Tax for the self-employed in Spain refers to the annual Personal Income Tax (IRPF) return that freelancers (autónomos) must submit to regularise the advance payments made throughout the year.

If you are registered as self-employed and operate under direct estimation (normal or simplified), you are required to file your annual income tax return, even if you have already submitted quarterly payments using Form 130 or 131.

Understanding how Tax for the self-employed works helps you avoid penalties, optimise deductions, and plan your cash flow more efficiently.

What does Tax for the self-employed include?

When you file your annual income tax return (Declaración de la Renta), you declare:

- Total income from your economic activity

- Deductible business expenses

- Advance payments made through Forms 130 or 131

- Withholdings applied on your invoices (7% or 15%)

- Other personal income (employment, savings, rental income, etc.)

The tax is regulated under Law 35/2006 on Personal Income Tax (IRPF) and its implementing regulations.

The annual return adjusts what you have already paid during the year. If you paid too much through quarterly instalments, you receive a refund. If you paid less, you must pay the difference.

When is Tax for the self-employed filed?

The income tax campaign usually runs between April and June of the year following the tax year, as published annually by the Spanish Tax Agency (Agencia Tributaria).

If the result is payable and you choose direct debit, the deadline is typically a few days before the general deadline.

Documents you need to prepare

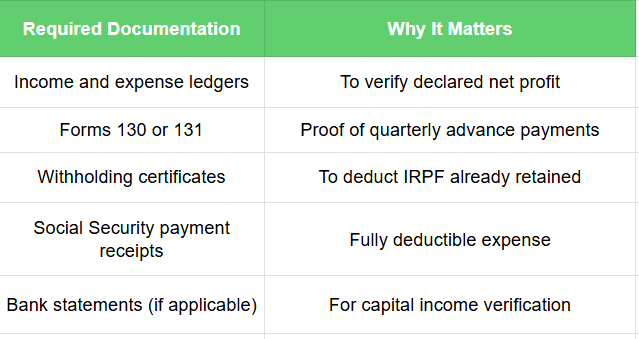

Before accessing Renta Web, gather the following:

Having complete documentation ensures your declared figures match your bookkeeping and the tax data provided by the Tax Agency.

How Tax for the self-employed is calculated

Under direct estimation, your taxable income equals:

Income – Deductible expenses = Net profit

From this net profit:

- Progressive IRPF rates apply (national + regional scale).

- Quarterly payments (Form 130/131) are deducted.

- Withholdings already applied on invoices are deducted.

If you operate under objective estimation (modules), your taxable base is calculated using objective criteria established annually by ministerial order.

Deductible expenses you must review carefully

When filing Tax for the self-employed, many freelancers miss deductions they are legally entitled to claim.

Common deductible expenses include:

- Office rent or coworking space

- Professional services (legal, accounting, consulting)

- Software and digital tools

- Social Security contributions (RETA quota)

- Business insurance

- Depreciation of equipment

- Proportional home office utilities (if declared in Form 036/037)

Under simplified direct estimation, hard-to-justify expenses may be deducted up to a legally established annual cap (as regulated by IRPF law).

Accurate bookkeeping is essential, especially as the Tax Agency increasingly cross-checks data digitally.

What happens if the result is payable?

If your income tax return shows an amount due:

- You may split payment into two instalments without interest:

- 60% upon filing

- 40% later in the year (usually November)

If you choose direct debit, it must be arranged before the specific annual deadline indicated by the Tax Agency.

Failure to file or late filing may result in:

- Surcharges

- Late-payment interest

- Administrative penalties under Ley General Tributaria (Law 58/2003)

How to file Tax for the self-employed

You can submit your return through:

- Renta Web (online platform)

- Digital certificate

- Cl@ve system

- In-person appointment

- Telephone assistance (Plan “Le Llamamos”)

The draft provided by the Tax Agency should always be reviewed carefully. It does not automatically include all deductible expenses related to your economic activity.

Practical example

A freelance consultant earning €45,000 in annual revenue with €15,000 in deductible expenses would declare:

- Net profit: €30,000

- Quarterly payments already made: €6,000

- Invoice withholdings: €3,000

The annual return determines whether additional payment is required or whether a refund applies.

This final adjustment is precisely what Tax for the self-employed is designed to regularise.

Managing Tax for the self-employed correctly is not just about filing a form. It is about ensuring that all advance payments, withholdings, and deductions are accurately reconciled so you neither overpay nor risk penalties.

Frequently Asked Questions (FAQs)

Do all freelancers have to file Tax for the self-employed?

Yes, if you are registered as self-employed and earn income from economic activity, you must file the annual IRPF return.

Can I avoid paying more tax if I already submitted Form 130?

Form 130 is an advance payment. The annual return adjusts the final amount owed.

Is Social Security deductible in Tax for the self-employed?

Yes. Your RETA contributions are fully deductible as a business expense under IRPF rules.

Filing your income tax return as a freelancer requires preparation and clarity. By understanding how Tax for the self-employed works, you can stay compliant, avoid unnecessary payments, and manage your finances with confidence.

If you need personalized assistance, at Entre Trámiteswe offer management and tax advisory services for freelancers and SMEs. You can contact us through this contact form for us to call you, or if you prefer, you can schedule a free consultation or write to us onWhatsApp.