Understanding Tax deductions for the self-employed in Spain is essential if you want to avoid overpaying IRPF and VAT (IVA) — and stay protected in case of an inspection.

Spanish tax law allows you to deduct certain business-related expenses, but only if they meet strict legal requirements. In this guide, you will learn what you can deduct, under which conditions, and how to declare everything correctly.

What are Tax deductions for the self-employed?

For self-employed workers (autónomos), tax deductions reduce the taxable base of:

- Personal Income Tax (IRPF) – regulated by Law 35/2006 of IRPF

- VAT (IVA) – regulated by Law 37/1992 of VAT

To qualify as deductible, an expense must be:

- Linked to your economic activity

- Properly justified with an invoice

- Recorded in your accounting books

If one of these three elements is missing, the expense can be rejected by the Tax Agency.

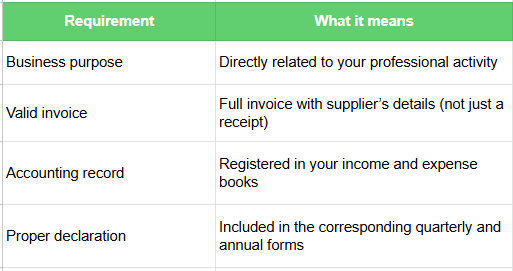

Main requirements for Tax deductions for the self-employed

Here is a simplified overview:

In 2026, the Spanish Tax Agency continues to increase digital cross-checking systems, so accurate documentation is more important than ever.

Most common deductible expenses

Below are the most frequent Tax deductions for the self-employed, provided they meet legal criteria:

Office rent and coworking spaces

Fully deductible in IRPF and VAT if the contract is in your name and linked to your activity.

Supplies (if you work from home)

If you work from home and have declared your workspace to the Tax Agency (via Form 036 or 037), you can deduct:

- 30% of the proportional part of utilities (electricity, water, internet), based on the square meters used for business.

This rule is established under Article 30.2 of the IRPF Law.

Professional materials and equipment

Computers, software, office supplies, tools, machinery, etc.

Items over €300 (excluding VAT) may need to be depreciated over several years.

Social Security contributions

Your monthly autónomo quota is fully deductible in IRPF.

Professional services

Legal, accounting, tax advisory services — fully deductible.

Vehicle expenses

Only deductible if the vehicle is exclusively used for business (except for certain professions like commercial agents).

For VAT purposes:

- Generally, only 50% of VAT on vehicles is deductible unless exclusive business use can be proven.

What expenses are deductible in VAT but not in IRPF?

This is a common source of confusion.

Some expenses allow partial VAT deduction but limited IRPF deduction depending on their business connection.

For example:

- Meals with clients are deductible if directly related to activity and properly justified.

- Since recent IRPF updates, meal expenses are deductible up to specific daily limits when paid electronically:

- €26.67 per day in Spain

- €48.08 per day abroad

These limits apply when the expense occurs during professional activity outside your usual workplace.

How to declare Tax deductions for the self-employed

To correctly apply Tax deductions for the self-employed, you must file:

Quarterly VAT return – Form 303

Declare VAT collected and VAT paid.

Quarterly IRPF payments – Form 130

Advance payment based on net income (income minus deductible expenses).

Annual summaries

- Form 390 (annual VAT summary)

- Income Tax Return (Renta)

Failure to justify deductions can result in penalties ranging from 50% to 150% of the improperly deducted amount, according to the General Tax Law (Ley 58/2003).

Frequent mistakes to avoid

Many self-employed workers face problems because they:

- Deduct expenses without a proper invoice

- Mix personal and professional expenses

- Fail to declare home workspace correctly

- Deduct full vehicle VAT without justification

- Forget to record expenses in official books

If you want to optimise your Tax deductions for the self-employed, proper bookkeeping is not optional — it is essential.

Frequently Asked Questions (FAQs)

Can I deduct expenses if I do not have an invoice?

No. A valid invoice is mandatory. Receipts or bank charges are not sufficient for tax purposes.

Are home office expenses fully deductible?

No. Only 30% of the proportional part of utilities is deductible, and you must have declared your workspace to the Tax Agency.

Can I deduct my car as a self-employed worker?

Only if it is exclusively used for business. Otherwise, VAT deduction is generally limited to 50%, and IRPF deduction may be restricted.

Managing Tax deductions for the self-employed correctly is one of the smartest financial decisions you can make as an autónomo in Spain. With proper planning and expert support, you can optimise your taxes while staying fully compliant.

If you need personalized assistance, at Entre Trámites we offer management and tax advisory services for freelancers and SMEs. You can contact us through this contact form for us to call you, or if you prefer, you can schedule a free consultation or write to us on WhatsApp.