The Spanish Congress approved the application of a special registration for the territory of the Canary Islands, where the Canary Islands General Indirect Tax (IGIC) will be applied with a tax rate much lower than that applied in the common territory of Spain known as IVA (Impuesto al Valor Añadido).

That is why all people who live in this territory and want to carry out professional or business activities must register in this special scheme, in order to sell to their clients and buy from their suppliers or creditors with the Canary Islands General Indirect Tax (IGIC).

This special scheme is known as Form 400. It corresponds to the census declaration of entrepreneurs or professionals, which allows charging and paying with the IGIC as long as the fiscal address is in the Canary Islands. It can be said that it is a way of keeping track or registering the collection of this tax.

Do you want to know how to sign up? In this blog, we’ll tell you so keep reading! And if you have any questions, you can contact Entre Trámites and we will solve them for you. You can also have a free consultation!

Who must present Form 400?

Those who want to set up their business in the Canary Islands will be obliged to present this form. However, there are activities that are not required to present it, such as activities related to education, health, and retail trade that are registered under the small professionals’ scheme.

Many make the mistake of believing that in the Canary Islands the registration is not made using Form 036 since Form 400 replaces it. Well, it is NOT like that, you must register in both forms and in Social Security.

So, what is the order that I must follow to register as a self-employed worker and pay taxes in the Canary Islands properly? The order to follow is this:

- Register with the Tax Agency by presenting Form 036 or 037.

- Register with Social Security in the corresponding scheme (when filling in Form 036 or 037 this can be requested).

- Register with the Canary Islands Tax Agency through the presentation of Form 400.

Should I fill out Form 036 of the Spanish Hacienda?

Yes, it is a mandatory requirement to submit Form 036, since first, you request your registration as a self-employed person or company, and then you request to be able to pay the IGIC as self-employed or company in the Canary Islands through the application of Form 400. This is presented prior to the start of the activity that you intend to carry out, as well as if one day you decide not to pay more taxes.

In other words, deregistering as a self-employed worker or company will have a period of one month from the day the decision is made. A piece of information to take into account when filling out Form 400: it is not difficult to fill it in, but it does require doing it with great care with respect to the information that is written. What kind of information goes into this form? Keep reading!

How is Form 400 filled?

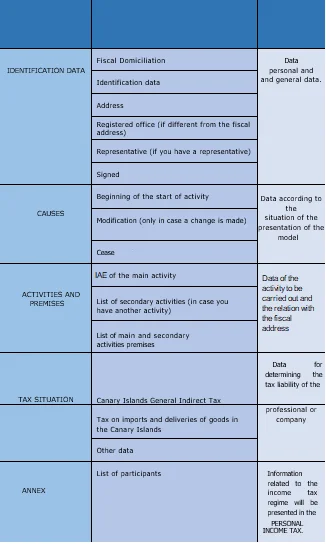

The form consists of 5 sheets to fill out carefully, these are:

Additionally, there are 3 ways to present Form 400:

- By certified mail to the corresponding office according to your fiscal address.

- Fill out the form online and submit it directly to the corresponding office.

- Fill it out through the Electronic Office online.

Now, it is already clear that there is a special form for people who want to work in the Canary Islands since Form 400 is the Mandatory Census Declaration that allows economic activity to start within the archipelago and to be able to pay the IGIC. That means, paying quarterly this tax to the Canary Islands Tax Agency through Form 420.

It should be noted that carrying out an activity within this territory has certain benefits: it allows you to collect and pay much lower taxes than the ones paid in the peninsula.

Do you want to know more?

Finally, we hope that this information about the IGIC has been useful to you! At Entre Trámites we invite you to know about all our services for SMEs and the self-employed, including tax and accounting management.

Contact us! Fill in our contact form and we will call you to help you as soon as possible, schedule a free online consultation, or simply text our WhatsApp.