The VIES System (VAT Information Exchange System) is an essential tool for any company or self-employed individual (autónomo) conducting intra-community commercial operations within the European Union. Its primary function is to validate the Value Added Tax Identification Number (VAT-ID or NIF-IVA) of your clients or suppliers, ensuring they are correctly registered in the census of intra-community operators.

Ignoring the verification of a VAT-ID can lead to severe tax penalties from the Agencia Tributaria (Spanish Tax Agency). If the partner company is not registered, the operation will not be considered intra-community and the VAT must be settled in the country of origin. In this guide, we explain what the VIES System is, how it works, and why it is crucial to avoid tax problems in Spain.

What is the VIES System and Why is it So Important?

The VIES System is an electronic database that allows businesses and autónomos to verify the validity of the VAT-IDs of their commercial partners across the EU. It is managed by the European Commission, and the data is updated in real-time by the tax administrations of each Member State.

The importance of this system lies in the fact that intra-community operations are generally VAT-exempt at the source. For a sale or provision of services to be considered intra-community and therefore exempt, two main conditions must be met:

- The goods or services are shipped or supplied to another EU country.

- Crucially: Both the issuer and the recipient of the invoice must be registered in the VIES System Census.

If your client’s VAT-ID does not appear as valid in the VIES System, the operation is not considered intra-community, and you must apply Spanish VAT (repercutir el IVA español). Failure to do so risks sanctions from the Agencia Tributaria for incorrect tax settlement.

How is the VIES System Used?

Using the VIES System is very straightforward and can be done free of charge through the Electronic Headquarters of the Agencia Tributaria or the European Commission’s website.

Step-by-Step Verification:

- Access the Platform: Navigate to the Agencia Tributaria Electronic Headquarters and search for the section on “Validation of VAT-ID for intra-community operators.”

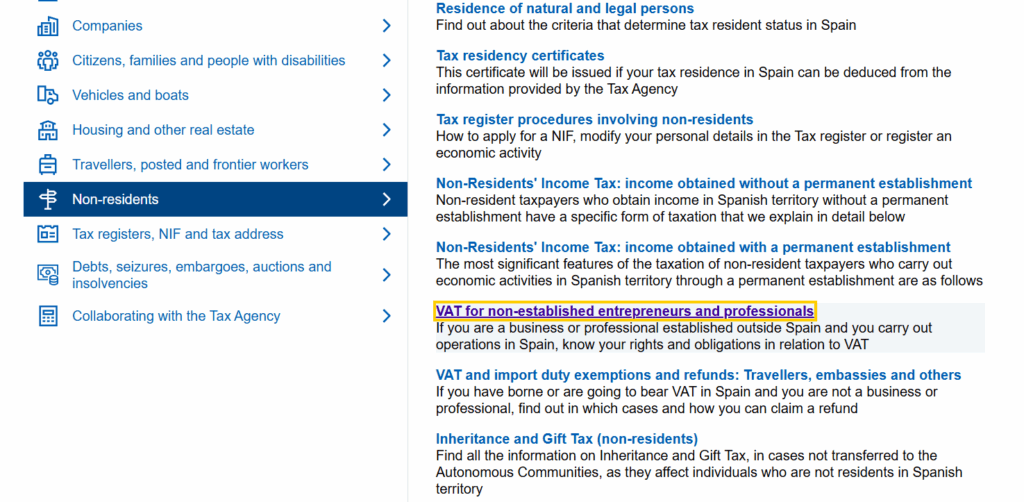

Click on Non-residents and then click on “VAT for non-established entrepreneurs and professionals”

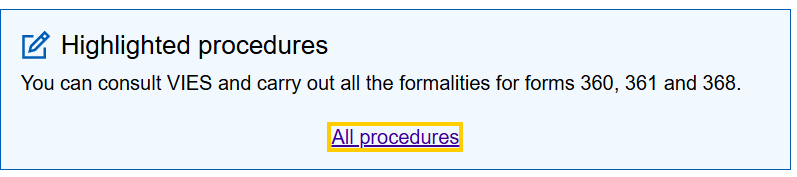

And click on “All procedures”

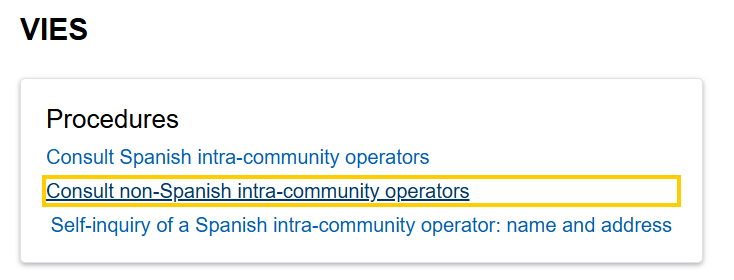

And select “Consult non-spanish intra-community operators”

- Enter Data: Select the country code of the client or supplier and their VAT-ID number. You can also verify your own number if needed.

- Verification: The system will immediately display whether the number is valid or not. If it is valid, it will also provide the name and address of the holder, allowing you to confirm your client’s identity.

- Save the Proof: It is essential that you save the result of the query. You should take a screenshot or print the validation screen, as this document serves as your proof in case of a potential inspection by the Agencia Tributaria.

Important Note: The query must be performed before issuing the invoice. If the number is verified and valid, the invoice should be issued without VAT. If the number is invalid, you must invoice with the corresponding Spanish VAT rate.

Frequently Asked Questions (FAQs)

What happens if my client’s VAT-ID does not appear in VIES?

If the number does not appear, the first thing to do is contact your client to have them verify that they are correctly registered. If they are registered, the issue might be a slight delay in the database update. If they are not registered, the operation is not considered intra-community, and you must invoice with the standard Spanish VAT.

Are the VAT-ID (NIF-IVA) and the Fiscal ID (NIF) the same in Spain?

No. The NIF (Número de Identificación Fiscal) is your general tax identification document in Spain. The VAT-ID (or NIF-IVA) is the NIF that specifically enables you to perform intra-community operations, and it must be registered in the VIES System. A standard NIF is not valid for intra-community operations unless it has been explicitly registered in VIES.

Should I verify the VAT-ID for every single transaction?

It is highly recommended practice to verify the VAT-ID for every intra-community operation, as a client’s registration status can change (e.g., they might be removed from the census). The consultation takes only a few seconds and provides a crucial layer of protection against potential tax penalties.

The VIES System is a fiscal security tool that allows you to operate in the intra-community market with confidence. Its correct use is an obligation for any business that wants to avoid sanctions and keep its accounts in order.

If you need personalized assistance, at Entre Trámites we offer management and tax advisory services for freelancers and SMEs. You can contact us through this contact form for us to call you, or if you prefer, you can schedule a free consultation or write to us on WhatsApp.