In the Spanish tax system, it is common to make mistakes when filling out a tax return (autoliquidación). If you realize you have overpaid or entered incorrect information that has penalized you financially, all is not lost. The Spanish Tax Agency (Agencia Tributaria or AEAT) allows you to correct these errors through the procedure known as rectification of a self-assessment (or filing an amendment tax return).

This process is fundamentally different from filing a complementary declaration (declaración complementaria), as the latter is strictly used to correct errors that benefit Hacienda (when you owe more). The rectification of a self-assessment is your right as a taxpayer to claim a refund of an undue payment or to nullify a settlement that has financially disadvantaged you.

When and Why to Request an Amendment Tax Return

The rectification of a self-assessment is requested when, after filing a tax return, the taxpayer realizes they have made an error that resulted in a tax payment higher than what was legally due.

The most common reasons for seeking this amendment tax return are:

- Calculation Error: Incorrect sums or subtractions that have inflated the final tax amount.

- Omission of Data: Forgetting to include a deductible expense (gasto deducible), a tax deduction, or a bonus that would have allowed you to pay less.

- Incorrect Data Entry: Consigning an erroneous amount in a box, resulting in a higher tax liability (e.g., misstating income or deductible contributions).

- Undue Payment: Making a payment that was not legally required, such as double-paying a self-assessment that you had already settled.

Crucial Distinction: This procedure only applies when the correction benefits you as the taxpayer. If the error harms Hacienda (you owe more), you must file a complementary declaration (declaración complementaria).

Process and Deadlines for the Rectification

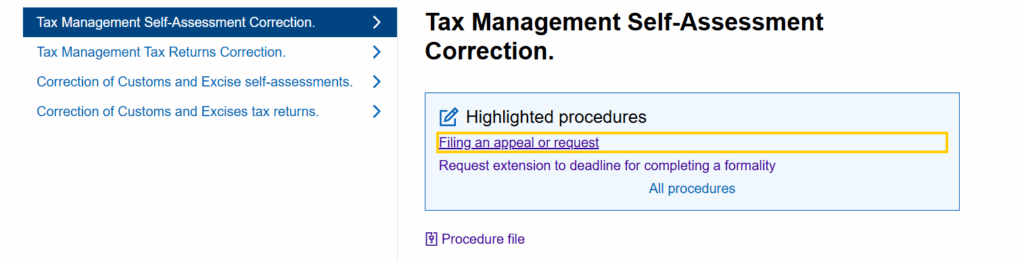

The procedure for filing an amendment tax return is carried out electronically through the AEAT’s Electronic Headquarters (Sede Electrónica).

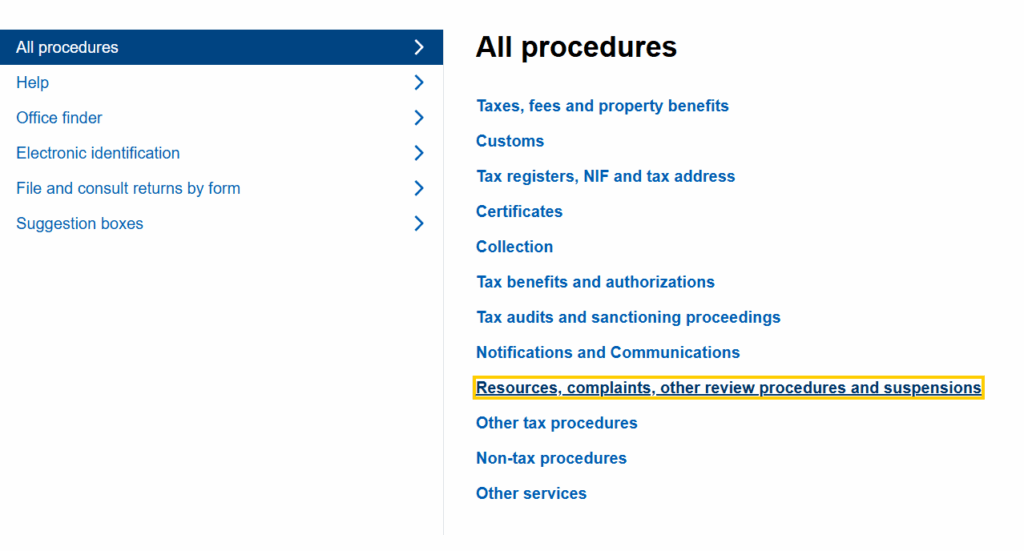

- Access the Form: Go to the AEAT website and look for the section “All procedures”

