The Active Insertion Income (RAI) is a form of financial aid aimed at unemployed people who face specific difficulties rejoining the labour market. It’s designed for groups with fewer employment opportunities and seeks to facilitate both their financial support and their reintegration into the workforce.

In this guide, we’ll look at who can apply for it, what its requirements are, how much you can receive, its duration, and how to file for it correctly.

What Is the Active Insertion Income (RAI)?

The RAI is a programme managed by the Spanish Public Employment Service (SEPE) that combines a monthly financial payment with active job search activities, training, and career guidance. It’s intended for people who meet specific requirements and, due to their situation, have more difficulty finding stable employment.

Groups That Can Apply for the RAI

Unemployed individuals who belong to one of the following groups can access the RAI:

- Long-term unemployed individuals who are over 45 years of age.

- People with a disability of 33% or more.

- Victims of gender or domestic violence.

- Returning emigrants over 45 who have worked at least 6 months abroad.

General Requirements

Although they vary depending on the group, in general, you must:

- Be registered as a job seeker and maintain your registration throughout the programme.

- Not have monthly income exceeding 75% of the Minimum Interprofessional Salary (SMI).

- Not have previously received the RAI more than three times.

- Comply with the obligations of the activity commitment: actively look for work, attend interviews, and participate in training when required.

Amount and Duration

- Monthly Amount (2025): The amount is equivalent to 80% of the IPREM.

- Duration: A maximum of 11 months for each recognised right.

- Compatibility: In some cases, it can be combined with part-time work, with the amount being proportionally reduced.

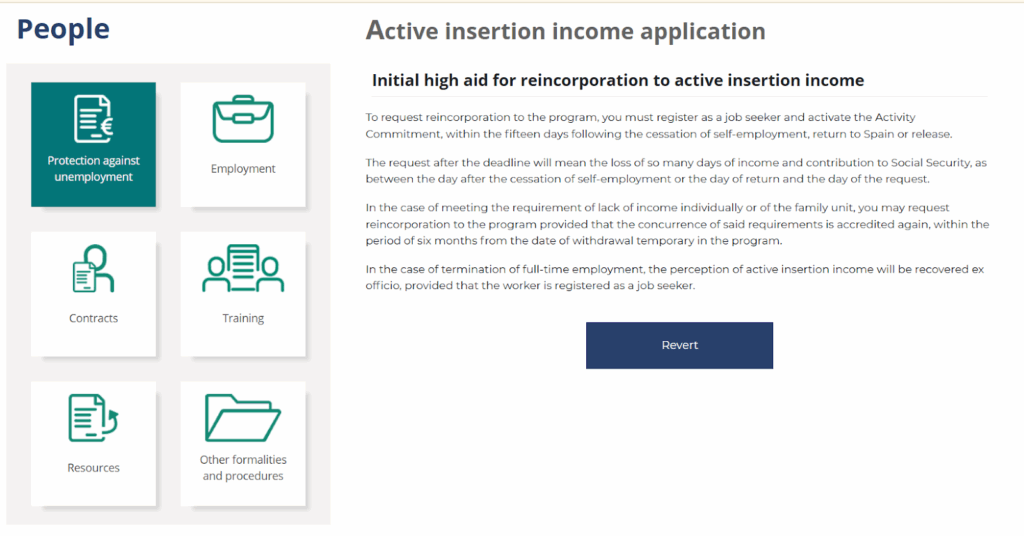

How to Apply for the RAI

You can apply through the following channels:

- Online (Recommended):

- Go to the SEPE E-Office.

- Select “Solicitar Renta Activa de Inserción” and fill out the form.

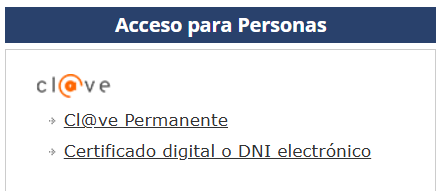

- Identify yourself with a digital certificate, electronic ID, or the Cl@ve system.

- In Person:

- Schedule a prior appointment at your local SEPE office.

- Bring the required documentation: DNI/NIE, DARDE, proof of income, and, if applicable, certificates that prove you belong to the corresponding group.

Frequently Asked Questions (FAQs)

Can I receive the RAI and another benefit at the same time?

No, the RAI is incompatible with other unemployment benefits or subsidies, except in cases of part-time work.

Is the RAI taxable?

Yes, it is considered employment income and must be declared on your tax return.

Can the RAI be renewed?

You can apply to receive it up to a maximum of three times in your life, but each time is a new application, not a renewal. You must also wait at least 365 days after receiving the last payment of your previous RAI benefit before applying for a new one.

In short, the RAI is a key support for unemployed people with special difficulties finding employment. Applying for it and complying with its requirements can provide a significant economic and professional boost.We offer labor, tax, and accounting advisory services tailored to your needs.

If you require personalized assistance to manage your labor obligations, at Entre Trámites we offer management and tax advisory services for freelancers and SMEs. You can contact us through this contact form for us to call you, or if you prefer, you can schedule a free consultation or write to us on WhatsApp.