How to fully understand what is a payroll? We explain the meaning of every payroll concept and its importance for an employee, plus we’ll give you some information on receiving a payroll.

The payrolls of workers are all very similar since they have to follow an official model and also most of the companies and agencies use the same programs to carry them out.

The Supreme Court admits that the payroll can be delivered on paper or in digital format to print it, but in any case (Judgment of January 17, 2019) the content of the payroll must be clear, with easy verification of the concepts paid, which must be broken down and allow the calculation of the amount of each one.

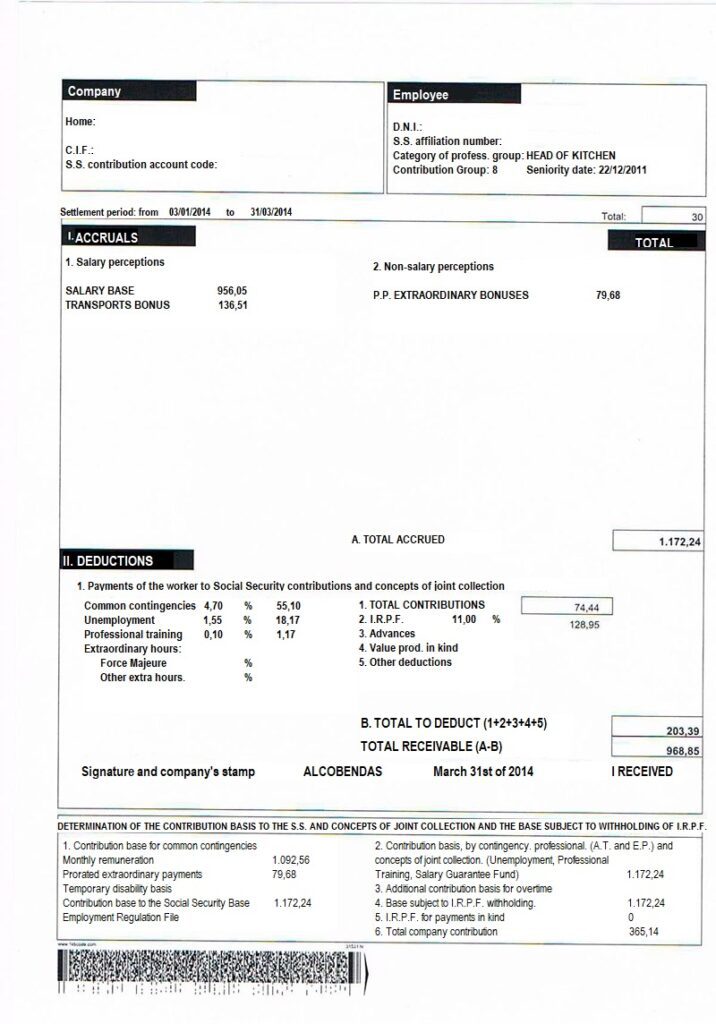

We will analyze a real payroll as an example:

Understand what is a payroll: The header

To understand what is a payroll we begin with one of the most important sections: the header. This must necessarily include fundamental data to identify the company and the worker. The company’s name, CIF and Social Security contribution account code must necessarily appear to identify it. The worker’s data that must appear is name and surname, ID, Social Security Affiliation Number, job category, contribution group, and seniority.

This personal data of the employee is very important. Many times, if a worker has been in the company for a long time, they have been moving up the ranks, and only the initial position appears in the contract. But in the payroll, the company recognizes the new position, and it is a way for the worker to demonstrate the position that they really occupy.

In some payroll models, a distinction is made between seniority and the date of entry into the company, which may be after seniority in the event of subrogation or recognition of seniority in another company. For salary purposes, the important thing is seniority level.

Settlement period

Beneath the heading is usually indicated the period to which that payroll refers. You must indicate which month that payroll corresponds to and which days within that month. For example, from March 1 to 31, 2019. In addition, the total number of days to which that payroll refers must be indicated. At this point the payroll can indicate it in 3 different ways:

- all the months of 30 days, regardless of whether they have 31 or 28.

- the number of calendar days of that month that have been worked (28, 30, 31, depending on the month)

- the number of business days actually worked that month (usually 22)

Putting it one way or another will depend on how the company accounts for it and what the Collective Agreement establishes.

Salary perceptions and Non-salary perceptions

The wages are the remuneration that a worker receives for their services. It always has to be made up of the base salary. Depending on the remuneration system established by the Collective Agreement, other concepts may appear, such as complements, bonuses, seniority, etc. In addition, the employer can also include prizes or improvements.

It is advisable to consult the Collective Agreement and see if all the concepts included in it are being received, and also consult the salary tables that usually appear at the end of the Agreement to see if you are being charged according to the position you hold.

In the event that extra prorated charges are received, they must also be indicated as a concept. It must be taken into account that there are Agreements that prohibit them from being prorated.

