When you register as a taxpayer in Spain—whether as an individual or a company—you are automatically assigned a set of tax obligations in Spain. These obligations depend on your legal status, your economic activity and, in some cases, your tax residence.

Understanding these obligations is essential. Not only to comply with Spanish law, but also to avoid penalties, delays in procedures, or issues with the Tax Agency (Agencia Tributaria).

What are tax obligations in Spain?

Tax obligations in Spain refer to the legal duties that taxpayers must fulfil in relation to taxes. These include both:

- Substantive obligations, such as paying taxes.

- Formal obligations, such as filing tax returns, registering with the Tax Agency, keeping records or providing information when required.

They arise from carrying out an economic activity, owning assets, earning income, or simply being considered a tax resident in Spain.

These obligations apply to individuals and legal entities, regardless of nationality, as long as Spanish tax rules consider them liable.

Why are tax obligations important?

Complying with your tax obligations in Spain is not optional. Failure to do so can lead to:

- Financial penalties and surcharges

- Interest for late payments

- Tax audits and inspections

- In serious cases, tax offences under Spanish law

Beyond the legal consequences, tax compliance is also linked to access to other administrative procedures, such as residence permits, company registrations, or public benefits.

What happens if tax obligations are not met?

Non-compliance with tax obligations is considered a breach of Spanish tax law. Depending on the seriousness of the infringement, consequences may include:

- Fines proportional to the unpaid amount

- Fixed penalties for missing or incorrect filings

- Temporary loss of tax benefits or incentives

Spanish tax regulations classify infringements as minor, serious or very serious, depending on intent, repetition and economic impact.

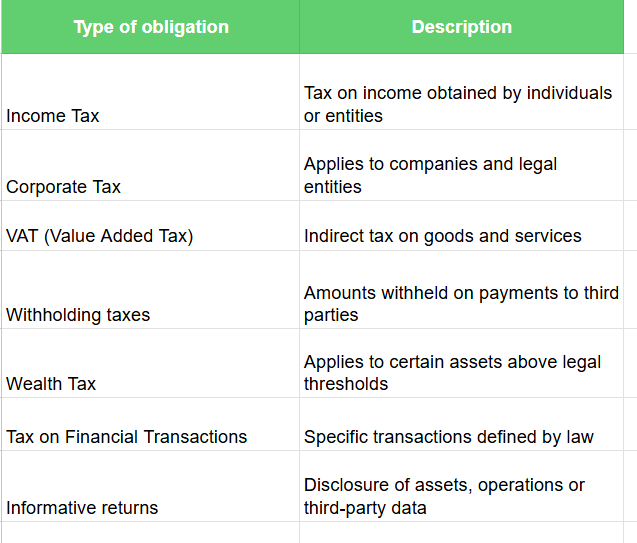

Main tax obligations in Spain

Tax responsibilities are identified through official codes assigned by the Spanish Tax Agency. These codes define which tax obligations in Spain apply to each taxpayer.

Some of the most common obligations include:

Not all taxpayers are subject to all obligations. The applicable ones depend on activity type, income source and legal structure.

How to check your tax obligations in Spain

You can consult your assigned tax obligations in Spain directly through the Spanish Tax Agency. This allows you to verify:

- Which taxes you must declare

- Whether you have reporting obligations

- Your current tax status

This step is especially useful before submitting Form 036, which is used to register or update tax information. It is also relevant if you already have an active registration and want to confirm that your obligations are correctly assigned.

Tax obligations and international taxpayers

Spain has specific rules for international taxpayers, particularly regarding tax residence, income obtained in Spain and double taxation treaties.

If you live abroad but earn income in Spain, or if you have recently moved to Spain, understanding your tax obligations in Spain is key to avoiding unexpected liabilities.

Spanish tax law is mainly governed by:

- Ley General Tributaria

- Personal Income Tax Law

- Corporate Tax Law

All published and updated through the Official State Gazette (BOE).

Common mistakes to avoid

Some frequent errors include:

- Assuming obligations only arise after generating profit

- Not updating tax data after a change in activity or status

- Missing filing deadlines even when no tax is due

Proper advice helps prevent these issues and keeps your situation compliant.

Frequently Asked Questions (FAQs)

What are tax obligations in Spain?

They are the legal duties taxpayers must fulfil, including paying taxes, filing returns and providing information to the Tax Agency.

Do tax obligations in Spain apply to non-residents?

Yes. Non-residents may have tax obligations if they earn income or hold assets in Spain.

How can I check my tax obligations in Spain?

You can consult them through the Spanish Tax Agency or with professional tax advisors.

Understanding and complying with your tax obligations in Spain is essential to avoid penalties and ensure smooth administrative procedures. Clear information and professional support make the process much easier.

If you need personalized assistance, at Entre Trámites we offer management and tax advisory services for freelancers and SMEs. You can contact us through this contact form for us to call you, or if you prefer, you can schedule a free consultation or write to us on WhatsApp.