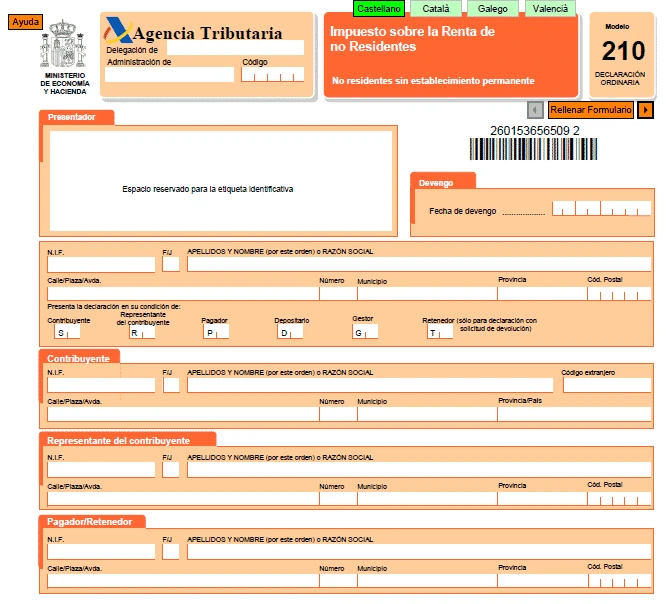

Entre Trámites » Taxes in Spain » Form 210: Non-Resident Income Tax

Form 210 for Non-Residents in Spain

Your Modelo 210, in expert hands

- Preparation and filing of Form 210 with the Tax Agency.

- Complete management of the application.

- Your own personal manager with unlimited advice.

🚨 Still not registered as autónomo? Register here and manage your taxes on time!

In a hurry? You can hire our service directly here

Personalized service

We adapt to your case, thoroughly analyzing your tax/financial situation and offering you the solution that best suits your needs.

Fast and Simple

We take care of everything: we provide you with the necessary documents and we take care of preparing and filing the Form 210 for you.

Managed by Experts

Don't worry, your case will be in good hands. Trust our expert team of accountants and tax professionals in Spain.

What is Form 210?

It is a form or “modelo” used in Spain to declare and settle the Non-Resident Income Tax (IRNR), corresponding to the income obtained by individuals and entities without tax residence in the country.

This form is used to self-assess the actual income obtained in Spain, capital gains, and/or real estate imputations related to real estate located in Spain by individuals and entities without tax residence in the country.

Who must file it?

- Non-resident owners of real estate in Spain: If you own property in Spain but are not a tax resident in the country, you must file Form 210 for income derived from that property, such as rent.

- Non-resident investors: Individuals or entities that obtain gains from investments in Spain, such as dividends or interest, and are not tax residents in the country.

- If you are a non-resident worker or autónomo with taxable income in Spain, you are also obliged to register and file Form 210. This applies to those who carry out economic activities or work in Spain for less than 6 months per year.

* If you have recently moved to Spain and have not accumulated more than 183 days of stay in the country by January 1, 2025, you will not be considered a tax resident. In this case, your income obtained in Spain will be subject to Non-Resident Income Tax (IRNR).

Filing Deadlines

-

Income from property rentals: If you group all the 2024 rentals for a single property, you must submit a single annual declaration between January 1 and 20, 2025. If you choose direct debit, the deadline is reduced to January 15, 2025.

Note: You can group the income if it comes from the same property, is subject to the same tax rate, and corresponds to the same type of income.

Quarterly declaration option: If you choose to declare quarterly, do so between January 1 and 20, April, July, and October, according to the income earned in the previous quarter.

More than one rented property: If you have several rented properties, you must submit a declaration for each property. - Other income (consulting, services, etc.): For other types of income, the declaration must be submitted between January 1 and 20, April, July, and October, according to the income earned in the previous quarter.

- Own use of property (income imputation): You can submit this declaration at any time in 2025, as it is not subject to specific quarterly deadlines.

- Sale of property: You must submit the declaration within three months after the month in which the property was sold.

If I don't, what are the penalties?

By omission

The monetary fine is set at 5,000€ for each piece of information or set of information that should have been declared but was not provided in the presentation.

Failure to file it

The minimum fine shall be €10,000 for each of the three sets of assets and rights set forth in this model.

Late filing

In this case the infringement is of a different nature, so the penalty will be €100 for each piece of data or set of data submitted, with a minimum of €1,500.

Presentation of Form 210 in Spain

Avoid penalties and complications!

Filing Form 210 can be a challenge. With our team, you have the security of complying with the Tax Agency in an agile and carefree manner.

FAQ

General Info

In Form 210, non-residents must declare income obtained in Spain from exercising rights or obtaining any type of income.

The main reasons for taxation in Spain are the imputation of real estate income and the taxation of properties leased or rented by non-residents.

The Form 210 is also used to declare the withholding tax levied on the acquisition of real estate from non-residents without permanent establishment and the special tax on real estate of non-resident entities.

Form 210 is filed online, you will need an electronic signature certificate accepted by the Tax Agency. You must complete and send some forms available at the website of the Tax Agency.

In Spain, a tax resident is a person who meets at least one of the following conditions:

- Staying in Spain for more than 183 days (consecutive or not) in a calendar year. Temporary absence for justified reasons does not interrupt this count.

- The main core or base of their economic activities or economic interests is located in Spain, either directly or indirectly.

The taxable base in Form 210 is calculated as the sum of the earned income by non-residents from the exercise of rights or obtaining of income of any kind in Spain.

To calculate the taxable base, the income obtained in Spain, including real estate income and income obtained from the sale of real estate, must be added together.

The calculation of taxable income may also include the deduction of certain expenses, such as property repair and maintenance expenses.

Deductible expenses in Form 210 include expenses necessary to obtain the income, such as property repair and maintenance expenses. Expenses related to the accommodation, such as electricity, water, legal advice, replacement of furniture, and depreciation, can also be deducted.

About reductions, Form 210 allows the reduction of 60% of the income obtained from the rental of real estate used for housing.

Process

- One of our experts will contact you promptly to start analyzing your case in depth and tell you the best step-by-step process to follow.

- You will know what is the necessary documentation to provide and you may also contact us to solve any remaining doubts.

- We’ll submit the Modelo 210 for you and let you know how it goes, always keeping you up-to-date on any notifications.

According to each case, the documentation to provide is different.

At the moment you hire one of the plans we will analyze your case and contact you to tell you the exact documentation you need to provide.

You have up to 30 days to send it.

Payment

The price you see in our pricing section is the final one (+ 21% of VAT that must be applied).

Payments must be made by debit or credit card.

Yes, you can request cancellation of the service as long as your personal manager has NOT started to handle your documentation to initiate the process. The money will be refunded to your card in less than 14 days.

See our Commercial Conditions.

Our

Team

You will always have personalized attention and direct contact with your advisor. You can communicate at any time (as long as it is business hours and about the services you have hired) by email or telephone, whichever is more comfortable for you.

Do you need more info?

We want to listen to you and know what your doubts are or what you need in relation to our accounting services for SMEs in Spain . You can count on the advice of our experts to clarify all your doubts.

Fill out our contact form, write to us at [email protected] or call us, and we will contact you as soon as possible.