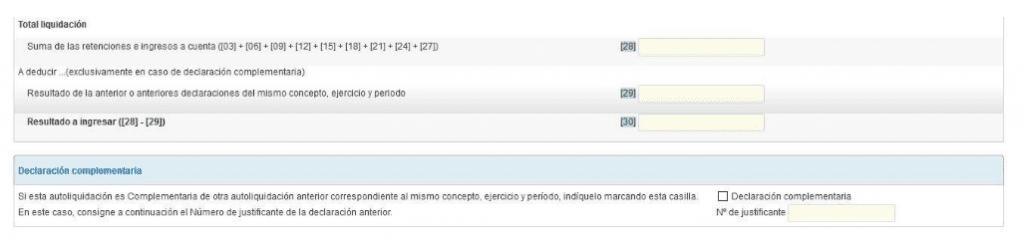

Settlement

When you have filled in the boxes you will get the result. As it is about declaring the amounts that you have withheld when paying workers or professionals, it is normal for it to be with a payable amount.

A negative statement will only result when:

- The result is zero because you have satisfied payrolls in which you should not have withheld.

- You have not paid any worker or professional.

- You have not carried out any economic activity.

Supplementary declaration

You must submit a supplementary declaration if you made a mistake in a tax return already filed and entered an inferior amount than the correct one.

In that case, fill in the form with the correct amounts and check the box indicating that it is a supplementary declaration. You must specify the receipt number of the model you are correcting.

In box 29 you must write down the result of the declaration presented previously corresponding to the same period and year. Thus, the box 30 result to enter will subtract this amount from box 28 and in the complementary settlement, you will only enter the amount that was missing.

Obtaining the PDF to file Form 111 on paper

You can download Form 111 here.

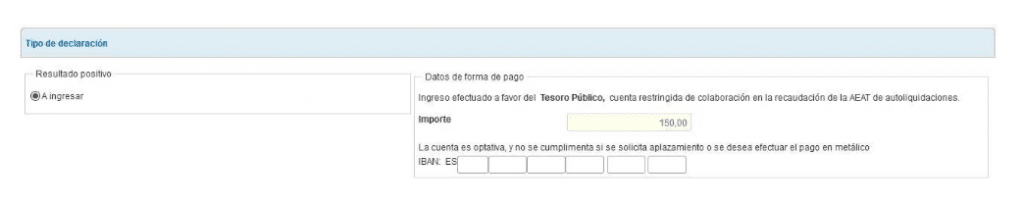

Once the model has been settled, the pre-declaration form allows you to write down the IBAN of the account where you will make the charge. You can also pay in cash.

All that remains is to generate the preliminary declaration to obtain the PDF, print it and present it.

Presentation of Form 111 online

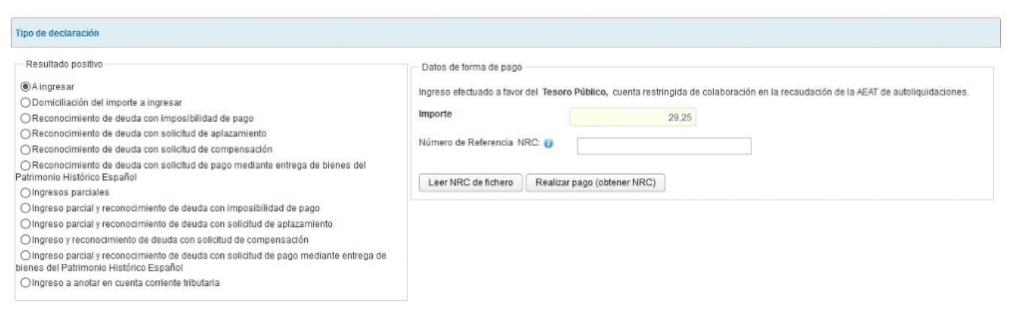

If you submit the online form you can choose the payment method.

The options are:

- Direct debit the payment in your account: If you present it in the first 15 days of the voluntary declaration period. That is, until the 15th.

