In Spain, the term prestación contributiva (contributory benefit) and prestación por desempleo (unemployment benefit) are often used interchangeably, leading to confusion, especially for foreigners navigating the system. While they are related, they are not exactly the same.

Understanding the differences between contributory vs non-contributory benefits is crucial to determining which state aid you are entitled to, how to apply for it, and what requirements you must meet, according to the Spanish Public Employment Service (SEPE).

Below, we provide a detailed, verified guide for 2025 to clarify these two essential economic supports.

1. What is the Contributory Benefit in Spain?

The contributory benefit in Spain, officially known as prestación contributiva por desempleo (or colloquially, el paro), is financial assistance granted to individuals who have lost their job through no fault of their own and have built up sufficient contributions.

It is funded by the mandatory contributions (cotizaciones) that both employees and employers make to the Social Security system during the employment relationship.

Core Characteristics of the Contributory Benefit:

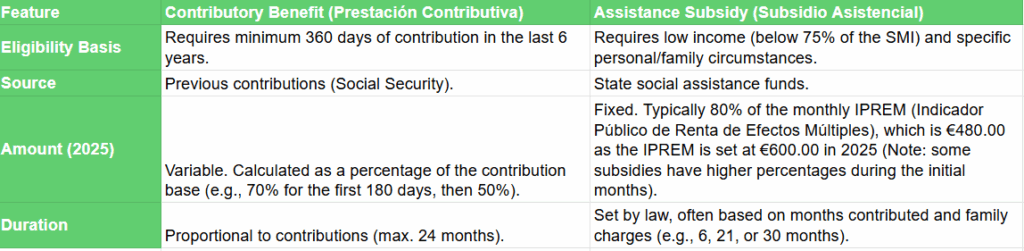

- Basis: Based entirely on the worker’s previous contributions.

- Minimum Contribution Time: Requires a minimum of 360 days (12 months) of contributions in the last six years.

- Amount Calculation: The amount is calculated based on the employee’s average contribution base (base reguladora) from the last 180 days worked.

- Duration: The duration is proportional to the number of days contributed, with a maximum period of 24 months (two years).

- Mandatory Requirement: You must be registered as an active job seeker (demandante de empleo) and maintain active availability for work.

Current Example: An expat who worked full-time in Spain for two years and is subsequently laid off will be eligible for the contributory benefit, provided they meet all SEPE requirements. They will receive a percentage of their previous salary’s contribution base.

2. What is the Unemployment Benefit (Prestación por Desempleo)?

In the broad sense, Prestación por Desempleo is an umbrella term that encompasses all state aid for job loss. This includes both the contributory benefit (based on contributions) and all subsidiary and assistance benefits (based on need).

This is why the confusion between contributory vs non-contributory benefits often arises—the former is a type of the latter.

Types of Unemployment Benefits:

- Contributory Benefit (The “Paro”): Based on having worked and paid Social Security contributions for at least 360 days.

- Assistance Subsidies (Subsidios Asistenciales): Designed for those who do not meet the minimum contribution requirements for the contributory benefit or who have exhausted it. Eligibility depends on income thresholds (e.g., must have monthly income below 75% of the Minimum Interprofessional Salary – SMI) and specific situations (e.g., people with family responsibilities, those over 52 years old, or returning emigrants).

- Extraordinary Aids (Ayudas Extraordinarias): Special, temporary state aids that target particular groups (e.g., the Extraordinary Unemployment Subsidy – SED).

Key Differences: Contributory vs Non-Contributory Benefits

The distinction is vital because it affects the amount, duration, and requirements for eligibility:

How to Apply for Your Contributory Benefit in Spain

If you have met the minimum 360 days of contribution, follow these steps with SEPE:

- Register as a Job Seeker: Enroll at your regional Public Employment Service office (this gives you the DARDE card/document).

- Submit the Application: You must submit the application for the contributory benefit within 15 working days from the day you became legally unemployed (e.g., the day after the contract termination).

- Provide Documentation:

- Valid identification (DNI/NIE/Passport).

- Company Certificate (Certificado de Empresa) – usually sent directly by your company to SEPE.

- Family Book (Libro de Familia) or equivalent documents for dependents (if applicable, as this impacts the minimum/maximum benefit amount).

- Wait for Resolution: SEPE typically issues a resolution within a maximum of 25 working days.

Important Technical Use: When referring to the act of losing the job that entitles you to this money, the term in Spanish is cese de actividad (cessation of activity).

Frequently Asked Questions (FAQs)

If I haven’t contributed for 360 days, can I still receive financial aid?

Yes, you may be eligible for an unemployment subsidy (subsidio por desempleo), provided you meet the specific SEPE requirements related to minimum days contributed (e.g., 90 days), income limits, and family situation.

Can the contributory benefit and a subsidy be collected at the same time?

No, they are generally incompatible. You must first exhaust the contributory benefit (if you are entitled to it) before you can apply for an assistance subsidy, provided you meet the subsequent eligibility criteria (such as not exceeding the income threshold).

Is the benefit amount the same across all of Spain?

Yes, the amount calculation for both the contributory benefit and the subsidies is regulated by the central government (SEPE) and applies equally throughout the entire Spanish territory.

In summary, knowing the fundamental difference between contributory vs non-contributory benefits (the paro versus the subsidio) is the essential first step to maximizing your employment rights and securing the correct economic support in Spain.

If you need personalized assistance, at Entre Trámites we offer management and tax advisory services for freelancers and SMEs. You can contact us through this contact form for us to call you, or if you prefer, you can schedule a free consultation or write to us on WhatsApp.