We will explain to you how to fill out and submit Form 349 so you learn how to complete this informative declaration of your intra-community transactions easily.

What is Form 349 and what is it for?

Form 349 is a declaration to report intra-community transactions, which means, all acquisitions or sales of goods and services to companies or professionals in EU member countries.

In fact, the Tax Agency has a list of your intra-community transactions in detail, with your CIF, name, and amount, so the amounts have to match to the last cent.

So it is important to emphasize that:

- We should only include the transactions that we carry out with companies or professionals. If we sell products or services to individuals, it is not considered an intra-community transaction.

- We must also take into account which countries belong to the European Union. Since if they do not belong to the EU, they would not be considered intra-community transactions, but exports. The EU countries are:

- Germany

- Austria

- Belgium

- Bulgaria

- Cyprus

- Croatia

- Denmark

- Slovakia

- Slovenia

- Spain

- Estonia

- Finland

- France

- Greece

- Hungary

- Ireland

- Italy

- Latvia

- Lithuania

- Luxembourg

- Malta

- Netherlands

- Poland

- Portugal

- Czech Republic

- Romania

- Sweden

What are intra-community transactions?

Explained in a simple way, they are the sales or purchases made to companies or professionals from a country member of the European Union.

If the recipient of the invoice is a natural person (individual), it is not considered an intra-community transaction.

Remember that not all European countries belong to the EU. If they are not a member state, then they are not considered intra-community transactions, but exportation.

The amounts included in Form 349 are also declared in Form 303.

It does not mean that you are going to pay or deduct an extra amount, keep in mind that it is an informative form. But, intra-community transactions do affect IVA, therefore they must be included in Form 303.

These amounts have to match exactly. The exact sum. This is key to filling it without errors. If the two forms do not match, some errors will appear.

Separate them by type of transaction and look for the boxes in Form 303:

- Intra-community acquisitions: put the amount in the accrued IVA (that of your issued invoices) and the same in the deductible IVA (that of your expense invoices).

- Intra-community deliveries: write down the amount (they go without IVA).

Who is required to submit Form 349?

The presentation of Form 349 is obligatory only if you are a self-employed worker or have a company that carries out intra-community transactions, regardless of the IVA scheme for which you pay taxes and regardless of the amount.

Remember that if you want to operate in the European Union, you must register in the Register of Intra-Community Operators (ROI) with Form 036 and they will give you a CIF so you are able to work legally.

On the other hand, if you do not have one, you are not required to present it.

You can register at the ROI online, but it becomes effective after a while, not immediately. In most cases, a Treasury technician will visit your office or premises to verify that this type of operation exists. But do not worry, they do this routinely.

What data will you need to fill in Form 349?

Before you start filling in the boxes, gather all the important information you will need.

Make a list of all your intra-community transactions.

Remember, you only invoice customers for your sales or suppliers for your purchases or expenses from EU member countries.

Look for your invoices and write down the intra-community CIF (it must start with the letters of the EU country code), name, and the total sum of the invoices.

Separate by type of transaction, sales or purchases.

Remember that Form 349 is another of the declarations that we must present to the Tax Agency. It aims to inform about the intra-community transactions that we carry out, that is, the purchases and sales of products and services to other member states of the European Union.

When do you have to present Form 349?

It is submitted during the first 20 calendar days of the following month, except for the one corresponding to July, which may be presented during August and the first 20 calendar days of September, and the one corresponding to December, which must be presented during the first 30 calendar days of January.

However, this presentation may be quarterly or annually in the following cases:

- Quarterly: When neither during the reference quarter nor in each of the four previous calendar quarters the total amount of the deliveries of goods and services (without IVA) exceeds 50,000 euros. The submission deadlines are:

- 1st quarter: from April 1 to 20.

- 2nd quarter: from July 1 to 20.

- 3rd quarter: from October 1 to 20.

- 4th quarter: from January 1 to 30.

