Self-employed social security is not optional in Spain — it’s a legal requirement for freelancers and sole traders. This protection under the Régimen Especial de Trabajadores por Cuenta Propia o Autónomos (RETA) ensures you have access to healthcare, disability support, pensions and more. In this updated guide, you’ll find clear, verified information about self-employed social security, what it covers, what the rules, and how to stay compliant and protected.

What Is Self-Employed Social Security?

Self-employed social security refers to the set of mandatory contributions that all freelancers and sole traders (autónomos) must make to the Spanish Social Security system (RETA). This system gives you:

- Public healthcare coverage

- Pension rights

- Benefits for temporary or permanent disability

- Access to unemployment-style protection for self-employed (cese de actividad) (if conditions are met)

These contributions are compulsory — failing to meet them can result in fines, loss of benefits, or personal liability for healthcare costs.

Why Is Self-Employed Social Security Mandatory?

Yes — contributing to self-employed social security is mandatory under Spanish law. Every self-employed professional must be registered with RETA and pay contributions based on your income. This requirement ensure you are covered in case of:

- Workplace accidents or occupational illnesses

- Temporary or permanent incapacity

- Retirement pension entitlement

- Healthcare services

There is no legal alternative that completely replaces this — even if you take private insurance, it cannot substitute compulsory Social Security contributions.

What Does Social Security Coverage Include for Self-Employed?

Your contributions give access to:

- Public healthcare, including care for accidents and illness

- Temporary disability benefits if you are unable to work

- Permanent disability compensation

- Retirement pension accrual

- Family and survivor benefits (e.g., widowhood or orphan pensions)

For example, a self-employed delivery professional injured on the job would receive medical treatment and financial support during sick leave through their Social Security coverage.

How Do You Manage Your Coverage?

When you register as self-employed in Spain:

- Register under RETA with the Social Security system.

- Choose a mutual insurance provider (Mutua) — these companies manage your professional contingencies (e.g., Fremap, Mutua Universal, Ibermutua).

- Your chosen mutual will handle existing benefits such as incapacity payments and rehabilitation services.

Choosing the right mutual matters: compare networks, reputation, response times and service levels.

Self-Employed Social Security Costs

The Social Security contribution for self-employed workers is tied to net income through a system of 15 income brackets. The more you earn, the more you contribute. This system — fully implemented — is designed to align contributions with real earnings.

Key points:

- You must estimate your expected annual income, and Social Security assigns you a bracket.

- You can adjust this estimate up to six times a year if your income changes.

- The maximum contribution base in 2025 is €4,909.50 per month.

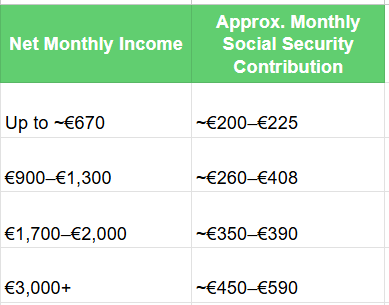

Below is a simplified example of how the contribution system works (based on typical figures):

(Actual amounts vary depending on chosen base within your bracket and additional factors like MEI. The table above is intended to illustrate proportional movement in contributions.)

What the contribution includes (typical breakdown):

- Common contingencies (healthcare, pensions) — part of your total contribution

- Professional contingencies — for work accidents and occupational illnesses

- Cessation of activity — unemployment-style protection for self-employed

- Professional training and support

- Intergenerational Equity Mechanism (MEI) — a small added percentage to support pension sustainability

Can You Pay Less When You Start?

Yes. If you are newly self-employed, you can apply for the “flat rate” (tarifa plana):

- Typically a reduced fee of around €80 per month for the first year.

- This reduced rate may extend into a second year if your income remains below certain thresholds.

This special regime helps new freelancers get started without the full contribution burden immediately.

Can You Adjust Your Contribution During the Year?

Absolutely. Under the system:

- You can change your contribution bracket up to six times per year to better reflect your actual or expected net income.

- This flexibility helps ensure your contributions are fair and aligned with what you actually earn.

What Happens If You Don’t Comply?

Failing to meet your self-employed Social Security obligations can result in:

- Fines and interest on late payments

- Loss of access to benefits (including healthcare or disability support)

- Personal liability for costs normally covered by the system

- Potential disqualification from certain state incentives

Frequently Asked Questions (FAQs)

Can private insurance replace Social Security contributions?

No. Private policies may offer extra coverage but cannot replace mandatory Social Security payments. You still must contribute under RETA.

Do new self-employed workers pay full Social Security contributions?

Not immediately. New freelancers can benefit from a lowered “flat rate” contribution for a set period, reducing costs while the business grows.

Can I change my Social Security bracket mid-year?

Yes. You can adjust your income estimate and contribution bracket multiple times a year to reflect changing circumstances.

Understanding self-employed social security is key to staying compliant and protected in Spain. It not only gives you access to health care and financial support when you need it most, but also ensures your long-term rights like retirement benefits. Meeting your obligations with clarity and planning gives you peace of mind to focus on your business.

If you need personalized assistance, at Entre Trámites we offer management and tax advisory services for freelancers and SMEs. You can contact us through this contact form for us to call you, or if you prefer, you can schedule a free consultation or write to us onWhatsApp.