If you are a shareholder and director of a Spanish company, understanding tax as a corporate self-employed is essential. Your tax obligations are not the same as those of an individual sole trader, and they directly affect how you pay yourself, how you invoice, and how much you contribute to Social Security.

In this updated guide, you will find clear and verified information based on current Spanish legislation, including the Personal Income Tax Law (IRPF), VAT Law, Corporate Income Tax Law and the General Social Security Law, as well as the latest contribution system in force in 2025.

What does “tax as a corporate self-employed” mean in Spain?

In Spain, you are considered a corporate self-employed (autónomo societario) when:

- You are a shareholder of a mercantile company (usually an SL).

- You perform management or executive functions.

- You have effective control of the company (generally holding at least 25% of shares if you are a director, or 33% if you provide services, according to Social Security criteria).

In this case, you must register with:

- The Spanish Tax Agency (Agencia Tributaria) using form 036/037.

- The Special Regime for Self-Employed Workers (RETA) with Social Security.

This classification determines your tax as a corporate self-employed, including how you are taxed under IRPF, whether you must charge VAT, and how much you contribute to Social Security.

IRPF and tax as a corporate self-employed: payroll or invoice?

One of the biggest doubts about tax as a corporate self-employed is how you should be paid.

Option 1: Through payroll

If you perform management duties as an administrator or director, remuneration is generally treated as employment income for IRPF purposes (Article 17 of the IRPF Law).

Your company:

- Pays you through payroll.

- Applies IRPF withholdings.

- Declares the expense in Corporate Income Tax.

This is common when your activity is clearly linked to management functions.

Option 2: Issuing invoices to your own company

If you provide professional services independently from management tasks, you may invoice the company.

In this case:

- You declare income as economic activity.

- You apply IRPF withholdings (usually 15%, or 7% during the first three years if eligible).

- You may have to charge VAT, depending on the nature of the service.

The key factor is whether the service is genuinely independent. The Spanish Tax Agency and the Directorate-General for Taxes (DGT) have clarified that when there is real organisational independence, invoicing may be justified.

Getting this wrong can trigger tax inspections, so reviewing your structure is essential.

VAT and tax as a corporate self-employed

VAT treatment depends on whether you act independently from the company.

According to the Spanish VAT Law (Law 37/1992):

- If your services are subject to VAT and carried out independently, you must charge 21% VAT (general rate).

- If your activity is not considered independent (for example, purely internal management functions), VAT does not apply.

In practice:

- Management remuneration paid via payroll → no VAT.

- Professional services invoiced separately → VAT usually applies.

You must also submit:

- Quarterly VAT returns (form 303).

- Annual VAT summary (form 390), unless exempt.

Social Security contributions for corporate self-employed

Since the 2023 reform of the self-employed contribution system, contributions are based on real net income.

As a corporate self-employed, you are included in RETA under specific rules.

How much do you pay in 2025?

- Contributions depend on projected annual net income.

- Corporate self-employed must respect a minimum contribution base, which is usually higher than that of standard sole traders.

- The minimum monthly contribution is approximately €310–€320, depending on your chosen base and income bracket.

Contributions cover:

- Common contingencies

- Professional contingencies

- Cessation of activity

- Training contribution

You must regularly adjust your income forecast with Social Security to avoid underpayment or overpayment.

Tax obligations calendar

Understanding tax as a corporate self-employed also means staying on top of deadlines.

Quarterly obligations

- IRPF instalment payments (form 130, if applicable)

- VAT return (form 303)

- Withholdings (form 111, if you have employees or professionals)

Annual obligations

- Income Tax Return (IRPF)

- VAT annual summary (form 390)

- Informative returns (form 190, 180, etc., depending on your activity)

Failing to comply may result in surcharges ranging from 1% upward, plus interest and possible penalties.

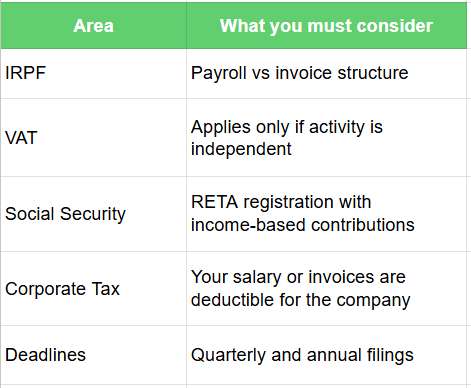

Summary: key elements of tax as a corporate self-employed

Frequently Asked Questions (FAQs)

Do corporate self-employed workers pay more Social Security?

Generally yes. Corporate self-employed are subject to a minimum contribution base that is usually higher than that of standard sole traders, even under the income-based system.

Can I invoice my own company as a corporate self-employed?

Yes, but only if the services are genuinely independent from your management role. Otherwise, remuneration should be treated as employment income.

Does VAT always apply when invoicing my company?

Not always. VAT applies only if the service is considered independent under Spanish VAT Law. Management functions paid via payroll are not subject to VAT.

If you are both a shareholder and actively involved in your company, understanding tax as a corporate self-employed is not optional — it is essential for protecting your business and your personal finances.

The way you structure your remuneration, whether through payroll or invoices, directly affects your IRPF, VAT obligations and Social Security contributions. A small mistake in classification can lead to penalties, inspections or unnecessary tax costs. On the other hand, when your setup is correctly planned from the beginning, you gain legal certainty, tax efficiency and peace of mind.

Before choosing how to pay yourself or defining your contribution base, make sure your structure complies with current Spanish legislation and reflects your real level of control and activity within the company.

If you need personalized assistance, at Entre Trámites we offer management and tax advisory services for freelancers and SMEs. You can contact us through this contact form for us to call you, or if you prefer, you can schedule a free consultation or write to us on WhatsApp.