Understanding self-employed taxes in Spain is essential if you work as a freelancer or are planning to register as autónomo. Spain has a structured tax system that combines income tax, VAT and Social Security contributions, and knowing how it works will help you avoid penalties and plan your finances properly.

In this guide, we explain in a clear and practical way which taxes you must pay, which forms you need to file, and how the Spanish system works for self-employed professionals.

Overview of self-employed taxes in Spain

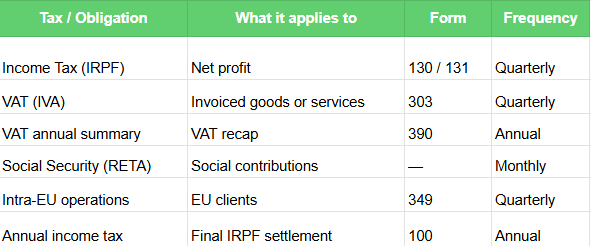

Before diving into details, this table gives you a quick snapshot of the main taxes and obligations affecting freelancers in Spain.

This structure is the backbone of self-employed taxes in Spain and applies to most freelancers, regardless of nationality.

Legal and tax obligations for freelancers in Spain

Before issuing invoices, you must complete two mandatory registrations:

- Register with the Spanish Tax Agency (Agencia Tributaria) using Form 036 or 037

- Register with Social Security (RETA – Régimen Especial de Trabajadores Autónomos)

Once registered, you are legally required to:

- Issue compliant invoices

- Keep accounting records

- File tax returns on time

- Pay Social Security contributions

What being self-employed legally means in Spain

Under the Estatuto del Trabajo Autónomo, a self-employed person carries out an economic activity independently, on a regular basis and for profit, without being subordinated to an employer.

Income tax (IRPF) for self-employed professionals

One of the most important elements of self-employed taxes in Spain is IRPF (Personal Income Tax). This tax is applied to your net profit, not your turnover.

IRPF calculation methods

You can be taxed under one of the following systems:

- Direct estimation (normal or simplified) → Form 130

- Objective estimation (modules) → Form 131 (only for specific activities and with strict limits)

Most freelancers operate under direct estimation, where taxable profit is calculated as:

Income – deductible business expenses

Quarterly IRPF payments

If you file Form 130, you must pay 20% of your quarterly profit as an advance payment. These payments are later adjusted in your annual income tax return (Form 100).

IRPF withholdings instead of quarterly payments

If at least 70% of your income comes from Spanish companies or professionals, you can apply IRPF withholding directly on your invoices:

- 7% for newly registered self-employed (limited period)

- 15% standard rate

In this case, you do not need to file Form 130.

VAT obligations for self-employed in Spain

VAT is another key component of self-employed taxes in Spain. As a freelancer, you collect VAT from clients and pay it to the Tax Agency after deducting VAT paid on business expenses.

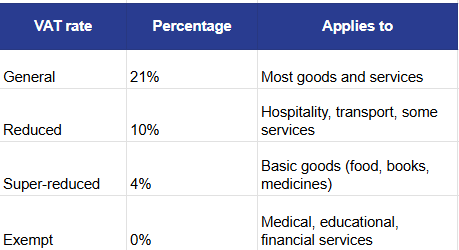

VAT rates in Spain

VAT forms you must file

- Form 303: quarterly VAT return

- Form 390: annual VAT summary

If you invoice EU companies with a valid VAT number, VAT is not charged, but you must submit Form 349.

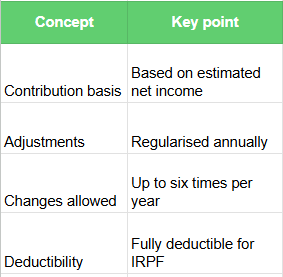

Social Security contributions under the income-based system

Social Security contributions are a mandatory part of self-employed taxes in Spain, although they are technically separate from taxes.

How the current system works

You choose a contribution base according to your expected income, and Social Security adjusts it later if needed.

Mandatory tax forms and filing deadlines

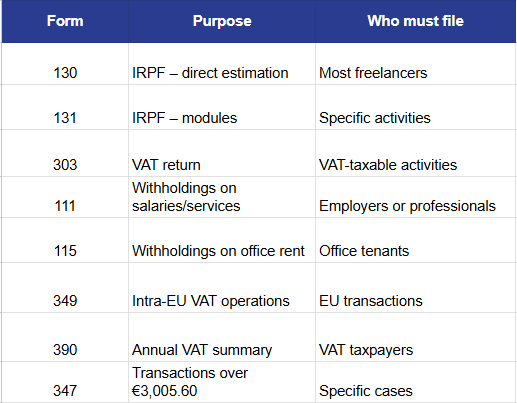

Understanding which forms apply to you is key to staying compliant.

Main tax forms for freelancers

Most quarterly forms are filed in April, July, October and January, with exact deadlines published annually by the Tax Agency.

How much tax does a self-employed person really pay?

IRPF in Spain is progressive, meaning higher profits are taxed at higher rates. The final amount depends on:

- Your net annual income

- The autonomous community where you are tax resident

- Applicable deductions and personal circumstances

Any IRPF already paid through quarterly payments or invoice withholdings is deducted from the final tax bill.

Practical tips to manage self-employed taxes efficiently

- Use accounting or invoicing software to avoid mistakes

- Keep all expense invoices properly classified

- Track deductible expenses such as home office costs, insurance or professional training

- Work with a tax advisor experienced with international clients

Good planning makes self-employed taxes in Spain much easier to manage.

Frequently Asked Questions

Do self-employed workers in Spain always pay VAT?

No. Some activities are VAT-exempt, such as certain healthcare, education or financial services.

Can I avoid quarterly IRPF payments as a freelancer?

Yes. If at least 70% of your income includes IRPF withholding, you do not need to file Form 130.

Are Social Security contributions deductible?

Yes. Social Security contributions are fully deductible as a business expense for IRPF purposes.

Understanding how self-employed taxes in Spain work allows you to operate confidently, avoid penalties and plan your income properly with no unpleasant surprises.

If you need personalized assistance, at Entre Trámites we offer management and tax advisory services for freelancers and SMEs. You can contact us through this contact form for us to call you, or if you prefer, you canschedule a free consultation or write to us on WhatsApp.