If you are a freelancer (autónomo) or run an SME in Spain, you have probably heard bells ringing for months about the new electronic invoicing rules and the software monitoring required by the Tax Agency (Hacienda). It is completely normal to feel worried about having to change your way of working or spending money on new software.

Well, we have some important news that will give you some breathing room. Although the regulations are moving forward, the deadlines have been stretched out. The Verifactu system, a key piece of the Spanish Anti-Fraud Law, will not be mandatory for the majority of small businesses until well into 2027.

In this article, we will explain—without complex jargon—what this delay means, what this system actually is, and how you should prepare (calmly) for when the time comes.

What exactly is the Verifactu system?

Before we talk about dates, let’s clarify the concept. When we talk about the Verifactu system, we are not referring to a specific program sold by the Government, but rather to a set of technical requirements that your invoicing software (like your accounting program or POS) must meet.

Hacienda’s goal is to prevent “dual-use software”—those programs that used to allow businesses to keep “B-books” (undeclared accounting) or delete sales records.

How does it work?

Basically, the software you use to issue your invoices must meet two main conditions:

- Integrity: Once an invoice is issued, it cannot be altered or deleted without leaving a trace.

- Connectivity (Optional but recommended): The ability to automatically send invoicing records to the Tax Agency (AEAT) instantly. This is what is technically known as “Verifactu mode.”

Additionally, your invoices will carry a QR code that any client can scan to verify that the invoice has been properly declared.

The new calendar: Why we are looking at 2027

The big news recently is the adjustment in the implementation schedule. Initially, this was expected to be up and running much sooner, but the approval of the Ministerial Order defining the technical details (approved in late 2024) has shifted the pieces on the board.

The regulation establishes staggered deadlines to give time to both software developers and taxpayers.

The timeline breakdown is as follows:

- For software developers: They have a period of 9 months from the approval of the technical order to adapt their products. This places us in mid-2025. From that point on, they will not be able to sell programs that are not “Verifactu” compliant.

- For companies and freelancers (the bulk of the business fabric): This is where the delay helps you. The general rule usually allows a wide margin after the software adaptation.

Here is the excellent news: The year 2026 is free of obligations for you. According to the latest updates, the calendar has been adjusted, moving the definitive entry into force directly to 2027.

Furthermore, not everyone will start at once. A staggered calendar has been set with two key dates during that year:

- From January 1, 2027: It will be mandatory for companies and societies (such as S.L. corporations).

- From June 1, 2027: It will be the turn for the rest of taxpayers (the vast majority of freelancers/sole traders).

This means you have even more margin than expected to get organized, without intermediate “patches” or temporary fixes in 2026.

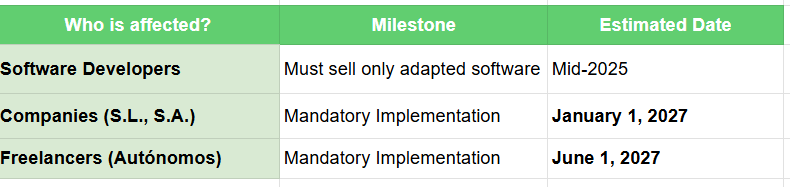

Visual summary of the situation

To make it clearer, here is a table with the current forecast:

What are the advantages of this delay for you?

The fact that the Government has delayed the entry into force of the Verifactu system to 2027 is good news for several practical reasons:

- Immediate savings: You don’t have to rush out tomorrow to buy a new software license or hire a digitalization service in a panic.

- Market maturity: By the time it’s your turn, invoicing programs will have already been tested by large companies. The “bugs” will be fixed, and the offer will be wider and likely cheaper.

- Planning for costs and aids: The Kit Digital calls have specific deadlines and, in some cases, have already closed for certain groups. However, since this is a state obligation, new lines of aid or surplus funds may likely emerge looking toward 2027. Keep a very close eye on subsidy news to catch any new financing opportunity on the fly to help with the software change.

Note: Don’t fall asleep at the wheel. Although there is time, digitalization is unstoppable. If you still make invoices in Word or Excel, start thinking about migrating to professional software, because those manual methods will no longer be valid to comply with the technical standards of integrity.

How to prepare without stress

You don’t need to take drastic action today. However, if you are thinking about changing your invoicing program now, make sure to ask the provider: “Will your software be adapted to the Verifactu system when it becomes mandatory?”

Most cloud-based software (SaaS) will update themselves, and you will barely notice the change, except that you will see a QR code appear on your invoices and perhaps a button to voluntarily submit them to Hacienda.

Remember that this system will coexist with the B2B Electronic Invoice (Create and Grow Law), which is a parallel regulation. The Verifactu system focuses on how the invoice is generated (fighting fraud), while the Create and Grow Law focuses on the format of exchange between companies. Both will converge around these dates.

Frequently Asked Questions

Can I be fined if I don’t have the Verifactu system installed today?

No. As of today, it is not mandatory for freelancers. The deadlines have been extended, and general mandatory use for SMEs and freelancers points to 2027. You should only worry if you are using dual-use software (to hide sales), as that is already illegal.

Will paper invoices disappear?

The Verifactu system allows you to print invoices, but these must have been generated by a computer system that includes the QR code. What will progressively disappear is the invoice made “by hand” or in simple word processors that do not guarantee data integrity.

How much will it cost to adapt my business?

If you already use cloud invoicing software, it is very likely that the cost will be zero or minimal, as the update will be handled by the software provider. If you don’t use any, you will have to hire one, but you can take advantage of aids like the Kit Digital if new calls open up.

Although 2027 may seem far away, in the world of administration, time flies. Keeping yourself informed will allow you to choose the best tool for your business without last-minute pressure. Use this extra time to organize your accounts and digitize at your own pace.

If you need personalized assistance, at Entre Trámites we offer management and tax advisory services for freelancers and SMEs. You can contact us through this contact form for us to call you, or if you prefer, you can schedule a free consultation or write to us on WhatsApp.