For any self-employed person or legally constituted company, it is a fundamental requirement to carry a Tax Identification Number better known as NIF, which allows them to carry out their financial activities in Spain.

It is important to bear in mind that the NIF of a self-employed person and a company are coded differently, but with the same functionality. In this article, you will learn about their differences, concepts and the process that you must take into account when requesting your duplicate of the NIF.

In order to understand the Tax Identification Number (NIF), it is necessary to talk about concepts such as the DNI, the CIF and the NIE that, although they are completely different, in some cases they complement each other and this, in turn, generates confusion among the applicants.

On one hand, the DNI is a document that allows the bearer to be identified as a Spanish citizen. Only in the case that you want to start an activity aimed at creating companies as a self-employed worker you will need to carry out another tax identification.

On the other hand, the CIF, an acronym with which the NIF of legal entities was known before no longer exists, leaving in both cases for both natural entities and legal entities the acronym NIF. Although the encoding is not the same. The NIF of natural entities carries the alphanumeric code, which is made up of 8 digits and a letter at the end; as for the NFT of legal persons, the letter goes at the beginning of these 8 numbers.

The NIE, for its part, is an identification document for foreigners residing in Spain or having business relationships when starting their activity in the country, in this case, its code begins and ends with a letter.

It is important to take this into account since there are people who do not differentiate the previously exposed terms, and this could generate confusion when carrying out any procedure or process that this document requires.

The letters used in a NIF

In all cases, the NIF has an identifying letter that is determined by the legal nature of the entity:

- A for Public Limited Companies (PLC).

- B for LLC or Ltd.

- C for general partnerships.

- D for limited partnerships.

- E for joint properties.

- F for cooperative societies.

How is the letter of the NIF of natural entities calculated?

To obtain the letter of the NIF that identifies you as a natural person, you must divide the figure given by the eight digits of the DNI by 23, this division leaves as a result a value between 0 and 22; each of the numbers assigns a letter randomly, you can consult this table on the website of the Ministry of the Interior.

Tax Agency

When registering a company, the NIF is needed to start the economic activity. For this, Form 036 must be used, indicating to the Tax Agency the census data of the company and thus leaving this record.

When requesting the NIF that allows you to carry out the economic activity, you must register with the appropriate heading in the Economic Activities Tax (“Impuesto sobre Actividades Económicas”). In this case, you must know to which professional sector the already registered activity belongs and continue with the process that we will see below:

As a first measure, Form 036 must be completed

If you have a digital certificate or Cl@ve PIN, you can complete it electronically following the instructions given by the Tax Agency. If not, you can do it in PDF and present it at your office as they also explain on their website.

Steps to obtain a duplicate of the NIF

If due to whatever circumstances, you already have a NIF but need a new card, these are the steps to follow:

- On the Tax Agency website, type in the search engine “Obtaining a new NIF card”, under the Form 036 and 037 tabs.

- Register with your Cl@ve PIN or with your digital certificate.

- Enter the data and click “Send”.

- A window will appear with the identification data. Check that everything is in order and press Generate NIF card.

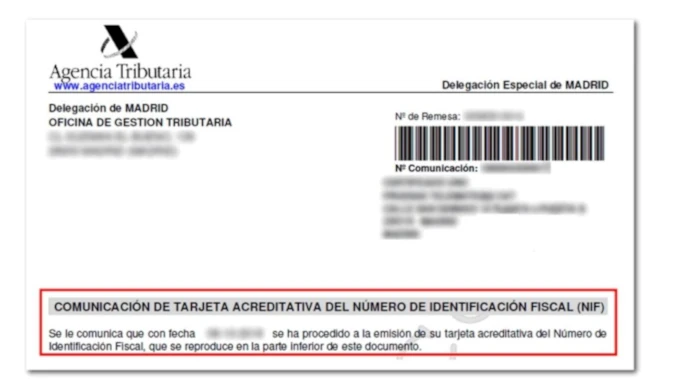

- A receipt will appear with the data of the holder and of the person presenting it, the date and time of the operation, secure verification code (CSV), etc., and the option “View receipt”. Click on this option.

- A document will appear that can be either saved or printed, and the identification card itself at the bottom.

- The card will also be available, within your personal area, in Communications issued/My notifications/Access to DEH notifications and communications.

To take into account when requesting the duplicate of the NIF

In step number 6, you may not be able to see the receipt or you did not write down the CSV and when you try again the following message will appear: “The card has already been generated today, you can print it with the CSV assigned at the time of generation”.

Don’t worry, because it is possible to recover it:

- Access, with a digital certificate or Cl@ve PIN, the Consultation of notifications and communications section.

- In the window that appears, indicate the corresponding filters and click on “Search”. The list of AEAT communications and notifications will appear there: look for the one that says NIF card issuance.

- Click now on Certificate Number to get the card.

- Check the data, click on See communication and you will obtain the PDF with the NIF card.

- You will also see a CSV: use it to check the data from the Check documents using the secure verification code option.

Contact us!

We want to listen to you and know what your questions are about the procedures you have to carry out. Count on the advice of our experts to clarify all your doubts.

In Entre Trámites we invite you to know about all our consultation services. Fill in our contact form and we will call you to help you as soon as possible, schedule your online consultation, or simply text our WhatsApp.