The National Classification of Economic Activities or CNAE code has the purpose of carrying out reliable statistics at a national level, but it has no fiscal repercussions, all commercial companies and autonomous professionals in Europe are obliged to have one.

The CNAE code consists of a 4-digit combination that identifies the main economic activity of the company or self-employed worker. It responds to a reform that came into force in 2009 when there were a series of changes to comply with European directives, such as a series of sub-levels that contain section, division, group, and class.

How to know the CNAE code? Step by Step

The CNAE code can be easily found in the contract, although you can also look for it in the Tax Agency e-Office.

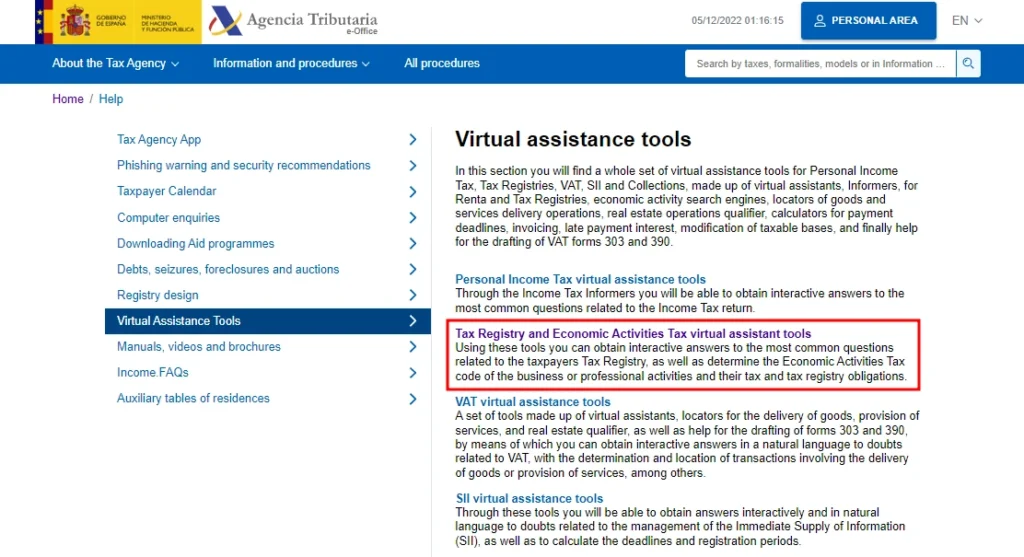

Go to the Virtual Assistance Tools section of the Tax Agency e-Office, and click on the link “Tax Registry and Economic Activities Tax virtual assistant tools”.

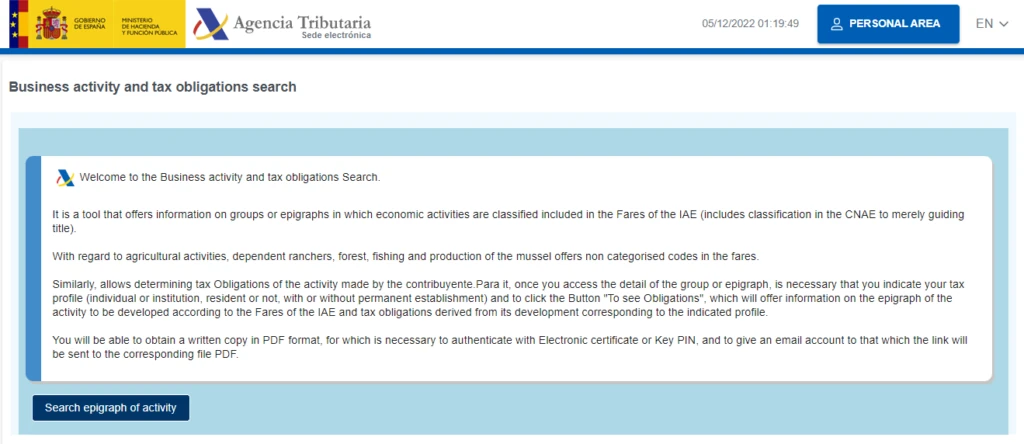

Within this section, you will find another link called “Activity finder and its tax obligations”.