- Annual: If the total amount of deliveries of goods or services during the previous year does not exceed 35,000 euros (without IVA) and, in addition, the total amount of deliveries of goods to other Member States (excluding new vehicles) does not exceed 15,000 euros. The submission deadline will be from January 1 to 30.

As we can see, to calculate the periodicity that corresponds to us for presenting Form 349, intra-community purchases will not be taken into account, but exclusively sales. So if your company carries out intra-community transactions but only makes purchases, you can make this declaration annually, quarterly or monthly, as you see fit.

Keep in mind that if you do not carry out intra-community transactions for a year, you will not be required to submit Form 349. But the Tax Agency will remove you from the Register of Intra-Community Operators (ROI).

How is Form 349 filled out?

Form 349 can only be submitted online. Here we tell you the step-by-step procedure to do it:

- Go to the Form 349 section. Informative Declaration. Summary statement of intra-community operations of the Electronic Office of the Tax Agency.

- In the Submit (via file) section, access “Form 349. Financial year 2022. Submission via file“. It will ask you for your digital certificate or the Cl@ve PIN.

- When you enter you will see some explanations about the procedure and the option to choose the file to import and generate the form appears.

- When you import the file, you will go to a summary screen with all the data filled in automatically.

- If all the information is correct, click on “Sign and send” and that’s all!

It is very important that you also include the data from Form 349 in Form 303 of the IVA declaration. Remember that this data must match exactly.

Separate by type of transaction and look for the boxes in Form 303:

- Intra-community acquisitions: we will record the IVA accrued and the same in the deductible IVA. This means that we are going to deduct it ourselves: we declare it as income and expense at the same time so that the result is neutral.

- Intra-community deliveries: as they are not subject to IVA, we will only have to report the transaction. Therefore, it has no incidence on the IVA amount.

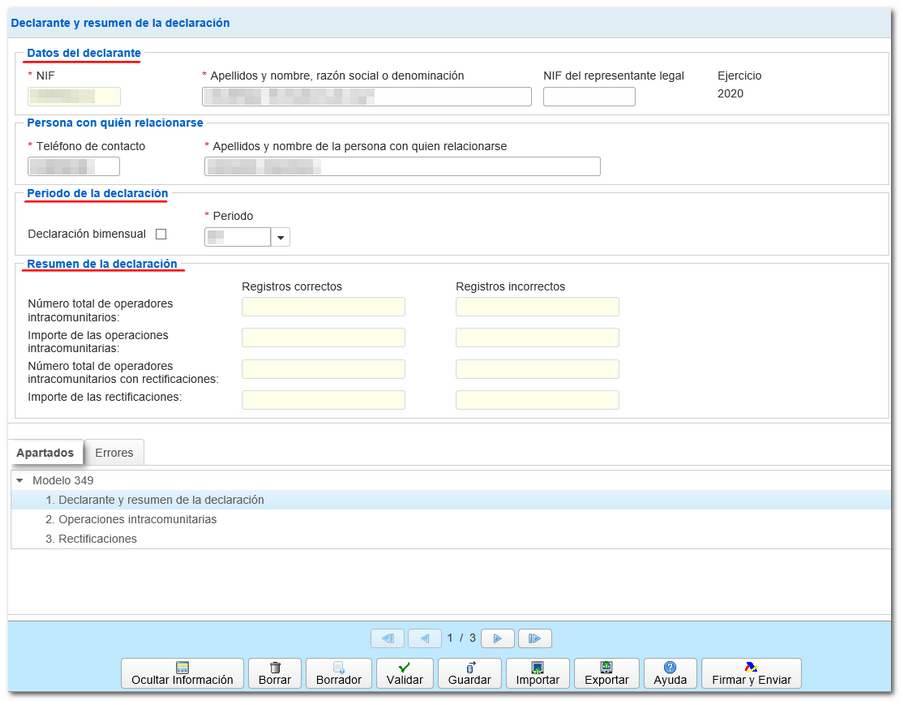

Declarant

The declarant is you. Write down your personal data like NIF, surname, name, telephone number, and contact person just in case.

