Among the measures and aid for companies contemplated in Royal Decree-Law 7/2020, of March 12, to avoid possible tensions in the treasury that they may experience, flexibility is established in terms of tax deferral. That’s why here we want to talk about how you can defer tax debt while on COVID-19 in Spain.

In such a way, the deferral of payment of taxes to SMEs and the self-employed is granted for six months, upon request, with a three-month interest grace period.

Thus, Article 14 of the aforementioned Royal Decree establishes that the deferral of payment of the tax debt corresponding to all those tax returns and self-assessments whose deadline for filing and payment is between March 13, 2020 and May 30, 2020, both inclusive, will be granted, provided that the applications submitted correspond to tax debts up to a maximum amount of 30,000 euros (including the remaining deferral/fractionation applications without guarantees granted or pending resolution).

Important!

“The interruption of administrative and procedural deadlines due to the decreed State of Alarm does not apply to tax deadlines subject to special regulations. Consequently, the deadlines for filing self-assessments and tax returns remain in force. However, for obligors with a volume of operations in 2019 not exceeding 600,000 euros, the deadline for submitting returns for the first quarter has been extended until May 20, 2020.”

For example: if the payment to be made is 36,000 euros and you already have a tax deferral granted for 9,000 euros, you can only request this extraordinary deferral for 21,000 euros. Having to pay or request a postponement with guarantees regarding the other 15,000 euros.

In addition, this extraordinary postponement can be requested even for withholdings and payments on account (Forms 111, 115, and 123), taxes that must be legally charged (VAT Form 303), or installment payments of Corporate Tax (Forms 202 and 222), which they cannot be postponed under normal conditions.

Defer tax debt while on COVID-19 in Spain: What are the conditions?

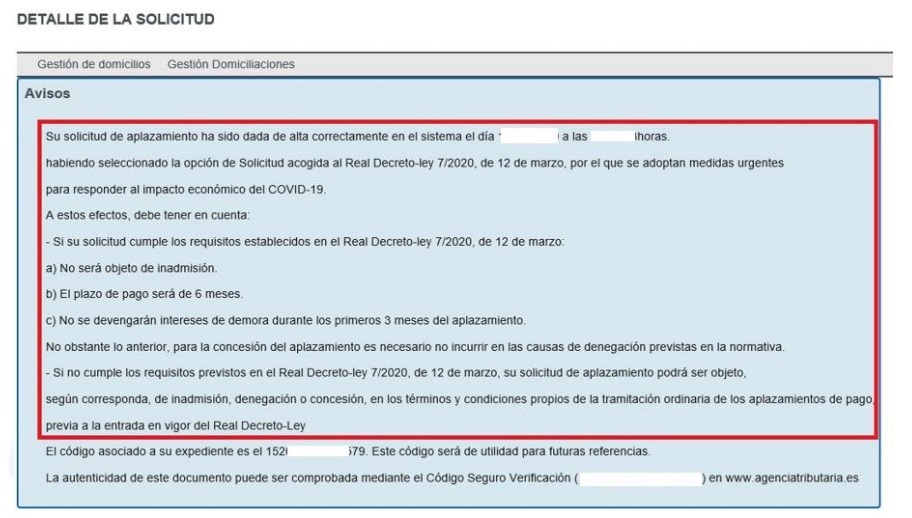

- Deferral period of 6 months.

- No late-payment interest will accrue during the first 3 months.

Only people and entities with a volume of operations not exceeding 6,010,121.04 euros in 2019 may request the deferral of tax debts under these conditions.

Although the extraordinary deferral is granted for 6 months, you can pay it before, in such a way that if you make the deposit in the first three months, interest will not be applied.

In this sense, once the postponement has been requested as indicated below, you can manage it at the following link: Deferrals section of the AEAT Electronic Office.

How do I carry out this tax deferral due to COVID-19?