Once clicked on this link, it will open a new window where you can read more information about this tool and its general purpose. Click on the “Search epigraph of activity” button.

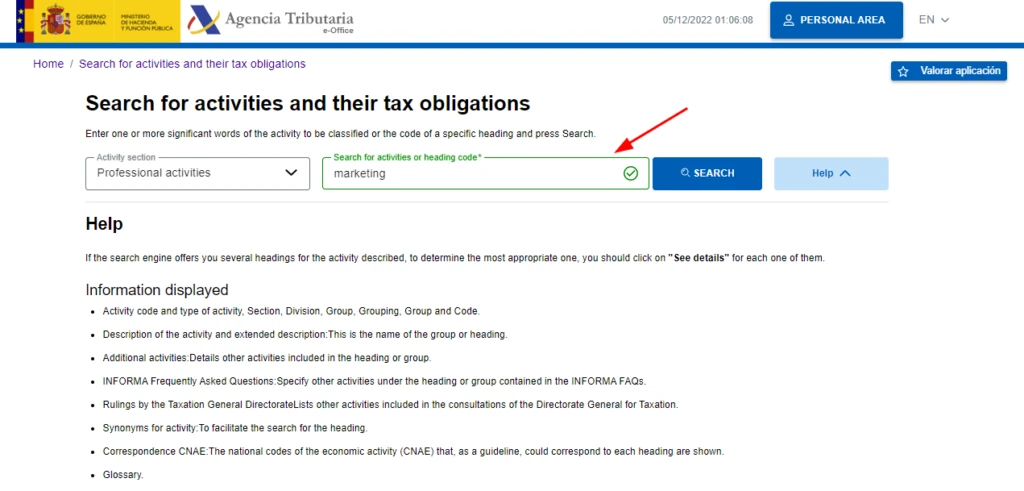

This will finally take you to the “Search for activities and their tax obligations” finder. Search for your activity using one or more words, in the search engine put a keyword related to your activity, with which you think your business identifies.

