As of January 1st, 2023, new self-employed rates will be available. One of them is the “Cuota Cero”: a 100% discount on their Social Security contributions at the start of their activity, available only in some autonomous communities.

This aid consists of the fact that self-employed employees will not have to be subject to the new rates for real income for 2 years, which is a very convenient support, taking into account the elimination of the Flat Rate (or, “Tarifa Plana”) and its replacement by the “Reduced Rate” included in Royal Decree – Law 13/2022.

How can I request this aid? And what requirements must I meet? Keep reading, because we will tell you everything you need to know to apply for the Cuota Cero!

And if you have any questions, you can contact Entre Trámites and we will solve them for you. We can request this aid on your behalf and manage your Social Security obligations for you. If you are self-employed or SME schedule your free consultation!

Requirements to request the Cuota Cero

As expressed by the president of the Association of Self-Employed Workers of Murcia (ATA), Francisco Casado: “only the self-employed who, from next year, enjoy the new bonus known as Reduced Rate will be able to opt for this Cuota Cero aid.”

Although the calls are not yet open, as of January there will be two ways to access the bonus, apparently similar to the requirements to request the current Flat Rate:

- Having an accrediting document that reflects the situation of registration or one similar to registration in the Special Regime for Self-Employed Workers (RETA), or in its absence, in the Special System for Self-Employed Agricultural Workers.

- Being registered in the Economic Activities Tax, with the signed Form 036 or 037.

What is the required documentation?

In addition, in each territory they could ask for some of the following information :

- Current DNI or NIE of the applicant.

- Updated Work History Report.

- Certificate showing that there are no debts with the Treasury.

- Certificate of being up to date with Social Security payments.

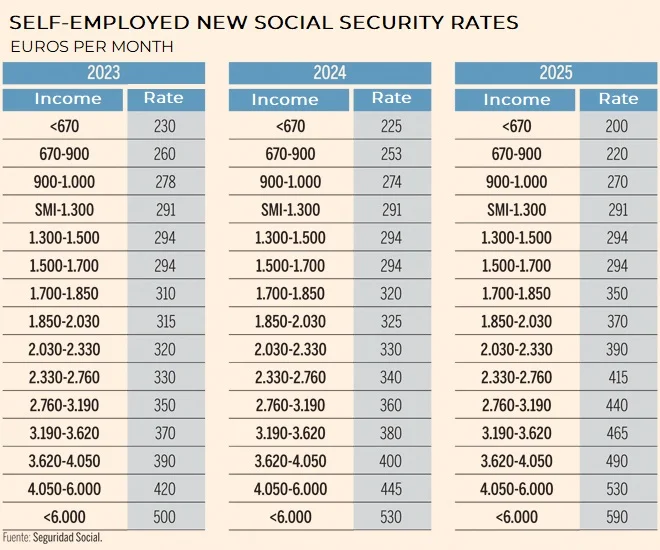

In the event that, in the second year, the income is higher than the Minimum Interprofessional Salary, the self-employed worker will not be able to extend the Cuota Cero to 24 months and must assume the new rates for 2024.

On the other hand, it should be taken into account that only those self-employed who start a new activity in Andalusia, Murcia, and Madrid will be the ones who may not pay the General Treasury of Social Security for their net income until 2025 .

Reduced rate for self-employed workers

As of 2023, what is known in Social Security as ‘Flat Rate’ will be called ‘Reduced Rate’; which consists of a minimum monthly contribution to Social Security for entrepreneurs at a fixed amount of 80 euros per month for 2 years.

Before the RETA Reform, self-employed workers used to pay 60 euros a month, but now it has increased by 20 extra euros. I.e., during the first year of activity, the self-employed worker will pay 80 euros per month, however, in the second year, the value can change depending on the net income of the worker.

If the net income is equal to or less than the Minimum Interprofessional Salary (SMI) of 1,000 euros, they will continue to pay those 80 euros. But if they overcome that barrier, they will contribute according to their real income.

Any questions about the new self-employed rates?

At Entre Trámites we provide a wide number of consulting and support services in processes related to the hiring of your employees, Social Security procedures, and payroll preparation for the self-employed, SMEs, and other companies.

Contact us! Through the contact form, you can leave your details for us to call you, schedule a free consultation with us, or simply text our WhatsApp.

You may be also interested in: All you need to know about the RETA Reform