Form 390 is the annual VAT summary that brings together all the VAT information declared during the year through periodic VAT returns. While it does not involve any payment, it remains an important informative tax obligation for certain self-employed workers and companies in Spain.

In this guide, you’ll find a clear and up-to-date explanation of what Form 390 is, who must file it, who is currently exempt and how it fits into the Spanish VAT system.

What is Form 390 and what is it used for?

Form 390 is an informative annual VAT return that summarises all VAT operations carried out during the tax year.

It consolidates the information already reported in Form 303 (quarterly VAT returns) and allows the Spanish Tax Agency (AEAT) to:

- Verify consistency between quarterly filings

- Analyse VAT activity on an annual basis

- Detect discrepancies or errors

Form 390 does not generate a payment or refund. It is purely declarative.

Who must file Form 390?

In general terms, Form 390 must be filed by professionals and businesses that:

- Carry out activities subject to VAT in Spain

- Are required to file Form 303

- Are not included in one of the exemption scenarios

Filing Form 390 is mandatory unless you are expressly exempt, so it is essential to confirm your specific situation.

Who is exempt from filing Form 390?

Currently, you do not have to file Form 390 if you fall into one of these categories:

Taxpayers filing Form 303 with additional information (Q4)

Self-employed workers and companies do not need to file Form 390 if:

- They submit Form 303 for the fourth quarter

- And that return includes the additional information that replaces the annual summary

This is the most common exemption today.

Taxpayers under the SII system

You are exempt from Form 390 if you are subject to the SII (Immediate Supply of Information) system, including:

- Large companies

- VAT groups

- Businesses registered under REDEME (monthly VAT refunds)

These taxpayers already send VAT records electronically in near real time, making Form 390 unnecessary.

Important clarification

Being in modules or leasing urban property does not automatically exempt you. The exemption depends on how Form 303 is filed, not just on the type of activity.

Deadline to file Form 390

The filing period for Form 390 is:

- From 1 to 30 January of the year following the tax year declared

It must be submitted within this window to avoid penalties, even though it is an informative return.

How to file Form 390

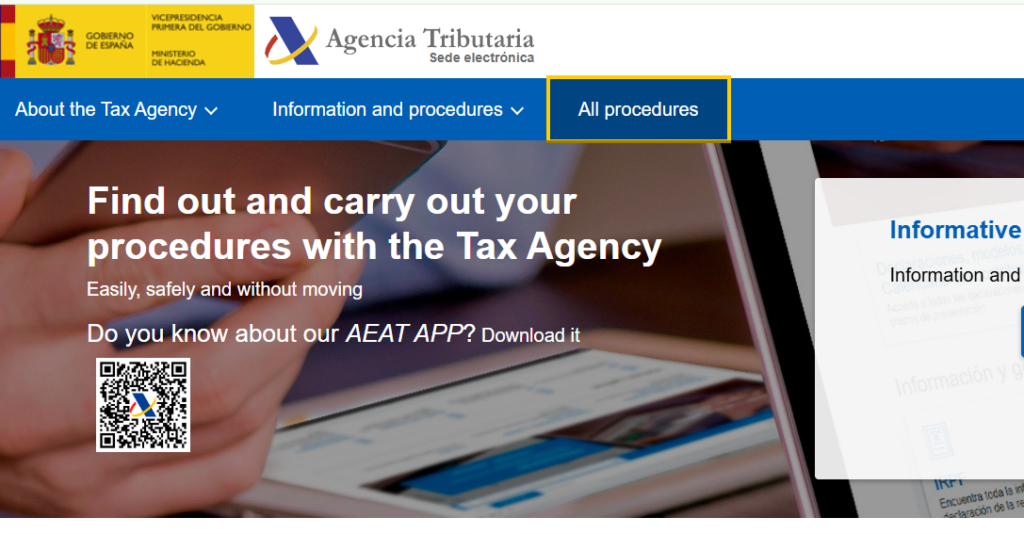

Form 390 is filed exclusively online through the Spanish Tax Agency website.

- Access the AEAT website Click on “All procedures”

