The RETA (Special Regime for Self-Employed Workers) is the backbone of the Social Security system in Spain for anyone working on their own. It is the legal framework that covers all professionals who habitually carry out an economic activity on their own account.

Understanding what is RETA, from the registration and cancellation process to calculating your monthly contributions (“cuotas”), is crucial for anyone deciding to start a business or currently operating as a freelancer (autónomo).

This guide offers you a complete and up-to-date look at the system, based on current Social Security regulations and the latest changes affecting self-employed contributions.

Understanding what is RETA and who needs to join

So, what is RETA exactly? It stands for Régimen Especial de Trabajadores Autónomos. It is the Social Security scheme that all workers who habitually perform a profit-making economic activity without a classic employment contract are required to join.

This includes freelancers, craftsmen, shopkeepers, and anyone else working for themselves, regardless of whether the activity is carried out in a physical shop or remotely from a laptop.

Your obligations when signing up

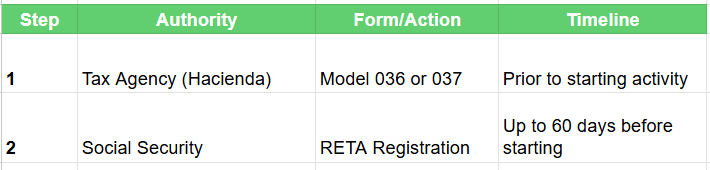

Getting your paperwork right from day one is vital to avoid fines. Here are the two main steps:

- Notify the Tax Agency (Hacienda): Before you officially “turn on the lights” of your business, you must notify the Tax Agency (AEAT) using Form 036 or 037 (Modelo 036/037).

- Join RETA (Social Security): You must register with Social Security.

- Important Correction: Legally, you must apply for registration up to 60 days before the start date of your activity. Do not wait until after you have started working, or you may lose benefits like the Flat Rate (Tarifa Plana). This can be done online via the Social Security Electronic Office using a Digital Certificate or Cl@ve system.

The new contribution system based on real income

Since 2023, a new contribution system has been in force for the self-employed based on real income (net earnings). The goal is for your monthly Social Security fee to fairly match your actual economic capacity—similar to how taxes work.

How does it work?

- Choosing your base: Each year, you must choose a contribution base that fits your forecasted net income. The system establishes 15 income brackets, each with a minimum and maximum contribution base.

- Declaration of income: At the end of the fiscal year, you will declare your actual earnings to the Tax Agency.

- Regularization (The Adjustment): Social Security will cross-check your actual declared income against the “cuota” you paid monthly.

- If you paid too much: Social Security will refund the excess contributions to you.

- If you paid too little: Social Security will claim the difference, and you will have to pay the remaining amount.

How to deregister from RETA

Knowing how to stop is as important as knowing how to start. When you cease your activity as a freelancer, you must notify Social Security to stop the bills.

- Online Procedure: Deregistration (known as “Baja”) is done through the Social Security Electronic Office.

- Deadline: You have a strictly enforced period of 3 calendar days from the cessation of activity to request the cancellation. If you miss this window, Social Security may charge you for the full month or impose penalties.

- Consequences: Deregistering from RETA means you stop paying the monthly fee, but you also stop accruing rights to benefits such as sick leave, retirement pension, or the “paro de autónomos” (cessation of activity benefit).

Frequently Asked Questions

Is it mandatory to pay if my income is low?

Yes, generally speaking. The obligation to contribute to RETA depends on “habituality” rather than income amount. If you carry out an economic activity on your own account on a regular basis, you are required to pay. However, the new system allows you to pay a lower monthly fee if your net returns are very low (below the Minimum Wage).

What happens if I deregister and then return to work as a freelancer?

If you deregister and later want to work as a freelancer again, you must re-register. If enough time has passed (generally 2 or 3 years since you last received aid), you may be able to benefit from the “Tarifa Plana” (Flat Rate) again.

What is the Tarifa Plana (Flat Rate)?

The Tarifa Plana is a state aid that allows new freelancers to pay a reduced Social Security fee during the first 12 months of activity. Since 2023, this quota is fixed at 80 euros per month. It can be extended for another 12 months if your net income remains below the Interprofessional Minimum Wage (SMI).

The RETA is a vital social protection scheme for the self-employed in Spain. Proper management—both when signing up and signing off—and a clear understanding of what is RETA regarding the real income system will allow you to operate with peace of mind, ensuring your rights are protected while you focus on growing your business.

If you need personalized assistance, at Entre Trámites we offer management and tax advisory services for freelancers and SMEs. You can contact us through this contact form for us to call you, or if you prefer, you can schedule a free consultation or write to us on WhatsApp.