Entre Trámites » Taxes in Spain » Filing Of The Modelo 600

Filing of the modelo 600 in spain

Simplify Your Tax Obligations!

Have you recently purchased real estate, reduced the capital of your SL or canceled a mortgage in Spain? If so, keep reading because you can get:

- Presentation of the Modelo 600 to declare transfer tax and stamp duty in Spain.

Working With Us Is...

No more confusion

We eliminate all the tedious paperwork for you and guide you through every step

100% Online Service

You don't even need to leave home to successfully complete the procedures you want

All-Inclusive Prices

There are no surprises. The prices you see are the final prices.

- Modelo 600

- Transfer Tax (ITP)

- Stamp Duty Tax (AJD)

Key Information to Simplify Property Taxes in Spain

What is the Modelo 600 in Spain?

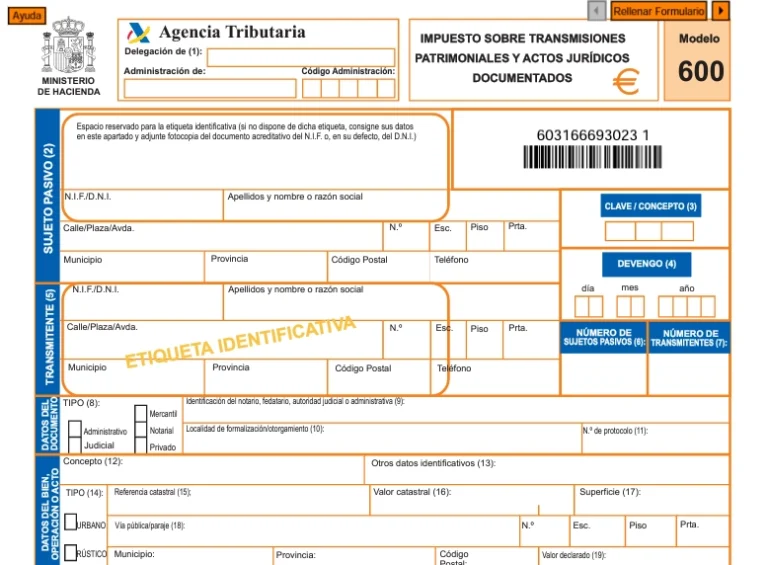

Also known as Form 600, is a tax declaration form used in Spain for various real estate transactions made and paid by the buyer.

It serves as a means to report and pay the corresponding transfer tax (Impuesto de Transmisiones Patrimoniales or ITP) and stamp duty tax (Impuesto de Actos Jurídicos Documentados or AJD).

Common transactions that need filing the Modelo 600:

- Real estate purchase

- Formalization and recording of deeds, mortgages, and loan agreements

- Purchase of a used vehicle

- Incorporation / dissolution of a company

- Capital increase of a commercial company

Get to know more about...

It is a regional tax imposed on the transfer of ownership or possession of real estate properties.

How is the transfer tax calculated?

The tax amount is determined based on the property’s value and the tax rates set by the autonomous community where the property is located.

When should the transfer tax be paid?

The payment is typically due within 30 days from the date of the property transaction.

It is a tax levied on certain legal documents, including deeds, mortgages, and loan agreements.

What documents are subject to it?

The tax applies to various legal documents related to real estate transactions, such as purchase deeds and mortgage agreements.

How is stamp duty calculated?

The tax amount is usually a percentage of the document’s value, which varies depending on the region and the type of document.

our professional services Include

Are you struggling with the world of property or notarial transactions in Spain and need to find a reliable solution to fill out your Modelo 600 in Spain?

We have the perfect solution to simplify your tax obligations and ensure a seamless experience from start to finish!

Any Doubts?

- Check our FAQ Section.

Expert Guidance

Full Documentation Support

Timely Submission

Cost and Time Savings

Check Which One of Our Plans Suits You Best

Basic

Submission of Modelo 600-

Choose this plan if the transaction to be reported on the Modelo 600 is exempt from VAT.

-

You can hire it now! Just click on the button to go to the payment section.

-

All the features of this plan

Premium

Submission of Modelo 600-

Choose this plan if the transaction to be reported in the Modelo 600 is not exempt from VAT and the amount of the tax does not exceed €10,000.

-

You can hire it now! Just click on the button to go to the payment section.

-

All the features of this plan

Don't know which plan would be best in your case?

Contact us and our team will help you!

Here's what our clients say about us

Your Taxes Made Simple!

Book a 1-Hour consultation with our tax specialist in Spain and you will get all your specific questions immediately answered.

FAQ

General

Info

You should file the Modelo 600 in Spain within 30 days from the date of the property transaction or event that triggers the tax obligation.

It is essential to meet this deadline to avoid penalties or legal consequences.

The Modelo 600 is typically required for property transactions such as purchases, inheritances, and donations.

However, it may not be necessary for certain cases like renting or leasing agreements.

It’s advisable to consult with tax professionals or authorities to determine the specific situations that require filing.

The specific documents you have to hand in to file the Modelo 600 may vary depending on the type of transaction.

Generally, you will need documents such as purchase agreements, property valuation reports, identification documents, and any other relevant supporting documentation related to the transaction.

Yes, the filing and submission of this form can be done online through the Agencia Tributaria website.

Payment can be made by credit card or by direct debit to your bank account.

It can also be filed in person, at the Tax Agency office of your Autonomous Community, after making the payment of the required amount of the tax at your bank.

The transfer tax calculation for the Modelo 600 is based on the applicable tax rates set by the Autonomous Community where the property is located.

These tax rates may vary depending on factors such as property value, type of transaction, and regional regulations.

Process

In each plan you will get:

- Online submission of the Modelo 600.

- We will send you the proof of filing in PDF format with which you will be able to go to the Registry.

- Organization of the required documentation for the filing of the Modelo 600.

- Online follow-up of the submission.

- Your own personal advisor.

- Unlimited advice.

According to each case, the documentation to provide is different.

At the moment you hire one of the plans we will analyze your case and contact you to tell you the exact documentation you need to provide.

You have up to 30 days to send it.

- One of our experts will contact you promptly to start analyzing your case in depth and tell you the best step-by-step process to follow.

- You will know what is the necessary documentation to provide and you may also contact us to solve any remaining doubts.

- We’ll submit the Modelo 600 for you and let you know how it goes, always keeping you up-to-date on any notifications.

Payment

The prices you see in our pricing section are the final ones (+21% of VAT).

Payments must be made by debit or credit card.

You have up to 15 days to request cancellation of the service, as long as you have not sent the documentation. The money will be refunded to your card in less than 14 days. See our Commercial Conditions.

Our Team

You will always have personalized attention and direct contact with your advisor.

You can communicate at any time (as long as it is business hours and about the services you have hired) by email or telephone, whichever is more comfortable for you.

Do you need more info?

We want to listen to you and know what your doubts are or what you need in relation to our service for restaurants. You can count on the advice of our experts to clarify all your doubts.

Write to us at [email protected] and we will contact you quickly or simply call us.