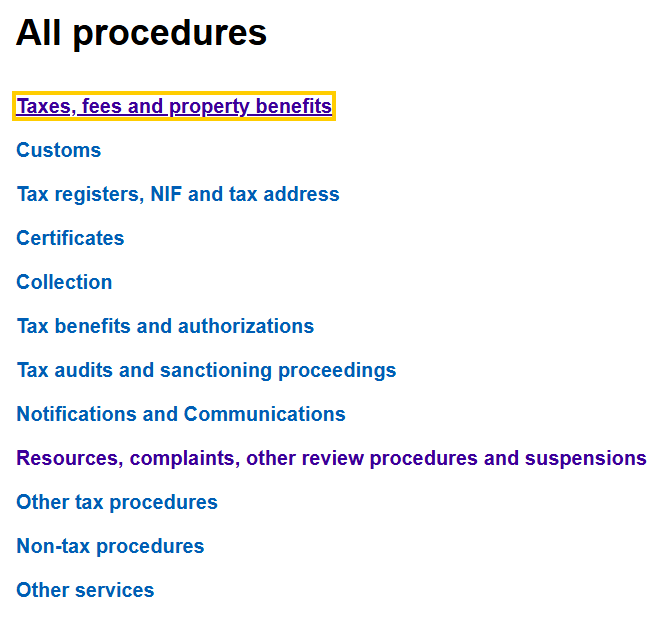

- Click on “Taxes, fees and property benefits“

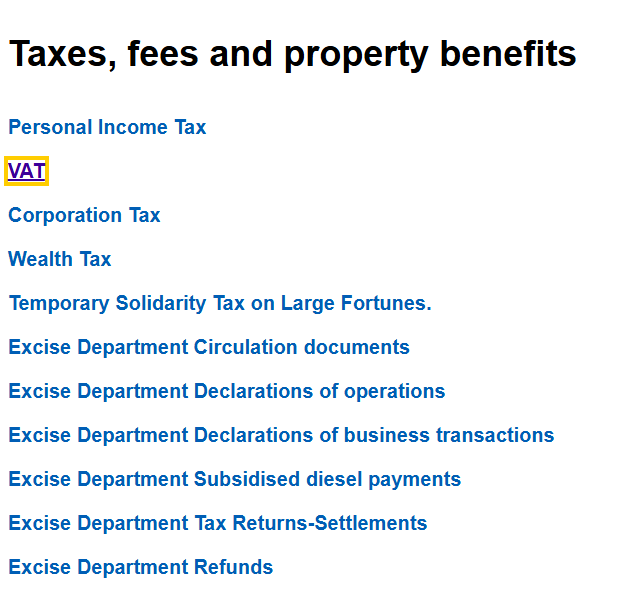

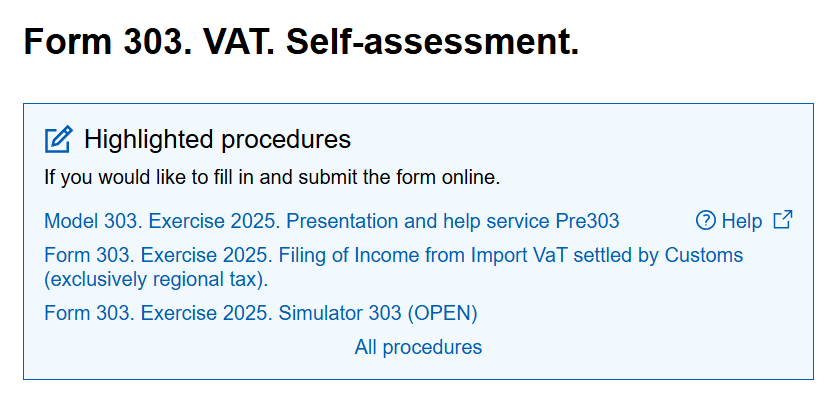

- Click on the option VAT then “Form 303. VAT. Self-assessment“

You can submit it using:

- A digital certificate or DNIe

- Or Cl@ve (for individuals)

There is no paper filing option for Form 390.

Information required to complete Form 390

To prepare Form 390, you need a full overview of your VAT activity for the year:

- VAT tax bases and VAT amounts

- VAT rates applied (4%, 10%, 21%)

- Classification of operations:

- Domestic

- Intra-EU

- Non-EU

- Identification of:

- Current expenses

- Investment goods

- Taxpayer identification details

The data must match exactly the totals declared in all Form 303 submissions.

Main sections of Form 390 explained

Form 390 is structured into several blocks:

Taxpayer identification

Includes NIF, name or business name and confirmation of exemption status.

Accrual (Devengo)

Indicates the tax year and whether the return is a replacement filing.

Statistical data

Lists the economic activities performed, classified by IAE codes, based on turnover volume.

VAT accrued

Reflects VAT charged on sales, broken down by:

- Type of operation

- Applicable VAT rate

- VAT regime

Deductible VAT

Summarises VAT paid on deductible expenses and investment goods.

Annual settlement result

Shows the annual difference between accrued VAT and deductible VAT, purely for informational purposes.

Volume of operations

Details total turnover, excluding:

- Transactions carried out outside the Spanish VAT territory under specific conditions

- Certain self-supplies defined in VAT legislation

Specific operations and prorrata

Includes:

- Non-deductible acquisitions

- Partial deduction regimes (prorrata)

- Activities with differentiated deduction systems

What happens if you do not file Form 390?

If you are required to file Form 390 and fail to do so:

- You may receive a formal request from the Tax Agency

- Administrative penalties may apply

- Your VAT filings may be reviewed in more detail

Even though no payment is involved, compliance is essential.

Frequently asked questions

Is Form 390 always mandatory?

No. Many taxpayers are exempt if their Q4 Form 303 includes the required additional information.

Does Form 390 replace Form 303?

No. Form 390 is only a summary. Quarterly VAT returns remain mandatory.

Can I file Form 390 if I am exempt?

No. If you are exempt, filing Form 390 is neither required nor expected.

Form 390 plays a supporting but important role in the Spanish VAT system. Knowing whether you must file it — or whether you are exempt — helps you avoid unnecessary filings and potential penalties. Reviewing your VAT situation at year-end and ensuring consistency across returns is key to staying compliant and keeping your tax obligations under control.

If you need personalized assistance, at Entre Trámites we offer management and tax advisory services for freelancers and SMEs. You can contact us through this contact form for us to call you, or if you prefer, you can schedule a free consultation or write to us onWhatsApp.