The coronavirus has caused the closure of airports and some businesses, and has led China to build new hospitals in a few days. In China, the outbreak could spell a period of slower growth and weakening stock markets as investors seek to hedge. But, there is also a great impact of coronavirus on investments, ¿How is this? Keep reading.

What are the consequences for the portfolios we manage?

Morningstar Investment Management teams are closely monitoring the situation. They continuously monitor more than 250 markets from every angle, from fundamental risks to counter-investment opportunities.

An examination of nine major epidemics since 1998 reveals little evidence linking these global phenomena to the rationale for long-term investment.

The Chinese economy could slow down, even significantly, but this is no reason to invest or divest. Long-term investing often works best if short-term economic trends are ignored, so we urge investors to focus on what really matters.

Through the portfolios Morningstar manage, we have relatively modest exposure to Chinese assets (both directly and indirectly), but we remain convinced that these positions will produce positive returns for investors in the long term.

Epidemics and investments

To understand the possible consequences of an epidemic, we need to use forecasts, either formally or informally. If done well, it is a complex task, beyond the scope of this note. However, it is important to recognize that we are trying to anticipate the future, which is a risky intellectual exercise. No one can predict the future, but there is a wealth of research suggesting ways to improve predictions.

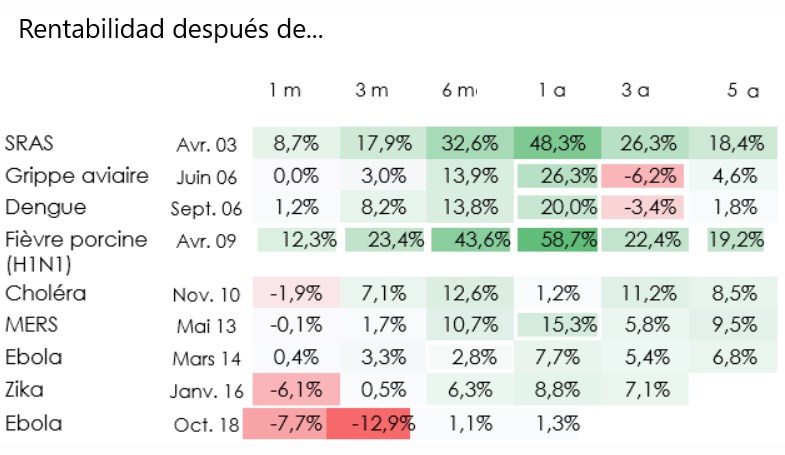

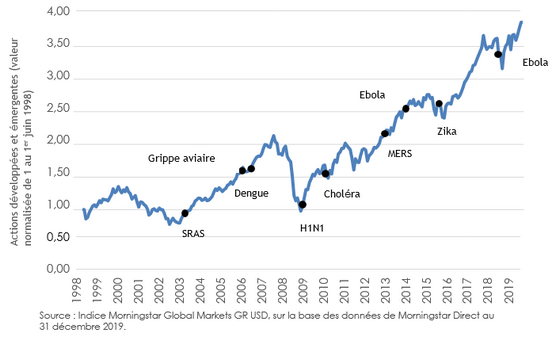

One way to achieve more accurate forecasts is to use base rates. How often do we see a disease turn into an epidemic? What impact do epidemics have on the economy or markets? To answer this last question, we refer to Figure 1, which gives an idea of base rates – in this case, the evolution of market performance after the main epidemics in recent history.

Investors tend to react to epidemics, but the long-term trend is positive.

Impact of Coronavirus on investments

As the illustration above shows, market participants tend to respond to these unforeseen outbreaks, but markets typically take no more than six months to recover. This suggests that while sentiment initially causes losses, the economic impact over time is less than investors might have initially feared.

Another way to improve foresight is to stay humble, especially since some things are and will remain unknown to us. Epidemiologists can produce baseline rates in terms of transmission and mortality, for example, but no one can predict how unknown factors may affect the transmission of a particular disease. Added to this is the fear that can take over the markets.

¿How to make a reasonable assessment of the possible impact of the coronavirus?

In this context, how can a reasonable assessment of the possible impact of the coronavirus be made? As long-term investors at Morningstar, focused on fundamentals and valuations, our concern is the potential impact of coronavirus on investments and corporate cash flows.

One question is whether the collective impact (lower flight rates, reduced trade, lost productivity, etc.) will be felt by a few companies, a few industries, or entire markets. Therefore, this is the question we must ask ourselves.

At this stage, we assume that the current outbreak will follow a similar trajectory to other recent epidemics, leading Morningstar to believe that investors have no reason to be alarmed. It should be noted that there is no ‘safe’ approach to investing: therefore moving from equities to cash carries its own risks, namely the crystallization of losses due to deteriorating sentiment and, almost certainly, the loss of a rebound if the spread of the virus is to be quickly contained.

Therefore, we intend to base ourselves on what we consider to be the most likely scenario, while taking into account other possible outcomes.

Some recommendations

Ultimately, Morningstar are monitoring the situation closely but not taking any particular action. Their main ambition is help investors achieve their goals, which requires a measured and repeatable investment process.

Across their portfolios, Morningstar may hold exposure to Chinese equities, emerging market equities, emerging market debt and companies with sales in China to varying degrees, depending on the mandate governing the portfolio. However, we expect positive results in the long term, and only a clear impact on the fundamentals would make us change our perspective.

It should be noted that if the situation were to change, we would have to change our minds. If we saw a clear and significant impact on investment fundamentals, we would study the situation closely, do a rigorous analysis of the scenarios, and try to integrate the new information into our portfolios. For now, we remain vigilant.

Final note on the impact of Coronavirus on investments

With lives at stake, it would be insensitive to speak of “noise” about the coronavirus. However, from an investor’s perspective, Morningstar believe this is not the time to act. Furthermore, we remain confident in our portfolio holdings as they are based on sound analysis and a well thought out investment approach. We’ll avoid panicking and we hope you won’t panic either.

Source: Morningstar