When a company faces a difficult financial situation, it often seeks legal solutions to restructure or liquidate in an orderly manner. In Spain, Concurso Express (fast-track insolvency) and Concurso Necesario (traditional insolvency) are two legal options for handling insolvency. But which one is the best for your business? This article analyzes the key differences, advantages, and disadvantages of both alternatives to help you make an informed decision.

What is Concurso Express (Fast-Track Insolvency)?

Fast-track insolvency, also known as “no-asset insolvency” (concurso sin masa), is a specific type of insolvency procedure designed for companies that completely lack sufficient assets to cover even the basic costs of the process. This legal tool, regulated by the new Spanish Insolvency Law, allows for an ultra-fast procedure that protects workers through the Wage Guarantee Fund (FOGASA) and avoids unnecessary costs.

Key features:

- Complete lack of assets: The company has no assets to liquidate.

- Ultra-fast procedure: Typically takes 2-3 months.

- Immediate protection for workers.

- Minimal procedural costs.

- Purpose: Immediate liquidation and closure.

The New Legal Framework

Fast-track insolvency has been significantly modified with Law 16/2022 in Spanish Ley 16/2022, which reforms the Consolidated Text of the Insolvency Law. This law has streamlined the process, improved protection for workers, and automated certain procedures

What is Concurso Necesario (Traditional Insolvency)?

The Concurso Necesario is the traditional and more formal insolvency procedure. In this case, the insolvency filing is mandatory when the company is in a state of insolvency, and it can be requested by the company’s creditors or the company itself. The process is more complex and involves greater judicial intervention, as the goal is either to liquidate the company or to negotiate a payment agreement with creditors.

For a broader understanding of the legal options available, you can also read our guide on Insolvency Proceedings in Spain.

Key features:

- Initiated by creditors or the debtor.

- More complex and formal procedure.

- Possibility of restructuring or liquidation.

- Greater judicial intervention and involvement of insolvency administrators.

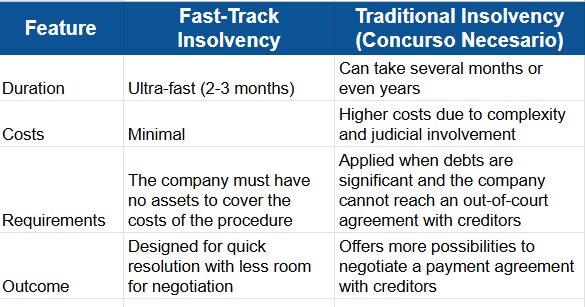

Key Differences Between the Two Types of Insolvency

When to Choose Fast-Track Insolvency vs. Traditional Insolvency?

The decision depends mainly on the size of the debt and the company’s financial situation.

- Choose Fast-Track Insolvency: If your company completely lacks sufficient assets and is looking for a quick and cost-effective solution. This path is ideal for businesses that have no possibility of recovery.

- Choose Traditional Insolvency: If the company has significant debts or assets, and needs more time to negotiate a payment agreement with its creditors or has a chance of being restructured and saved.

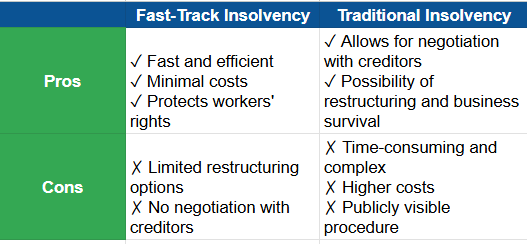

Pros and Cons

Ultimately, the choice between fast-track insolvency and traditional insolvency will depend on various factors. For companies with no assets and a need for a swift, economical resolution, the Concurso Express is the clear choice. For larger companies with significant debts that need time to negotiate, the Concurso Necesario offers more flexibility and opportunities.

If you need personalized assistance, at Entre Trámites we offer management and tax advisory services for freelancers and SMEs. You can contact us through this contact form for us to call you, or if you prefer, you can schedule a free consultation or write to us on WhatsApp.