1. Usual Procedures

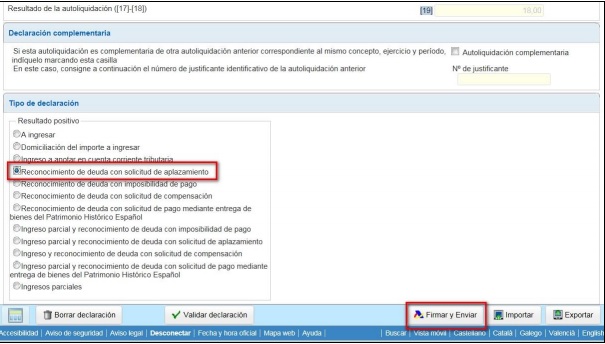

The first step is to file the self-assessment tax return for which you wish to defer payment through the usual procedures. Do not forget to check the option “Reconocimiento de deuda con solicitud de aplazamiento” (debt acknowledgment with a request for deferment) to be able to sign and send it by clicking on the button “Firmar y Enviar”:

2. Form to be assessed

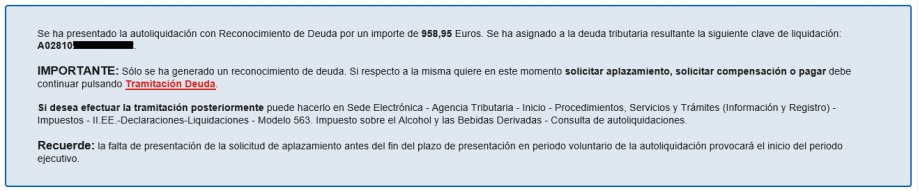

Once the form that is the object of assessment is presented (after clicking “Firmar y Enviar”), if the data entered is correct and there are no errors that we will have to correct, the message “Correcta presentación” appears next to the assessed key corresponding to the debt that must be processed and a link to be able to process it (“Tramitación deuda”).

Once the tax form has been filed (you must save the attached PDF with the self-assessment submitted). The procedure to defer or pay in installments the generated debt is opened, having to continue this process so that the deferral is carried out correctly.

3. Process Debt

To submit the deferment/installment request, click the “Tramitar deuda” (“Process debt”) option, and in the subsequent pop-up window select the “Aplazar” (“To defer it”) option:

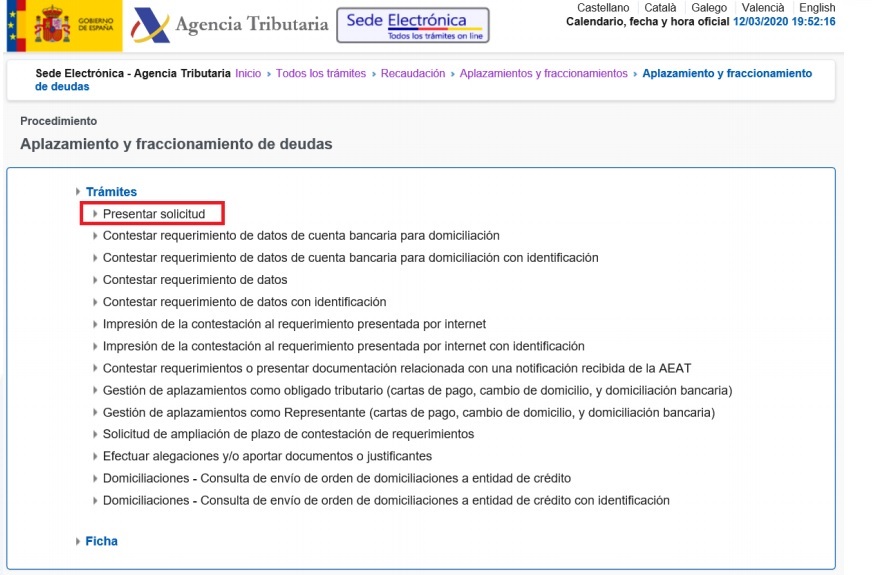

If the option to process debt does not appear, or if you have marked another option for “debt acknowledgment” when submitting the self-assessment, you must access the deferrals section of the AEAT Electronic Office and select the “Presentar solicitud” (“Submit application”) option to be able to request the postponement correctly.

To access the filing of the deferral request, it is required to identify oneself with an electronic certificate, DNIe, or Cl@ve PIN of the declarant or its representative (in this case, access with Cl@ve PIN is not allowed).

In relation to those taxpayers whose electronic certificate has expired or is about to expire, it is reported that the AEAT allows the use of expired certificates in their website in accordance with the provisions of Royal Decree 463/2020, of March 14.

It is possible that your usual browser does not allow it, in which case we recommend that you export it to Firefox where you can continue using it.

In any case, the AEAT itself is at the taxpayer’s disposal so that if they have any doubts about computer technical issues, they can call the related telephone numbers.