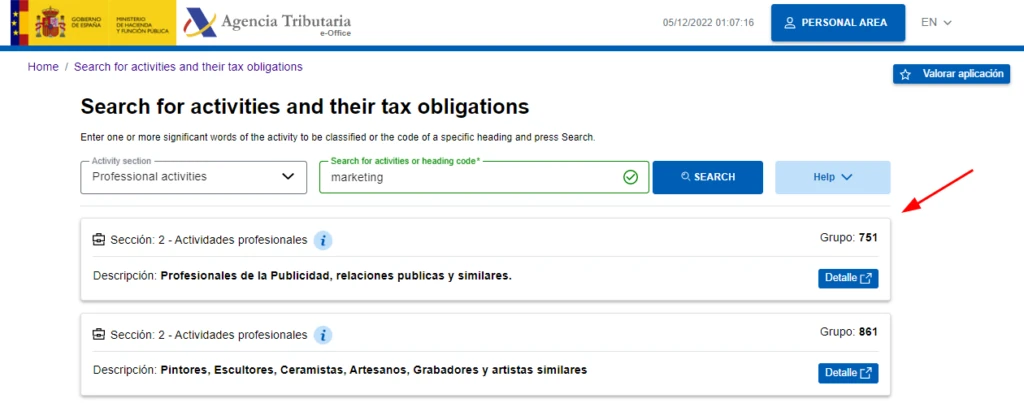

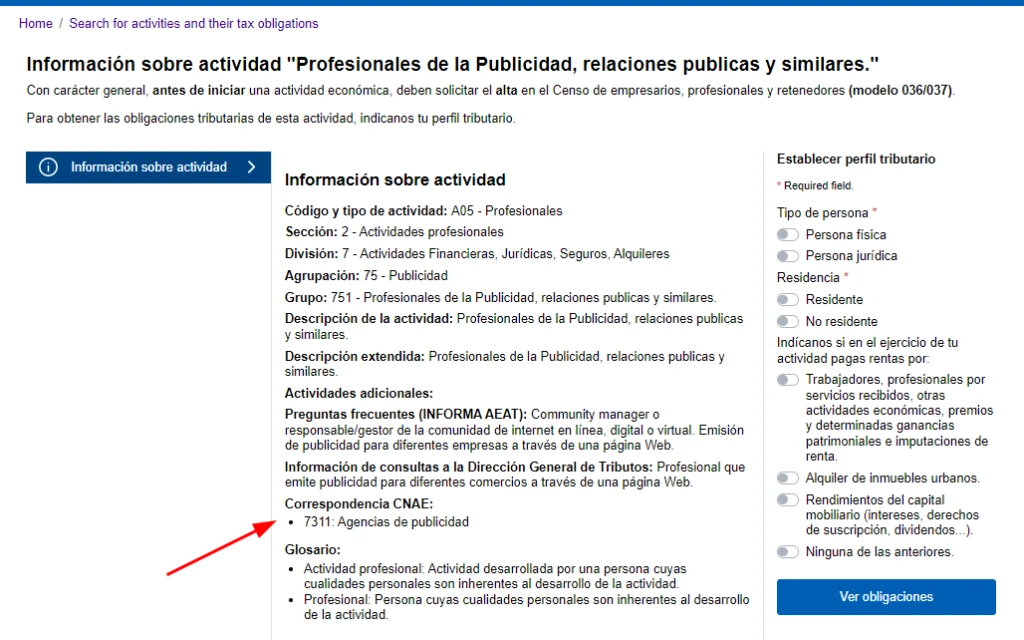

Once you have found it, enter its detail to see the CNAE code. If the search was satisfactory and the results provide you with an activity that matches what you do or will do, then click on “Ver detalle”.

This will take you to another page (in Spanish) that indicates a series of relevant data corresponding to your activity and where you can see its CNAE code (which appears as “Correspondencia CNAE”). We recommend that you save it, since other data may be useful for some other procedure, such as the heading of the IAE to which you correspond, etc.

Can you change the CNAE code?

Yes. It is not unusual for companies to change their activity over time, taking into account the demand of their customers. It is only necessary to change their deed of incorporation and notify the Mercantile Registry and Social Security.

How to change the CNAE code?

The change depends on whether you are a company or self-employed. In the case of the latter, they can access the Electronic Office of Social Security with the digital certificate and request the change. As for companies, they have to follow the same procedure but they must register said modification in the deeds through a notary so the modification is effective.

How to know what is the CNAE of a company?

There are 21 business titles, categorized from A to U, to try to cover all types of business activities.

| CNAE group |

| U – Activities of extraterritorial organizations and bodies |

| T – Household activities as employers of domestic staff; household activities as producers of goods and services for own use |

| S – Other services |

| R – Artistic, recreational and entertainment activities |

| Q – Health and social services activities |

| P – Education |

| O – Public Administration and defense; mandatory Social Security |

| N – Administrative activities and auxiliary services |

| M – Professional, scientific and technical activities |

| L – Real estate activities |

| K – Financial and insurance activities |

| J – Information and communications |

| I – Hospitality industry |

| H – Transport and storage |

| G – Wholesale and retail trade; repair of motor vehicles and motorcycles |

| F – Construction |

| E – Water supply, sanitation activities, waste management and decontamination |

| D – Supply of electricity, gas, steam and air conditioning |

| C – Manufacturing industry |

| B – Extractive industries |

| A – Agriculture, livestock, forestry and fishing |

Each of these categories is subdivided into several headings, and these in turn into a few others, up to the fourth level. Each of them is represented by a number; therefore, the total number of them in the CNAE code is four.

Duration of the CNAE code

It has no date of expiration, so the CNAE code will be valid at all times, without forgetting how long the activity will be developed. In this sense, it is only necessary to obtain it once, at the moment in which the activity is going to begin.

The differences between CNAE and IAE

The IAE number is a code that, like the CNAE, identifies the activity of the company or self-employed person, however, they are not the same. While the CNAE has a purely statistical function, the IAE number responds to a certain tax and will mark a series of obligations with the Tax Agency. You will also need the IAE number to register as self-employed with Social Security.

Contact us!

We want to listen to you and know what your questions are about the procedures you have to carry out. Count on the advice of our experts to clarify all your doubts.

In Entre Trámites we invite you to know about all our consultation services. Fill in our contact form and we will call you to help you as soon as possible, schedule your online consultation, or simply text our WhatsApp.