On the other hand, there are non-salary perceptions, which are made up of allowances, transportation bonuses, supplies, etc. In general, they are compensation for the expenses that have been incurred for working and are usually established in the applicable Collective Agreement.

Deductions and Withholdings

Below the concepts that make up the payroll, there are the contributions and withholdings that the company has to make on the employee’s payroll because the company acts as a collaborator of both Social Security and the Treasury.

A) Contributions due to different concepts

The Social Security contribution is made up of both the worker’s contribution and the employer’s contribution. The first appears on the payroll and is the one that is paid by the worker, and for this reason the employer makes this deduction from the salary. The business quota must also appear broken down in the payroll.

There are different types of contributions, and they are broken down in the payroll: for common contingencies, for unemployment, for training, and for overtime in the event that it has been done. The percentage of this deduction is usually indicated on the payroll itself and depends on the legislation of each moment.

In 2020, in the general regime, 28.30% is contributed for common contingencies, which is distributed as follows: 23.60% will be paid by the company and 4.70% by the worker.

In the Salary Guarantee Fund: 0.20%, paid by the company.

Vocational Training: 0.70%, of which 0.60% will be paid by the company and the remaining 0.10% by the worker.

Unemployment, in permanent contracts, 5.50% will be paid by the company and 1.55% by the worker.

At the bottom of the list, where it indicates “determination of the Social Security contribution bases and concepts of joint collection and the base subject to personal income tax withholding and company contribution”, the contribution data is broken down by the employer (in the example it is 365.14 euros).

B) The withholding made from Personal Income Tax (IRPF)

It is a payment on account that is forwarded regarding the following year’s income tax return. The company makes in advance the payment of that percentage on behalf of the worker (because it has been withheld from the payroll) and pays it to the Treasury. The withholding percentage will depend on the type of contract and the personal circumstances of the worker. In the sample payroll, 128.95 euros of personal income tax are withheld, 11% of the total accrued.

Gross and Net… How much do I have left at the end?

Gross salary is the sum of all salary and non-salary payments. Normally the specified amount appears in the payroll as the total of the accruals. (In the example payroll the gross salary is €1,172.24).

From this gross salary, the total deductions must be subtracted, which are made up of the previously mentioned contribution and withholding. (€203.39 in the example).

To find out how much the company will actually deposit the worker in their checking account, the net salary must be taken into account, which is the result of subtracting the deductions from the gross salary (net salary in the example, €968.85).

Many times workers think that their salary is only made up of this net salary, or liquid, which is what they see deposited in their checking account. But the actual salary is the gross salary since those deductions are part of it. Thanks to these contributions, for example, the worker has the right to receive Social Security or unemployment benefits and with the IRPF withholdings, their annual Income Tax Return will be adjusted.

The contribution bases

At the bottom of the payroll, the contribution bases are indicated, which are used to calculate, above all, the future benefits to which one may be entitled.

Currently, for the calculation of these contribution bases, all the concepts of the perceptions received are taken into account, including all the concepts of the payroll, plus the proportional part of the extraordinary payments.

Normally it is broken down into the base for common contingencies, and professional contingencies. In addition, the base that is taken into account for the purposes of Personal Income Tax withholdings is indicated.

Tips when receiving the Payroll

The pay slips can be delivered on paper to each worker or through an electronic format, for example by downloading them from the company’s Intranet, to be later printed by the worker. Even if the worker signs the payroll or receives it electronically and the amount is paid by bank transfer, this does not imply acceptance and if the worker is not satisfied with the amount received, they may claim it.

Payrolls are a fundamental document when it comes to subsequent claims against the company, since, as previously stated, they indicate many data that can influence when requesting amounts that have not been paid or compensation in the event of dismissal. Being a document issued by the company, it is the best proof of the salary you had.

Disadvantages of Cash-in-hand Payments

Unfortunately, many companies make cash-in-hand payments to their employees, that is, outside the payroll, and in this way they save, among other expenses, the cost of the contributions that the company must make.

This greatly harms the worker, since their contribution bases are reduced and when it comes to receiving benefits, such as unemployment (Paro), disability or retirement, these are calculated based on the “official payroll” and not on the real remuneration that the employer has paid the worker.

E.g., a worker has a real daily workday of 8 hours, but with an official part-time contract only. The employer pays him half in payroll and the other half in an envelope in hand. When the worker is going to collect an unemployment or retirement benefit, he will receive it exclusively in relation to what he has officially received, that is, he will receive 50% of the benefit that would actually correspond to him for the hours he has worked.

The official format that a payroll must have

Here you can access and download a template of the Official Payroll Model.

Let’s talk!

We want to listen to you and know what your questions are about the procedures you have to carry out. Count on the advice of our experts to clarify all your doubts.

In Entre Trámites we invite you to know about our labor consultation services. Fill in our contact form and we will call you to help you as soon as possible, schedule your online consultation, or simply text our WhatsApp.