- Enter your amount: You have to make the payment to obtain a NRC code (Complete Reference Number) and then present the form.

- Deferment: although the option of recognizing debt with a request for deferment continues to appear, Royal Decree-Law 3/2016 definitively ended the possibility of postponing the payment of withholdings and payments on account. Why does it appear if is no longer possible?

The NRC is a code that the bank gives you at the time you pay it. It is proof of having made the payment. Once you write it down on the form, you can sign and send to submit it. Companies can only submit form 111 online.

At the moment in which the income subject to withholding is paid for the first time or in the census declaration of the beginning of the activity, the payer must present the census declaration 036 marking in the corresponding box the obligation to present this form.

From that moment on, you have the obligation to present the form as long as the deregistration is not made using the same procedure.

Most frequent errors when filling out and presenting Form 111

Previous errors when making the form

The most common mistakes you can make before submitting the form are:

Withholdings calculation in employee payroll

Be careful and calculate withholdings correctly. The Tax Agency offers you a withholding calculation service. Make sure your workers fill out and sign form 145 where they communicate their personal and family circumstances.

Withhold obligation

What happens if a professional worker issues you an invoice without any withholding or with the withholding incorrectly calculated? In this case, you must retain (15% of the base) regardless of whether it does not appear on the invoice or does so for a different amount.

When should you withhold

Article 99 of the Income Tax Law states that the obligation to withhold arises when the income subject to withholding is paid.

If you receive an invoice from your computer in May but do not pay it until July, you must include it in the declaration corresponding to the third quarter, which is the time of payment.

Obligation to Present Form 111

The obligation to present form 111 is generated in the declaration of the start of an economic activity (form 036) or when the income subject to withholding is paid for the first time. It is you who inform the Tax Agency that you have to present the form.

This does not mean that the Treasury cannot claim it if you had not marked it and you are obliged to present it.

On the other hand, if in a given quarter you do not have contracted workers and you have not paid any income subject to withholding, you will not be obliged to present the form.

If this happens in the following quarters, the most convenient thing is to realize that this obligation has been withdrawn by checking the corresponding box in the census declaration 036, to avoid the Tax Agency requiring the presentation of the form.

Today, all procedures are automated. For this reason, it is easier for them to claim an obligation that you have registered and that you have failed to pay, than one that does not appear in their database.

Detected mistakes once presented the Form

Once Form 111 has been presented, you may have made the following mistakes:

Amounts in other boxes

If by mistake you write down the amounts of income from economic activities in the boxes corresponding to income from work, do not worry too much. The result does not change. The amounts are correct but they are noted in other boxes.

However, it should be corrected so that it does not distort form 190, which contains the annual summary and from which the Treasury obtains the information for the income tax returns of the people who have been withheld.

For this reason, you must present a letter to Hacienda indicating in detail the occurred mistake.

Incorrect amounts

This time the error does not consist in making a mistake in the boxes, but in entering amounts that are not correct and that give rise to a different result than the one that should have occurred. If the result of the presented declaration is higher than the correct one, you must request the return of undue income.

When you have entered an amount that is less than the correct one, you can correct the error by submitting a complementary declaration as we have already explained.

Forget to include payslips or invoices

Once the deadline for submitting form 111 is over, you realize that you have not included an invoice from the designer of your web page that was issued in the quarter, for example.

So the first thing you should do is check the payment date of the invoice. If you did not pay it in the quarter in which it was issued, the declaration is correct. If you paid it in the quarter of its issuance, you should make a complementary one.

Bear in mind that if the form’s voluntary settlement term has passed, the supplementary payment will appear as out of date and will generate interest.

Conclusion

Here you have all the keys to fill out and present Form 111 of withholdings on account of personal income tax.

If you still consider that it’s very complicated or doing it on your own takes away valuable time that you could dedicate to your business, and you need some type of advice and procedures for SMEs or Self-Employed, you can contact us! It is always good to leave your tax issues in the hands of specialists.