The contributory retirement pension (prestación por jubilación) is one of the pillars of Spain’s social protection system, representing the main source of income for millions of people after their working life ends. To access it, you must meet specific age and contribution requirements, and understand precisely how the final amount is calculated.

Mastering this process is crucial for long-term planning, as proper strategies can significantly impact your quality of life during retirement. In this article, we break down the requirements and the calculation method for your Spanish pension according to the Social Security regulations for 2025.

1. Key Requirements to Access the Retirement Pension

To access the contributory retirement pension in Spain, the worker must meet two essential conditions: age and the contribution period. These requirements are increasing progressively until they reach their final target in 2027, as part of the ongoing pension reform.

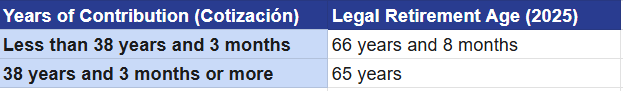

A. Legal Retirement Age in Spain (2025)

The legal retirement age depends directly on the number of years you have contributed (cotizado) to the Social Security system. For 2025, two scenarios apply:

B. Minimum Contribution Period

A minimum of 15 years of contributions to the Social Security system is required to qualify for any contributory pension.

Furthermore, at least 2 of these 15 years must have been contributed within the 15 years immediately preceding the date of the “causal event” (the day the person officially retires).

Important Note: Although you meet these minimums, the actual pension amount will be directly proportional to the total number of years contributed and the corresponding contribution bases.

2. The Spanish Pension Calculation Process

The calculation of the contributory pension in Spain is based on two primary factors: the contribution bases and the years contributed. The formula involves two main steps:

Step 1: Calculating the Regulatory Base (Base Reguladora)

The Regulatory Base is the average of your contribution bases over a determined period. For retirements granted in 2025, the Regulatory Base calculation takes into account the last 300 months (25 years) of contribution immediately preceding the month of the retirement date.

- Sum the Contribution Bases: The bases from the last 300 months are totaled.

- Apply Inflation Coefficients: To compensate for the effect of inflation, contribution bases prior to the last 24 months are updated using the Consumer Price Index (IPC).

- Divide: The total sum is divided by 350 (which represents the 300 months plus the pro-rated extraordinary payments/bonuses).

Upcoming Reform Impact: The current methodology (25 years / 350) applies for 2025. However, starting in 2026, a new system will begin phasing in, allowing workers to choose between the current 25-year period or a new 29-year period, where the 2 worst years are excluded.

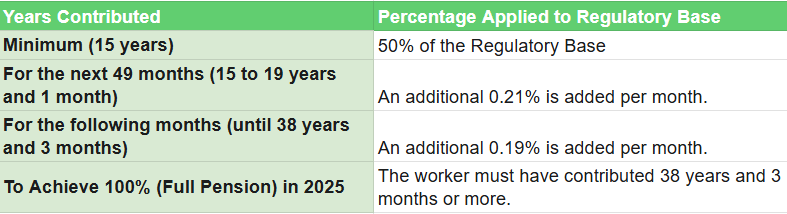

Step 2: Applying the Percentage to the Regulatory Base

Once the Regulatory Base is obtained, a percentage is applied based on the worker’s total years of contribution:

Practical Example: An individual retiring in 2025 with 38 years and 3 months of contribution and a calculated Regulatory Base of €2,000/month would receive 100% of that base, or €2,000/month (before taxes). If the same person had only contributed 25 years, they would receive approximately 73.76% of the Regulatory Base.

3. Other Retirement Options (The Flexible Retirement Age in Spain)

In addition to the ordinary pension, Spain offers flexible modalities that influence the requirements and calculation:

- Early Retirement (Jubilación Anticipada): Allows retirement up to two years (voluntary) or four years (involuntary/forced) before the legal age. The pension amount is subject to permanent reductions (coeficientes reductores) for each quarter of anticipation.

- Deferred Retirement (Jubilación Demorada): If the worker decides to remain active after reaching the legal retirement age, their pension is increased. For each additional year worked, the worker receives a bonus, which can be a percentage increase to the base (currently 4% per year), a lump-sum payment (tanto alzado), or a combination of both.

- Partial Retirement (Jubilación Parcial): Allows the combination of part-time work with the receipt of a portion of the retirement pension.

The contributory retirement pension is a fundamental right built throughout your entire working life. Understanding the contribution system and the calculation method is the best way to secure a financially stable and dignified retirement in Spain. Long-term planning is essential to maximize your future pension.

If you need personalized assistance, at Entre Trámites we offer management and tax advisory services for freelancers and SMEs. You can contact us through this contact form for us to call you, or if you prefer, you can schedule a free consultation or write to us on WhatsApp.