Form 131 (Modelo 131) is a quarterly tax declaration that self-employed individuals (autónomos) in Spain, particularly those under the Objective Estimation Regime (Modules), must submit to pay the fractional Income Tax (IRPF). However, errors or omissions can occur in the initial submission.

In these cases, the Spanish Tax Agency (Agencia Tributaria or Hacienda) permits—and legally requires—the submission of a complementary tax return (declaración complementaria).

Understanding what the complementary Form 131 is and how to file it is crucial for avoiding penalties and keeping your fiscal situation in order. This article breaks down the situations requiring this form and guides you through the process step-by-step.

What is a Complementary Declaration and When is it Mandatory?

A complementary declaration is a form submitted to correct or add data to a tax return that has already been filed. Its main function is to regularize the tax situation when the taxpayer realizes they have made an error that harms the Public Treasury (Hacienda).

In the case of Form 131, a complementary declaration is mandatory in the following situations:

- Calculation Error: If, upon reviewing your quarterly declaration, you realize you declared a lower figure than the actual one. For instance, if you miscalculated the number of employed staff or the module index that corresponds to your activity.

- Omission of Data: If you forgot to include relevant information that affects the tax calculation, such as a new activity or a change in the module elements that increases the final amount to be paid.

- Underpayment: If the result of the original declaration was a payment, but the amount paid was less than what was actually due.

Key Rule: A complementary declaration is always filed when the correction results in an amount in favour of the Administration (i.e., you owe more than you paid initially). If the error was in your favor (you overpaid), you must file a request for rectification of the self-assessment, not a complementary declaration.

How to File the Complementary Form 131

The process for submitting a complementary declaration is similar to the original filing, but with one critical additional step.

- Access the Form: Form 131 is submitted electronically via the Tax Agency’s Electronic Headquarters (Sede Electrónica de la Agencia Tributaria). You can access it using your Digital Certificate, electronic DNI, or Cl@ve system.

- Fill Out the Form: You must complete all data as if you were filing the original declaration. However, in the “Settlement” (Liquidación) section, you must mark the “Complementary Declaration” box.

- Indicate the Justification: In the “Complementary Declaration” section, you must select the reason for the submission, typically “correction of errors or omissions.” You must also enter the identifying number (número de justificante) of the original declaration you are correcting.

- Consign the Result (The Difference): The result of the complementary declaration is not the total amount due, but rather the difference between the correct new settlement and the settlement already paid.

- Example: If your original settlement was €300 and the correct amount is €450, the complementary declaration must reflect an amount due of €150.

- Make the Payment: Once the form is correctly filled out, Hacienda will offer payment options. You can pay by direct debit if you are within the deadline, or obtain a reference number (NRC) for direct bank payment if the original deadline has passed.

It is crucial to carry out this procedure as soon as the error is detected. Filing voluntarily is considered an act of good faith and will result in either a minor sanction or, frequently, no sanction at all.

Penalties for Failing to File the Complementary Declaration

If the Tax Agency detects an error in your Form 131 before you have corrected it, they may impose a penalty. The amount of the sanction depends on the seriousness of the error and the economic harm caused to the Public Treasury.

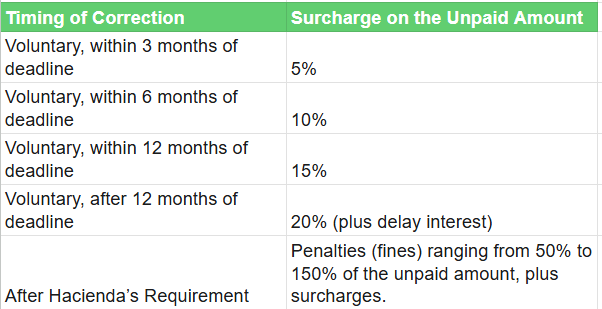

Penalties often include surcharges (recargos) on the amount not paid on time.

The complementary Form 131 is an essential tool for correcting fiscal errors and maintaining compliance with your tax obligations. Correct handling of this process allows you to avoid inconveniences with Hacienda and ensures your fiscal situation is accurate.

If you need personalized assistance, at Entre Trámites we offer management and tax advisory services for freelancers and SMEs. You can contact us through this contact form for us to call you, or if you prefer, you can schedule a free consultation or write to us on WhatsApp.