Form 130 is one of the key tax forms self-employed workers must deal with in Spain. If you are registered as a freelancer under the direct estimation system, this form is how you make quarterly advance payments of your personal income tax (IRPF).

In this guide, you’ll learn what Form 130 is, who must file it, how to complete it correctly and how to submit Form 130 online, with clear explanations and no unnecessary complications.

What is Form 130 and what is it used for?

Form 130 is the quarterly self-assessment used by self-employed professionals to pay advance installments of their income tax (IRPF).

Instead of paying all your income tax once a year, the Spanish Tax Agency (AEAT) requires many freelancers to pay it in advance every quarter, based on their business profits.

With Form 130, you:

- Declare your income and deductible expenses

- Calculate your net profit

- Pay 20% of that profit as an advance payment

These payments are later offset against your final annual Income Tax Return.

Who must file Form 130?

You must file Form 130 if you are self-employed and:

- You are taxed under direct estimation (normal or simplified)

- You carry out an economic or professional activity in Spain

This includes:

- Entrepreneurs registered under business IAE headings

- Professionals who invoice without sufficient withholding

- Members of communities of property, according to their share

Who is exempt from Form 130?

You do not have to file Form 130 if:

- You are under the module system (you file Form 131 instead)

- You carry out a professional activity and at least 70% of your income was subject to IRPF withholding in the previous year

This exemption applies only if the withholding condition is met consistently.

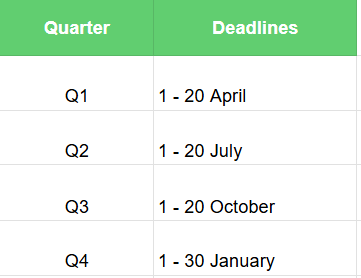

How often is Form 130 filed?

Form 130 is filed quarterly, four times a year:

If the deadline falls on a weekend or public holiday, it moves to the next working day.

How to file Form 130 online

Form 130 is filed electronically through the Spanish Tax Agency website.

You can submit it using:

- A digital certificate or DNIe

- Or Cl@ve (for individuals)

General filing steps:

- Access the AEAT online platform

- Select Form 130

- Enter income and expense data

- Review the calculation

- Submit and download the confirmation receipt

How to fill in Form 130 correctly

Form 130 is divided into sections depending on your activity.

Section I – General activities

This section applies to most self-employed workers.

You must enter cumulative figures from 1 January to the end of the quarter you are filing.

Key boxes include:

- Income: total business income

- Expenses: deductible business expenses

- Net profit: income minus expenses

- Advance payment: 20% of the net profit (if positive)

- Previous payments: amounts already paid earlier in the year

If the result is negative, no payment is due, but the form must still be filed.

Section II – Agricultural, livestock, forestry and fishing activities

This section applies only to specific activities.

Here, the calculation is based on:

- Total income

- A fixed percentage applied to that income

- Withholdings already applied

Expenses are not deducted in this section.

How Box 13 works in Form 130

Box 13 allows a small reduction for freelancers with low net income in the previous tax year.

The reduction depends exclusively on last year’s net income from economic activities, not on projections or current-year estimates:

- Up to €9,000 → €100

- €9,000.01 to €10,000 → €75

- €10,000.01 to €11,000 → €50

- €11,000.01 to €12,000 → €25

If your previous year’s net income exceeded €12,000, no reduction applies.

Final result and payment

After applying deductions and offsets, Form 130 shows the final amount payable.

- If the result is positive, you must pay it to the Tax Agency

- If the result is negative, it can be offset against future quarters within the same year

A negative result does not mean a refund.

How do you pay Form 130?

If payment is due, you can:

- Pay by direct debit (request before the 15th of the filing month)

- Pay by bank transfer, card or online banking through AEAT

Payment methods are selected during the online submission process.

Frequently asked questions

Do I have to file Form 130 if I had no income?

Yes. If you are registered under direct estimation, you must file it even with zero income.

Is Form 130 the same as the annual Income Tax Return?

No. Form 130 is an advance payment. The final calculation is done in the annual return.

Can I deduct expenses in Form 130?

Yes, provided they are directly related to your activity and properly documented.

Form 130 is a fundamental obligation for self-employed workers in Spain under direct estimation. Filing it correctly ensures your income tax payments are spread throughout the year and avoids penalties or unexpected charges later on. With proper records and professional support, managing Form 130 becomes a routine task rather than a source of stress.

If you need personalized assistance, at Entre Trámites we offer management and tax advisory services for freelancers and SMEs. You can contact us through this contact form for us to call you, or if you prefer, you can schedule a free consultation or write to us on WhatsApp.