4. Fill in the application fields

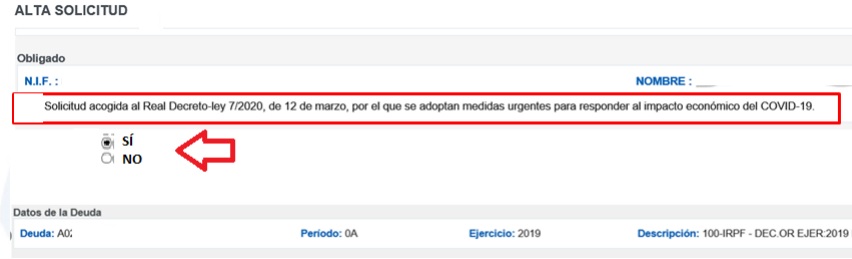

The first thing to take advantage of this modality of postponement is to check the box “Request accepted by Royal Decree-Law 7/2020, of March 12, by which urgent measures are adopted to respond to the economic impact of COVID-19.”

If the presentation of the application comes from the presentation of the corresponding self-assessment form, the assessment key is already informed and it is not necessary to complete it. Otherwise, you must fill in the assessment key in the “Deuda…” box and the amount in the “Importe” box.

In addition to the above, the following information will be requested:

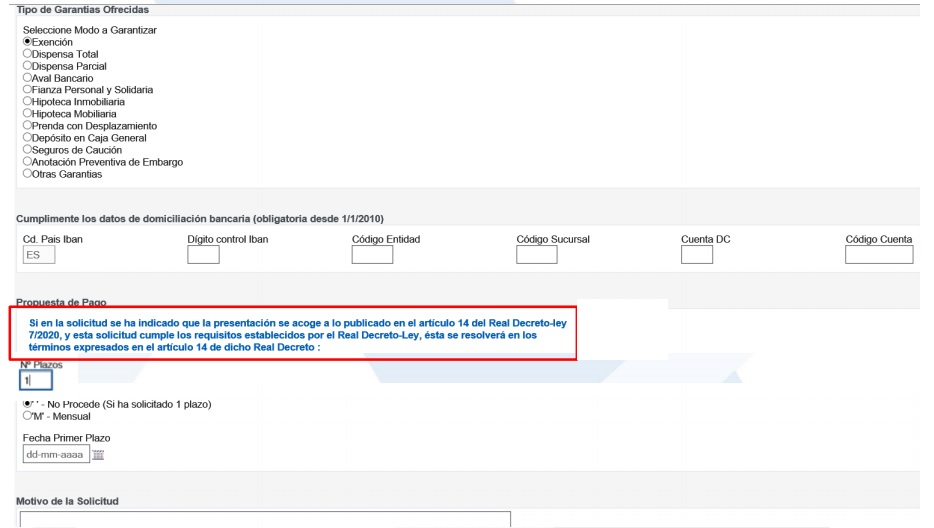

- Type of guarantees: check the “Exención” option.

- Direct debit bank account.

- Number of installments: write 1.

- Periodicity: Mark the option “not applicable”.

- Date of the first installment: 6 months after the end date of the voluntary declaration period (if the self-assessment filing period ends on April 20, write 10-20-2020).

- Reason for the request: write “RDL Postponement” (this step is very important, otherwise the postponement will not be granted in the terms indicated).

In the payment proposal section, the following message will appear: “Request accepted by Royal Decree-Law 7/2020, of March 12, by which urgent measures are adopted to respond to the economic impact of COVID-19.”

5. Submit the application by pressing the “Firmar y Enviar” button

If the request has been submitted correctly, the following warning message will appear:

On the other hand, although the procedural and administrative deadlines, the prescription and expiration periods, and the other deadlines for the processing of the procedures of the public sector entities have been suspended, as we have already analyzed in this article, it has been stated that the aforementioned suspension and interruption of administrative deadlines will not apply to tax deadlines, subject to special regulations, nor will it affect, in particular, the deadlines for filing a tax return and self-assessments, which are still in force.

However, for taxpayers with a volume of operations in 2019 not exceeding 600,000 euros, the deadline for submitting self-assessments and tax returns due between April 15 and May 20, 2020 (such as the statements of the first quarter, which expire on April 20) until May 20, 2020 (until May 15 if the payment is to be direct debit).

Do you need help with your taxes?

We want to listen to you and know what your questions are about the procedures you have to carry out. Count on the advice of our experts to clarify all your doubts.

At Entre Trámites we invite you to know about all our tax services. Fill in our contact form and we will call you to help you as soon as possible, schedule a free online consultation, or simply text our WhatsApp.