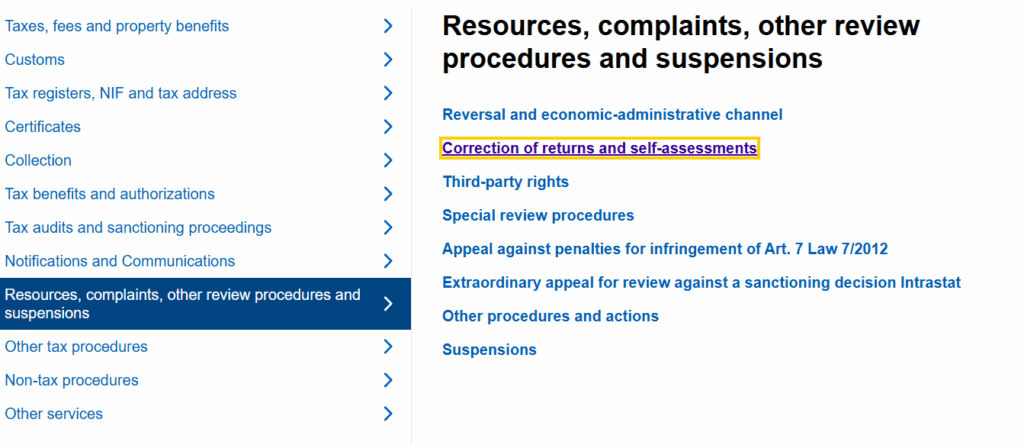

Within this section, you will find the link to the “Resources, complaints, other review procedures and suspensions

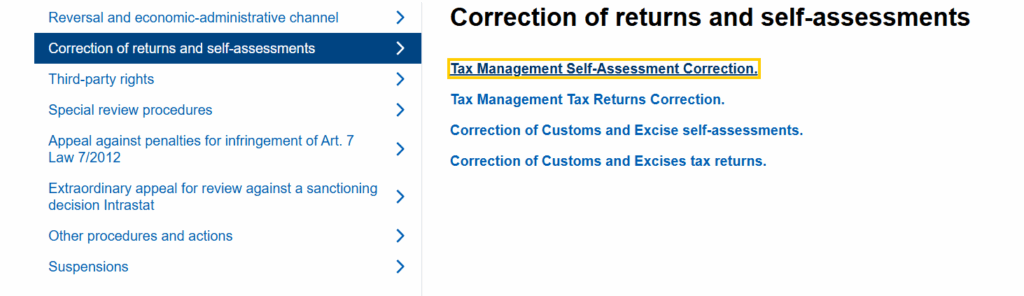

Within this section, you will find the link to the “Correction of returns and self-assessments.

Then click on Tax Management Self-Assessment Correction.

And click on “Filling an appeal or request”

- Identification: You must identify yourself using your electronic DNI, digital certificate, or the Cl@ve system.

- Identify the Document: In the form, you must accurately provide the details of the tax return you wish to correct, including the model number (e.g., Form 131 or Form 130), the fiscal year (ejercicio), and the period (e.g., Q1, Q2).

- Justification and Correct Data: In a dedicated section, you must explain the reason for the rectification in detail and attach the documentation that justifies your request.

- Example: If you forgot to include a deduction for large family status (familia numerosa), you must attach the official title. You must also specify the correct result of the self-assessment.

- Submission: Once the form is complete, you submit it electronically to the AEAT.

Deadlines:

The time limit for requesting the rectification of a self-assessment is four years, counted from the day following the end of the deadline for filing the original declaration (or from the day it was filed if submitted late).

Resolution and Refunds:

The Tax Agency has a maximum period of six months to resolve your application. If the resolution is favorable, Hacienda will refund the amount you overpaid, along with the corresponding delay interest (intereses de demora).

Frequently Asked Questions (FAQs)

Is an amendment tax return (rectificación) the same as a complementary declaration?

No, they are distinct legal procedures. The complementary declaration corrects errors that result in Hacienda receiving more money (you pay more). The amendment tax return corrects errors that result in the taxpayer paying too much (you get a refund or pay less).

What if a tax audit by Hacienda has already begun?

If Hacienda has already notified you of an audit, inspection, or provisional settlement procedure, you cannot submit an independent rectification request. In that case, you must include your claims about the error within the arguments of the AEAT’s ongoing procedure.

How can I prove the error if I lost the document?

The amendment tax return requires robust justification. You should provide all available evidence: bank statements showing the incorrect payment, official certificates confirming an applicable deduction (like a disability certificate), or documentation related to an expense you failed to deduct. An advisor can help you gather proof.

The rectification of a self-assessment is a fundamental fiscal right that you should not overlook. If you detect an error that has penalized you financially, do not hesitate to initiate this procedure to recover what is rightfully yours.

If you need personalized assistance, at Entre Trámites we offer management and tax advisory services for freelancers and SMEs. You can contact us through this contact form for us to call you, or if you prefer, you can schedule a free consultation or write to us on WhatsApp.