If you are registered as self-employed in Spain, knowing how much you will pay every month to Social Security is essential for managing your finances properly. The monthly tax fee for self-employed can be checked online before it is charged, allowing you to anticipate payments, review calculations, and correct potential errors in time.

Spain’s Social Security system provides an official online service that lets you consult your self-employed contribution receipts easily and securely. Below, we explain what this service offers, when it becomes available, and how you can access it step by step.

What is the monthly tax fee for self-employed in Spain?

The monthly tax fee for self-employed is the Social Security contribution paid by freelancers registered under the Régimen Especial de Trabajadores Autónomos (RETA). This contribution covers benefits such as healthcare, sick leave, maternity or paternity leave, retirement pensions, and other Social Security protections.

Since the implementation of the new contribution system based on real net income, the amount of the monthly tax fee depends on your declared earnings bracket. This makes it even more important to review your monthly receipt before the charge is made.

Official service to consult your self-employed receipts online

Self-employed workers can consult their contribution receipts through the official service:

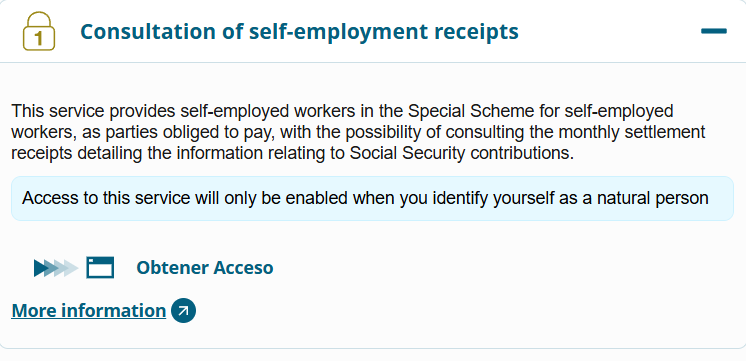

“Consulta de recibos emitidos para el Régimen Especial de Trabajadores Autónomos (RETA)”, provided by the General Treasury of Social Security (TGSS).

This service is available through the Social Security Electronic Headquarters (SEDESS) and allows you to view detailed information about your monthly tax fee for self-employed before it is charged.

When can you check the monthly tax fee for self-employed?

You can consult your receipt from the 26th day of each month.

This timing is important because:

- The monthly tax fee for self-employed is charged by direct debit on the last working day of the month.

- From the 26th onwards, you can see the exact amount that will be charged, including any adjustments or additional contributions.

- If you access the service before the 26th, you will only see the receipt for the previous month.

This early access gives you time to detect errors and request corrections before the payment is processed.

What information does the service provide?

The online consultation service allows you to:

- View the current monthly tax fee for self-employed.

- See a full breakdown of how your contribution has been calculated.

- Check additional charges or adjustments, if applicable.

- Consult previous receipts issued since July 2018, when the SEPA-compliant debt issuance system was implemented.

Important:

This service does not confirm whether payments have been successfully made. It only shows issued receipts, not payment status or Social Security clearance certificates.

How to check the monthly tax fee for self-employed online

To consult your receipt, follow these steps:

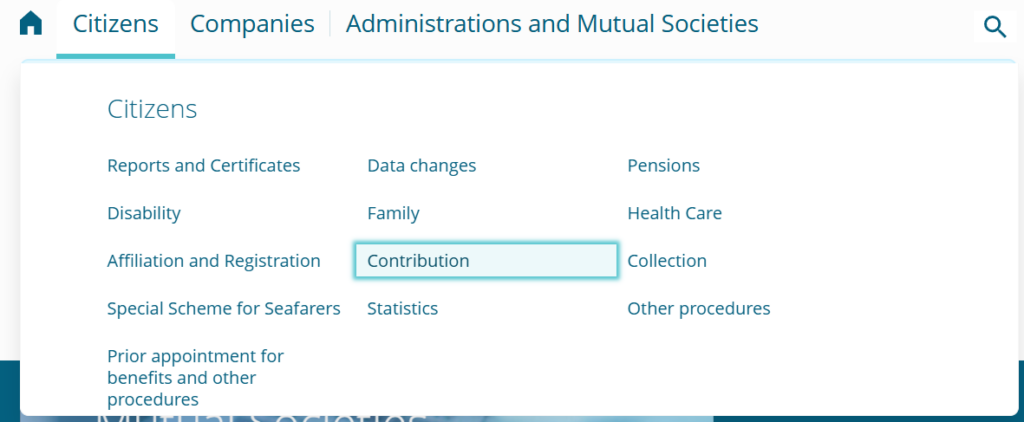

- Go to the Social Security Electronic Headquarters (SEDESS).

- Select “Ciudadanos” (Citizens).

- Click on “Cotización” (Contributions).

- Choose “Consulta de recibos emitidos para el Régimen Especial de Trabajadores Autónomos (RETA)”.

- Identify yourself using one of the available methods:

- Digital certificate

- Cl@ve system

- Username and password

- SMS verification

Once logged in, you will see the latest issued receipt. By selecting “Ver detalle del recibo” (View receipt details), you can access the full breakdown of your monthly tax fee for self-employed, including contribution bases and applied rates.

Can you check receipts from previous months or years?

Yes. The system allows you to filter by month and year, giving you access to historical receipts issued since July 2018.

This is especially useful if you need to:

- Review past contributions for accounting purposes.

- Detect discrepancies over time.

- Prepare documentation for financial or legal procedures.

However, remember that historical receipts do not replace official payment certificates issued by Social Security.

Who can use this service?

To use the consultation tool, you must:

- Be registered as self-employed under RETA.

- Have a valid identification method (digital certificate, Cl@ve, or mobile number registered with Social Security).

At present, the service is consultative only. The monthly tax fee for self-employed continues to be paid exclusively by direct debit, and cannot be paid manually through this platform.

Why checking your monthly tax fee matters

Being able to consult the monthly tax fee for self-employed online helps you:

- Keep your accounting up to date.

- Anticipate cash flow needs.

- Detect errors related to income brackets or contribution bases.

- Avoid surprises at the end of the month.

For self-employed professionals in Spain, especially those with variable income, this review has become a key financial control step.

Frequently Asked Questions (FAQs)

When is the monthly tax fee for self-employed charged in Spain?

It is charged by direct debit on the last working day of each month.

Can I modify my monthly tax fee after checking the receipt?

If you detect an error, you must contact Social Security promptly to request a correction before the charge date.

Does this service prove I am up to date with Social Security payments?

No. It only shows issued receipts, not payment confirmation or clearance status.

Checking your monthly tax fee for self-employed online is a simple but powerful way to stay in control of your obligations with Spanish Social Security. Reviewing your receipt before the charge date allows you to plan better, avoid errors, and keep your self-employed activity financially healthy.

If you need personalized assistance, at Entre Trámites we offer management and tax advisory services for freelancers and SMEs. You can contact us through this contact form for us to call you, or if you prefer, you can schedule a free consultation or write to us onWhatsApp.