IVA Form 303 is the standard VAT return that self-employed professionals and companies must file in Spain to declare Value Added Tax (IVA). If you invoice with VAT or deduct VAT on expenses, this form is part of your regular tax obligations.

In this guide, you’ll learn what IVA Form 303 is, who must file it, how to submit Form 303 online, key deadlines and common mistakes to avoid, all explained in a practical and straightforward way.

What is IVA Form 303 and what is it used for?

Form 303 is the VAT self-assessment return used to declare the VAT you have charged to your clients and the VAT you have paid on business expenses during a specific period.

VAT in Spain works as a collection system:

- You charge VAT on your invoices (output VAT)

- You pay VAT on business expenses (input VAT)

- With IVA Form 303, you declare the difference

If you charged more VAT than you paid, you pay the difference to the Spanish Tax Agency (AEAT).

If you paid more VAT than you charged, the amount can usually be offset or refunded, depending on the period.

Form 303 is linked to the annual VAT summary (Form 390), although not all taxpayers are required to file that summary.

Who must file IVA Form 303 in Spain?

In general, you must file Form 303 if you are:

- Self-employed (autónomo)

- A company registered in Spain

- Carrying out an economic activity subject to VAT

You must file Form 303 even if there is no activity, unless you are formally exempt.

There are specific situations where VAT regimes differ, but most professionals and SMEs fall under the General VAT Regime.

VAT regimes and Form 303

Spain applies different VAT regimes. The most common are:

General VAT Regime

This applies by default when no special regime is used. VAT rates are:

- 21% (standard)

- 10% (reduced)

- 4% (super-reduced)

Most businesses filing IVA Form 303 are under this regime.

Simplified VAT Regime

Applies mainly to certain small activities listed by the Tax Agency. It is more limited and subject to specific requirements.

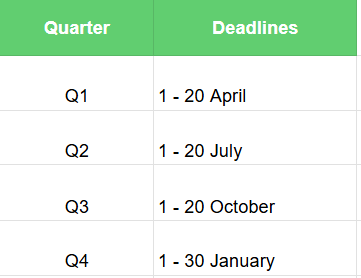

How often do you file Form 303?

Form 303 is usually filed quarterly, although some taxpayers file it monthly.

If the deadline falls on a weekend or public holiday, it moves to the next working day.

Monthly filing

Monthly filing applies mainly to:

- Large companies

- VAT groups

- Businesses registered under REDEME (monthly refund system)

Monthly returns are filed:

- From the 1st to the 20th of the following month

- December is filed from 1–30 January

Monthly filers report VAT through the SII (Immediate Supply of Information) system and do not submit additional VAT books separately.

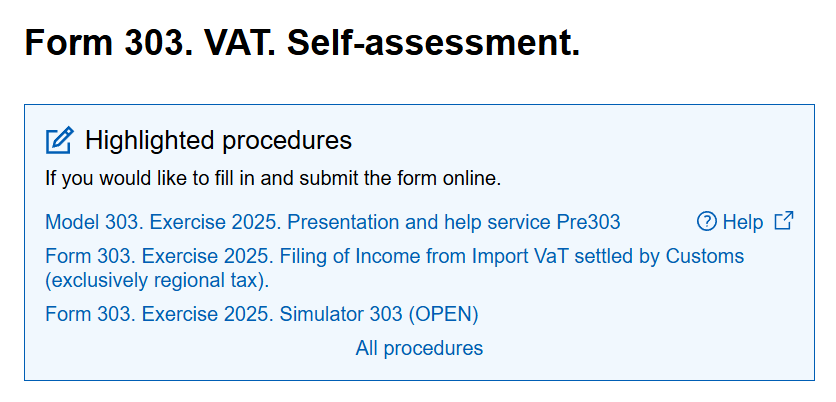

How to file Form 303 online

Form 303 is filed exclusively online. Paper submission is not allowed.

You file it through the Spanish Tax Agency (AEAT) using:

- Digital certificate or DNIe

- Or Cl@ve (for individuals)

Step-by-step overview:

- Access the AEAT online platform

- Select All procedures – Taxes, fees and property benefits – VAT

- Select Form 303

- Complete VAT data for the period

- Review the calculation

- Submit and download the receipt

Information you need to complete Form 303

Before filing Form 303, gather:

- Sales invoices issued

- Expense invoices received

- VAT bases and VAT amounts

- VAT rates applied (4%, 10%, 21%)

- Classification of operations:

- Domestic

- Intra-EU

- Non-EU

Only valid invoices allow VAT deduction. Tickets or receipts without full invoice details are not deductible.

Input VAT, output VAT and investment goods

- Output VAT: VAT charged to clients

- Input VAT: VAT paid on deductible expenses

Some assets are considered investment goods (equipment, machinery, IT assets). These usually:

- Are used for more than one year

- May require adjustment over time

The classification depends on use and nature, not just price.

What happens if the result is negative or positive?

- Positive result: you pay VAT to the Tax Agency

- Negative result: you can:

- Offset it against future VAT

- Request a refund (usually in the last quarter)

How do you pay Form 303 if VAT is due?

You can pay:

- By direct debit (request before the 15th of the deadline month)

- By bank payment through AEAT or your bank

Planning VAT cash flow is essential to avoid surprises.

Frequently asked questions

Do I have to file Form 303 if I had no activity?

Yes, unless you are officially exempt. Zero activity still requires filing.

Can I file Form 303 without an accountant?

Yes, but errors are common. Professional advice helps avoid penalties.

Is Form 303 the same as VAT payment?

Form 303 calculates VAT. Payment depends on the result.

IVA Form 303 is a core tax obligation for anyone doing business in Spain. Filing it correctly and on time avoids penalties, audits and unnecessary stress. Understanding how VAT works and keeping accurate records throughout the year makes the process much simpler. Professional support ensures your VAT returns are compliant and optimised, letting you focus on running your business.

If you need personalized assistance, at Entre Trámites we offer management and tax advisory services for freelancers and SMEs. You can contact us through this contact form for us to call you, or if you prefer, you can schedule a free consultation or write to us on WhatsApp.