Entre Trámites » Taxes in Spain » Wealth Tax in Spain

Presentation of Wealth Tax in Spain

Declare your assets expertly and avoid mistakes!

Wealth Tax in Spain

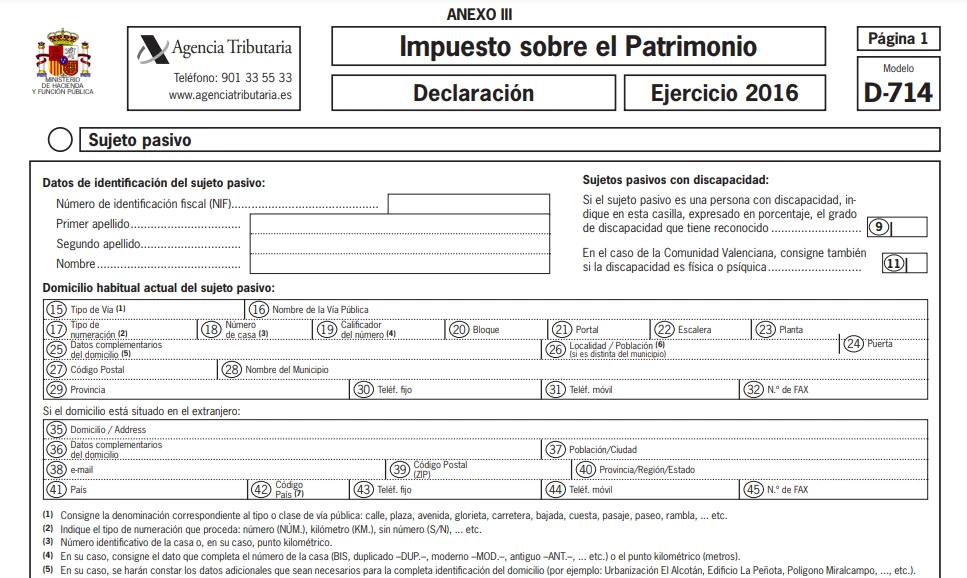

Form 714

The Wealth Tax (Impuesto sobre el Patrimonio) is a tax levied on the possession of goods and rights of an individual as of December 31 of each year. It is filed online using Form or Modelo 714 and varies according to the autonomous community in which you reside.

This tax affects both tax residents in Spain and non-residents who own assets in the country.

Deadline for filing:

It must be filed every year between April and June, in parallel with the income tax return (IRPF). In 2025 the deadline is from April 3 to June 30.

Who is required to file it?

The most relevant assets to declare include: Real estate, stocks, investment funds, money in bank accounts or deposits, luxury vehicles, boats, aircraft, intellectual or industrial property rights and other assets of significant value.

You must file Form 714 if you meet any of these conditions:

- Your net worth exceeds €700,000 (although some autonomous communities have reduced this limit).

- You have assets in Spain valued at more than €3,000,000, even if you are a non-resident.

- The regulations of your autonomous community oblige you to declare it, even if your net taxable income is lower than the state minimum.

- The Tax Agency expressly requires you to do so, even if your net worth is below the general threshold.

🔍 Important: Some autonomous communities have bonuses that can reduce the payment of the tax up to 100%, such as Madrid or Andalusia.

Steps to file Form 714

Enter the AEAT Electronic Office, identify yourself with your digital certificate, electronic ID or Cl@ve PIN and check your tax data (assets, accounts, investments, debts).

Enter the information about your assets and rights, applying allowances or reductions if applicable. Finally, check the simulator to verify the calculation and avoid errors.

Send the declaration online before the deadline (April - June) and download the filing receipt. If there is payment, choose direct debit or transfer.

Book a consultation with our specialists

Do you need help filing Form 714?

- Personalized advice according to your fiscal and patrimonial situation.

- Review of bonuses and regional exemptions to reduce the tax.

- Preparation and filing of Form 714 in a safe and uncomplicated way.

- For residents and non-residents with assets in Spain.

- Any doubts? Contact us!