Transactions

Now write down the data of the transactions that you are going to declare. Take the list you made and start filling in the boxes.

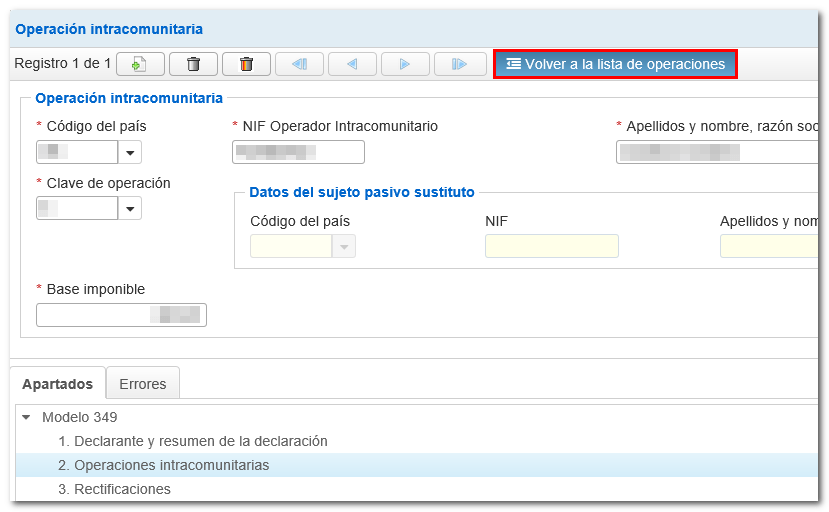

Register a new transaction.

Write down all the details of the transaction:

- Country code: clicking on the arrow will display the list with all the countries and their corresponding code. Filling in this box will open the next one so you can continue entering the data.

- NIF of the intra-community operator: write down the numbers without the initial letters of the country since they already are in the previous box.

- Operator name (company or self-employed, your client or supplier).

- Select the key of the transaction. You can also click on the arrow to see all the keys.

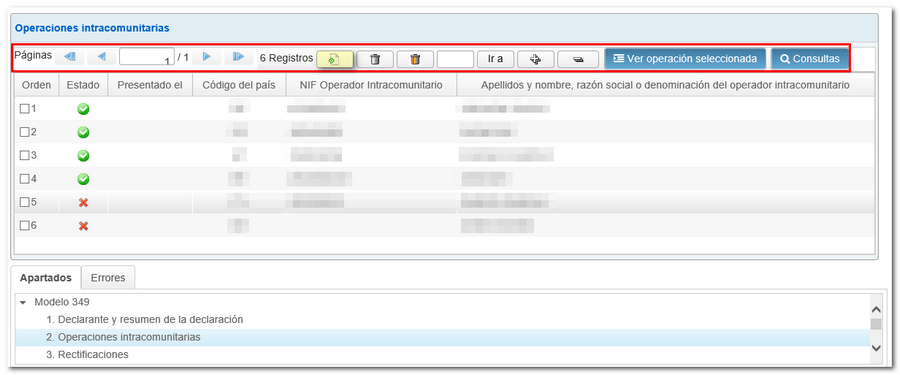

The list of transactions will display the relationship of all the records registered with the information organized in columns.

Using the icons in the “Status” column, you can easily check the records that are correct and those that contain errors, in order to make the corresponding changes, additions or deletions.

You can access the details of each record by double-clicking on the NIF or by marking a particular record and clicking “See selected transaction”.

Once inside the detail, you can return to the general list by clicking “Back to the list of transactions”.

Corrections

Negative amounts are not allowed in Form 349.

Imagine that you receive or issue a corrective or credit invoice to a previous one. This invoice cannot be written down directly.

You will have to write down the previous data, which you have already declared in some other quarter or period, and then enter the amount. You have to subtract it so that in the end you get the total for that customer or supplier.

