Staying on top of your tax obligations is one of the most important parts of being a freelancer (autónomo) or running a company in Spain. We know it can feel overwhelming, but failing to file declarations or omitting data can lead to significant sanctions from the Spanish Tax Agency (Hacienda).

Understanding exactly what these infractions are—and the VAT penalties associated with them—is your first line of defense.

In this guide, we break down the most common fines regarding census obligations and Value Added Tax (VAT), giving you practical advice to keep your tax situation healthy and stress-free.

Census Infractions: The Importance of Models 036/037

“Census obligations” refers to registering, modifying, or deregistering your activity details in the Censo de Empresarios (Census of Entrepreneurs). You do this using Model 036 (standard) or Model 037 (simplified).

Think of this as your “ID card” for Hacienda. If this information isn’t up to date, the system breaks down, and fines follow.

Common Mistakes and Fines

- Not filing the “Start of Activity” (Alta): This is considered a serious infraction. If you start working but don’t register in the census, Hacienda can impose a fine. While amounts vary based on severity, the standard fixed penalty for failing to communicate data is often €400, though depending on the specific circumstances and potential harm to the treasury, it can range from €150 to €2,000.

- Not updating your data: Did you move house? Change your business activity? You must notify Hacienda within one month of the change. Failing to update your tax domicile or activity details usually carries a fixed fine (often around €250 to €400).

- Not filing the “End of Activity” (Baja): If you stop working or close your business, you must officially deregister. Simply stopping isn’t enough. Failing to present your deregistration can result in a fine, typically starting around €100 to €400, depending on the delay and context.

VAT Penalties and Surcharges (Model 303)

The Impuesto sobre el Valor Añadido (VAT) is strictly monitored by the Tax Agency. Consequently, the VAT penalties for non-compliance can be steep.

1. Failure to File the VAT Return (Model 303)

Not filing your quarterly Model 303 on time is the most frequent error. The consequence depends on the result of the declaration:

- Result is Zero or Negative (To Compensate/Refund): If you don’t owe money but file late, the penalty is a fixed fine, usually €200 (often reduced to €150 or even less if you pay quickly and admit the error).

- Result is Positive (You owe money): If you fail to file at all, the penalty increases significantly. It can be 50% of the unpaid amount, plus interest.

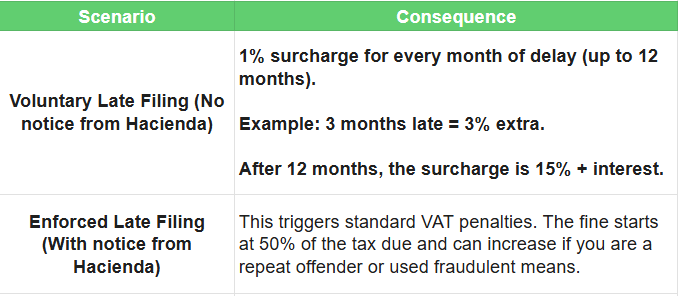

2. Filing Late (Surcharges vs. Penalties)

If you realize you forgot to file and you submit the Model 303 late voluntarily (before Hacienda sends you a notification), you avoid the heavy sanctions. Instead, you pay “surcharges” (recargos).

3. Invoicing Without VAT

If you issue invoices to clients within Spain without applying the correct VAT rate, penalties can range from 50% to 150% of the VAT amount that should have been charged.

Prevention: How to Avoid Problems with Hacienda

The best strategy against VAT penalties is simple prevention. Here are four essential tips to keep your business safe:

- Keep a Fiscal Calendar: Mark every deadline (VAT, IRPF, withholdings) in your calendar. Do not leave it for the last day, as technical glitches can happen.

- Use Digital Tools: Modern invoicing software helps you keep a precise record of your income and expenses, ensuring you don’t miscalculate the tax due.

- Check Your Census Data: Once a year, review your Model 036/037 status. Ensure your registered address matches your actual location.

- Get Professional Help: A gestor (tax advisor) is often worth the investment. They handle the paperwork, ensuring you comply with every deadline and requirement, drastically reducing the risk of errors.

Non-compliance with census obligations or VAT rules can become expensive very quickly. Taking proactive steps is the only way to operate with peace of mind.

Frequently Asked Questions

What happens if I file my VAT return one day late?

If you file voluntarily (before Hacienda notifies you), you will only pay a small surcharge of 1% of the amount due. If the return was negative (no money to pay), you might face a fixed fine of roughly €150-€200, which is reduced if paid promptly.

Can I appeal a fine from the Tax Agency?

Yes, you always have the right to appeal. However, you need valid proof that the error wasn’t your fault or that the administration made a mistake. If the error was clearly yours, it is often cheaper to accept the sanction and pay early to get the 25% reduction on the fine amount.

Do I have to deregister if I am just taking a break for a few months?

If you are pausing your activity completely and want to stop paying the Social Security fee (Cuota de Autónomo), you must formally deregister (Model 036/037). If you don’t, you remain liable for tax obligations and fees.

If you need personalized assistance, at Entre Trámites we offer management and tax advisory services for freelancers and SMEs. You can contact us through this contact form for us to call you, or if you prefer, you can schedule a free consultation or write to us on WhatsApp.