If you live, work, or run a business in Spain, understanding the tax calendar in Spain is essential. Missing a deadline can mean penalties, surcharges, or unnecessary stress. The good news? Once you understand how the Spanish tax system works, everything becomes much easier.

In this guide, we explain the Spanish tax calendar step by step, using clear language and real examples, so you know exactly what taxes you need to file and when.

How the tax calendar in Spain works

The tax calendar in Spain is managed by the Spanish Tax Agency (Agencia Tributaria). It sets out all official tax deadlines for individuals, self-employed workers (autónomos), and companies.

Spain mainly uses a quarterly tax system, with additional annual returns. This means most taxpayers file several times a year, not just once.

The tax calendar applies whether you are:

- Self-employed

- Running a company

- A tax resident in Spain

- Earning income in Spain

Official deadlines are published and updated by the Agencia Tributaria

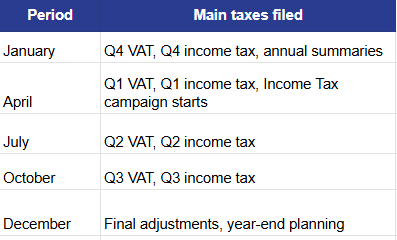

Key tax deadlines in the Spanish tax calendar

Below is a clear summary table of the most important deadlines in the tax calendar in Spain.

These dates are fixed every year unless the Tax Agency officially announces changes.

Quarterly taxes you must know

VAT (IVA) returns

If you are self-employed or run a business, VAT is one of the core elements of the tax calendar in Spain.

- Filed quarterly using Form 303

- Annual summary filed with Form 390

- Deadline: 20th day after each quarter ends

VAT applies even if you had no activity, in which case you must file a zero return.

Income tax for self-employed (IRPF)

Self-employed workers must make advance income tax payments.

- Filed quarterly with Form 130 (or 131 for modules)

- Annual income tax return filed with Form 100

- Payments are deducted from your final annual tax

This is one of the most commonly missed obligations in the Spanish tax calendar, especially by new autónomos.

Annual taxes and key campaigns

Personal Income Tax (IRPF)

The Income Tax campaign usually runs from April to June.

- Applies to tax residents in Spain

- Covers all worldwide income

- Filed online via the Tax Agency platform

Even if you already paid quarterly, you still must file the annual return.

Corporate tax

If you have a company, corporate tax is another key date in the tax calendar in Spain.

- Filed annually using Form 200

- Deadline: within 25 days after six months from the end of the fiscal year

For most companies, this means July.

What happens if you miss a tax deadline?

Missing deadlines in the tax calendar can lead to:

- Surcharges starting at 1%

- Late payment interest

- Fines for non-filing

- Increased scrutiny by the Tax Agency

The longer you wait, the higher the cost. Even filing late voluntarily is better than waiting for a tax notice.

How to stay on top of the tax calendar in Spain

Here are some practical tips to avoid problems:

- Set calendar reminders for quarterly deadlines

- Keep invoices updated monthly

- Don’t wait until the last day to file

- Work with a tax advisor familiar with Spanish tax law

Common mistakes foreigners make

Many non-Spanish taxpayers struggle with the tax calendar in Spain because:

- Deadlines are stricter than in other countries

- Filing is required even with zero income

- Language barriers cause misunderstandings

- Tax residency rules are often misinterpreted

Understanding the Spanish tax calendar early saves time, money, and stress.

FAQs about the tax calendar in Spain

Do I need to follow the tax calendar if I have no income?

Yes. In many cases, especially for self-employed workers, zero returns are still mandatory.

Is the tax calendar in Spain the same for everyone?

No. It depends on whether you are self-employed, a company, or an individual taxpayer.

Can someone file taxes on my behalf?

Yes. A registered tax advisor can file and manage all obligations for you.

Keeping control of the tax calendar in Spain is not about memorizing dates. It’s about having a clear system and understanding your obligations. Once you do, Spanish taxes become far more manageable and predictable.

If you want to avoid mistakes and focus on your work, getting professional help can make all the difference.

If you need personalized assistance, at Entre Trámites we offer management and tax advisory services for freelancers and SMEs. You can contact us through this contact form for us to call you, or if you prefer, you can schedule a free consultation or write to us on WhatsApp.