- First, what you have previously declared (previously declared tax base).

- Then the correct amount that should have been written (rectified tax base).

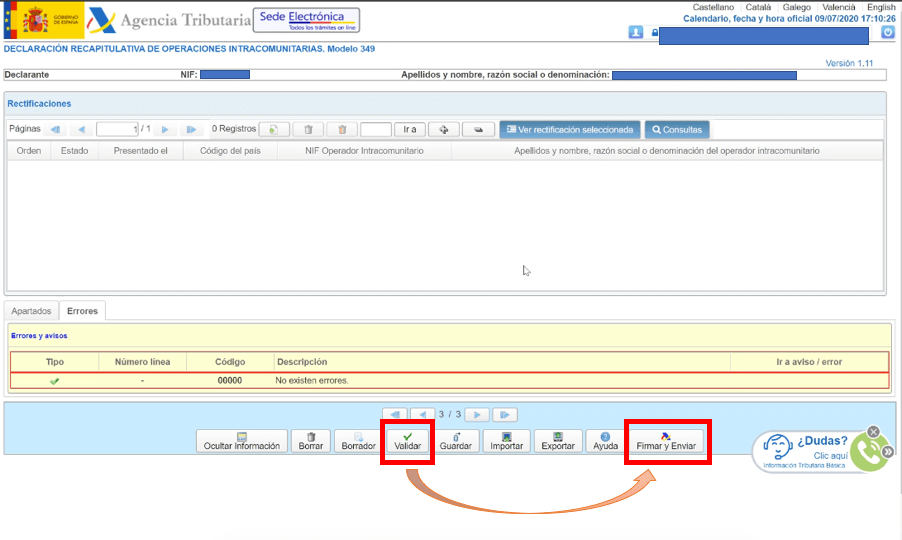

Presentation

It only remains to submit it. In a few steps, you will finish it.

Do not forget to download the PDF that will appear on the screen.

Frequent errors when filling out and presenting Form 349

Filling out Form 349 is actually simple and easy. But occasionally you may make some mistakes. Pay attention so that it is not your case.

1. Forgetting to include the data in Form 303 or Form 349

You may present Form 349 for the current quarter and then forget to put the same amounts in Form 303. This is more frequent than you might believe.

Why?

Because intra-community transactions do not alter the result of IVA. First, you put the amounts in the accrued IVA (that of your issued invoices) and then the same in the deductible IVA (that of your expense bills). So the result is the same.

If they are intra-community deliveries they are out of the result, because this amount goes without IVA, in a box near the bottom.

So, what to do if you see yourself with mismatched 303 and 349 forms?

If you have forgotten to include the data in Form 303, submit a letter indicating the error.

2. Being confused with intra-community transactions

Knowing the countries of Europe is easy, but you may have some confusion about some particular ones.

So maybe you believe that, for example, Norway belongs to the European Union.

Where is the problem? Well, if you have gotten confused, you may have included the total amount in the IVA Form 303 and when you go to Form 349 you find that you cannot find the country in the drop-down menu of EU countries. Then, how can you solve this?

Make a document modifying Form 303 and submit Form 349 correctly.

3. Including the wrong CIF

In Form 349 this error is one of the most common, you will wonder why.

It is because the intra-community CIF has a sequence of different numbers for each country. When you look at the bill sometimes it is not so easy to tell.

You do not even realize that you have it written down incorrectly until you start filling in Form 349. That is when the wrong CIF notification pops up. You get desperate typing a thousand times but, nothing, you don’t get it.

So in the end you end up calling I don’t know what country to get someone to give you the correct number. You may have even left it for the last day of the deadline, leaving you with little time to fix it.

Make sure before that you have the correct CIF. Do not leave it for the last day.

Conclusion

As you can see, completing Form 349 is easier than it seems, but doing it on your own will consume valuable time that you could dedicate to your business. If you need any type of advice for SMEs or self-employed, you can contact us. It is always good to leave tax issues in the hands of specialists.